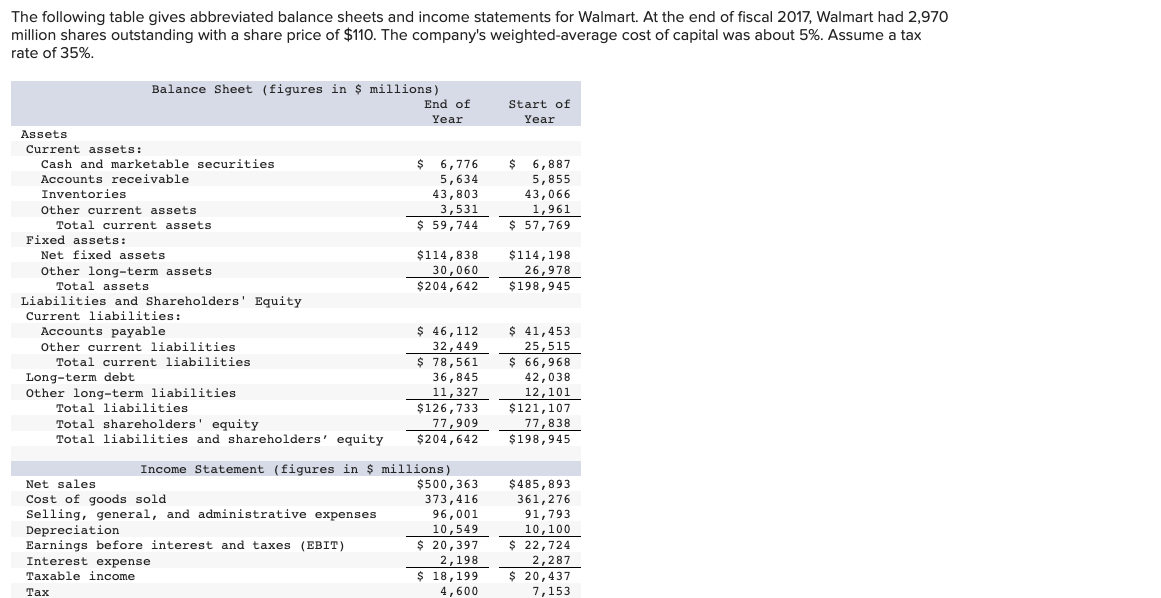

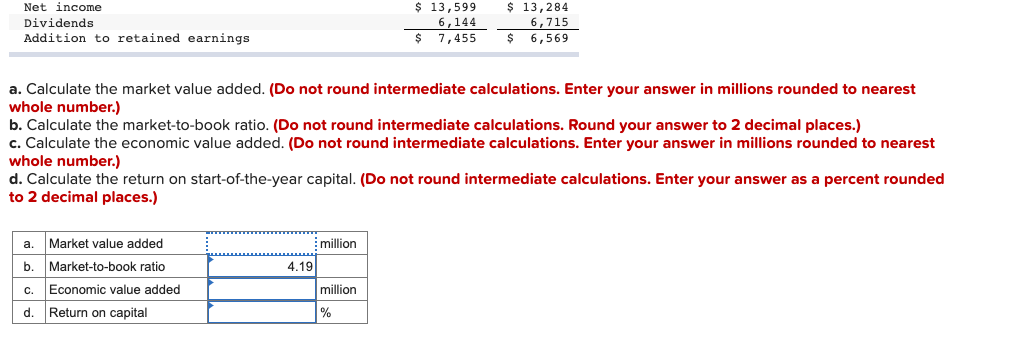

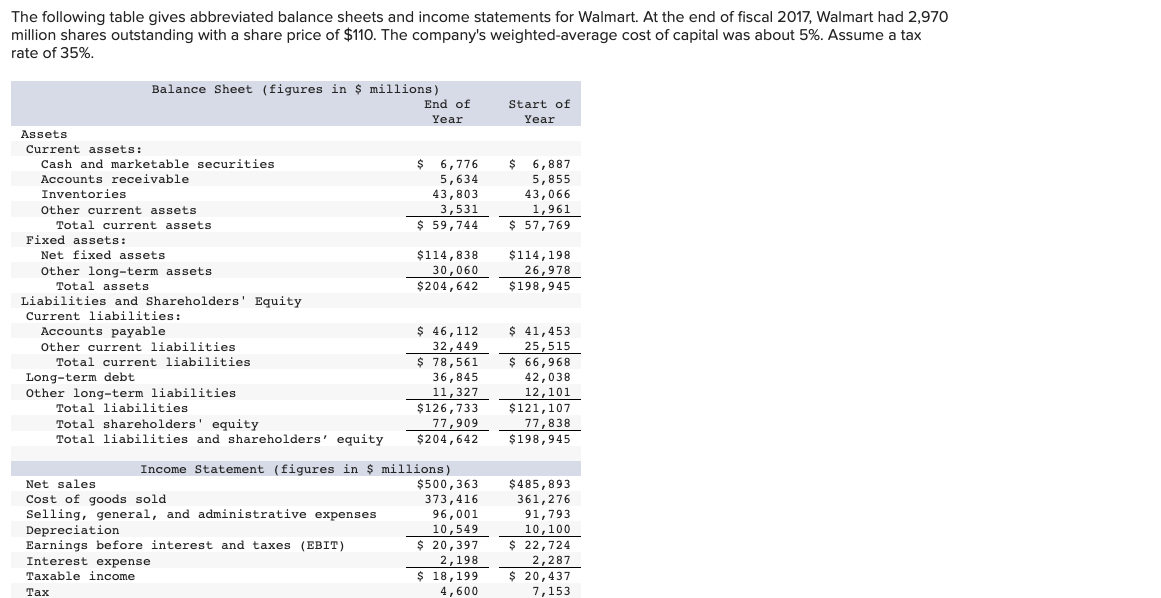

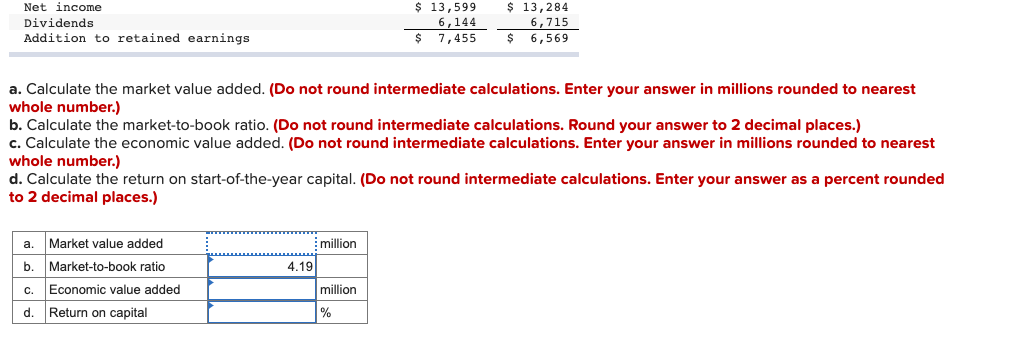

The following table gives abbreviated balance sheets and income statements for Walmart. At the end of fiscal 2017, Walmart had 2,970 million shares outstanding with a share price of $110. The company's weighted average cost of capital was about 5%. Assume a tax rate of 35%. Balance Sheet (figures in $ millions) End of Start of Year Year $ 6,776 5, 634 43,803 3,531 $ 59, 744 $ 6,887 5,855 43,066 1,961 $ 57, 769 Assets Current assets: Cash and marketable securities Accounts receivable Inventories Other current assets Total current assets Fixed assets: Net fixed assets Other long-term assets Total assets Liabilities and Shareholders' Equity Current liabilities: Accounts payable Other current liabilities Total current liabilities Long-term debt Other long-term liabilities Total liabilities Total shareholders' equity Total liabilities and shareholders' equity $ 114,838 30,060 $ 204,642 $114,198 26,978 $198,945 $ 46,112 32,449 $ 78,561 36,845 11,327 $126,733 77,909 $ 204,642 $ 41, 453 25,515 $ 66,968 42,038 12,101 $121, 107 77,838 $198,945 Income Statement (figures in $ millions) Net sales $500,363 Cost of goods sold 373,416 Selling, general, and administrative expenses 96,001 Depreciation 10,549 Earnings before interest and taxes (EBIT) $ 20,397 Interest expense 2,198 Taxable income $ 18,199 Tax 4,600 $ 485,893 361,276 91,793 10,100 $ 22, 724 2,287 $ 20,437 7,153 $ 13,599 Net income Dividends Addition to retained earnings 6,144 $ 13,284 6,715 $ 6,569 $ 7,455 a. Calculate the market value added. (Do not round intermediate calculations. Enter your answer in millions rounded to nearest whole number.) b. Calculate the market-to-book ratio. (Do not round intermediate calculations. Round your answer to 2 decimal places.) c. Calculate the economic value added. (Do not round intermediate calculations. Enter your answer in millions rounded to nearest whole number.) d. Calculate the return on start-of-the-year capital. (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) a. million b Market value added Market-to-book ratio Economic value added 4.19 c. million d. Return on capital %