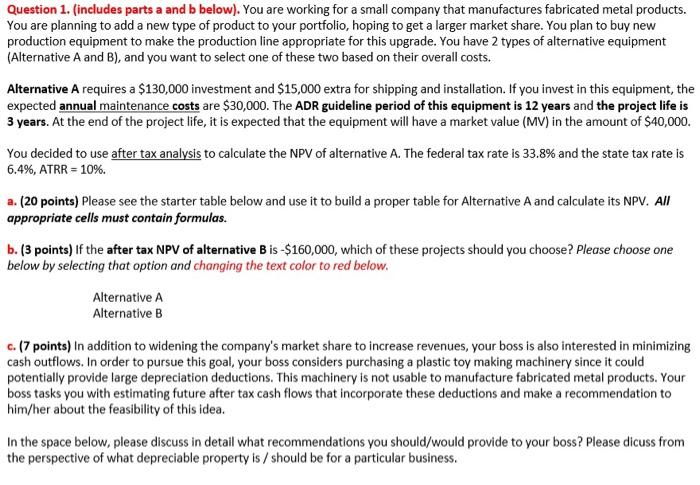

Question 1. (includes parts a and b below). You are working for a small company that manufactures fabricated metal products. You are planning to add a new type of product to your portfolio, hoping to get a larger market share. You plan to buy new production equipment to make the production line appropriate for this upgrade. You have 2 types of alternative equipment (Alternative A and B), and you want to select one of these two based on their overall costs. Alternative A requires a $130,000 investment and $15,000 extra for shipping and installation. If you invest in this equipment, the expected annual maintenance costs are $30,000. The ADR guideline period of this equipment is 12 years and the project life is 3 years. At the end of the project life, it is expected that the equipment will have a market value (MV) in the amount of $40,000. You decided to use after tax analysis to calculate the NPV of alternative A. The federal tax rate is 33.8% and the state tax rate is 6.4%, ATRR = 10%. a. (20 points) Please see the starter table below and use it to build a proper table for Alternative A and calculate its NPV. All appropriate cells must contain formulas. b. (3 points) If the after tax NPV of alternative B is -$160,000, which of these projects should you choose? Please choose one below by selecting that option and changing the text color to red below. Alternative A Alternative B c. 17 points) In addition to widening the company's market share to increase revenues, your boss is also interested in minimizing cash outflows. In order to pursue this goal, your boss considers purchasing a plastic toy making machinery since it could potentially provide large depreciation deductions. This machinery is not usable to manufacture fabricated metal products. Your boss tasks you with estimating future after tax cash flows that incorporate these deductions and make a recommendation to him/her about the feasibility of this idea. In the space below, please discuss in detail what recommendations you should/would provide to your boss? Please dicuss from the perspective of what depreciable property is / should be for a particular business. Question 1. (includes parts a and b below). You are working for a small company that manufactures fabricated metal products. You are planning to add a new type of product to your portfolio, hoping to get a larger market share. You plan to buy new production equipment to make the production line appropriate for this upgrade. You have 2 types of alternative equipment (Alternative A and B), and you want to select one of these two based on their overall costs. Alternative A requires a $130,000 investment and $15,000 extra for shipping and installation. If you invest in this equipment, the expected annual maintenance costs are $30,000. The ADR guideline period of this equipment is 12 years and the project life is 3 years. At the end of the project life, it is expected that the equipment will have a market value (MV) in the amount of $40,000. You decided to use after tax analysis to calculate the NPV of alternative A. The federal tax rate is 33.8% and the state tax rate is 6.4%, ATRR = 10%. a. (20 points) Please see the starter table below and use it to build a proper table for Alternative A and calculate its NPV. All appropriate cells must contain formulas. b. (3 points) If the after tax NPV of alternative B is -$160,000, which of these projects should you choose? Please choose one below by selecting that option and changing the text color to red below. Alternative A Alternative B c. 17 points) In addition to widening the company's market share to increase revenues, your boss is also interested in minimizing cash outflows. In order to pursue this goal, your boss considers purchasing a plastic toy making machinery since it could potentially provide large depreciation deductions. This machinery is not usable to manufacture fabricated metal products. Your boss tasks you with estimating future after tax cash flows that incorporate these deductions and make a recommendation to him/her about the feasibility of this idea. In the space below, please discuss in detail what recommendations you should/would provide to your boss? Please dicuss from the perspective of what depreciable property is / should be for a particular business