Answered step by step

Verified Expert Solution

Question

1 Approved Answer

question 1 is part one question is part 2 A-C use the formula please Assume that Social Security promises you $40,000 per year starting when

question 1 is part one

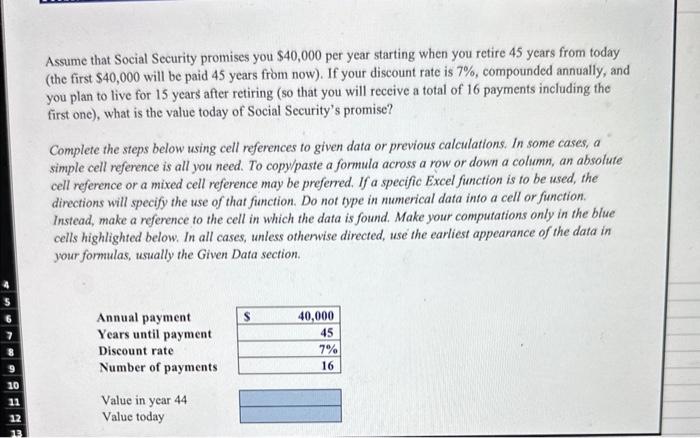

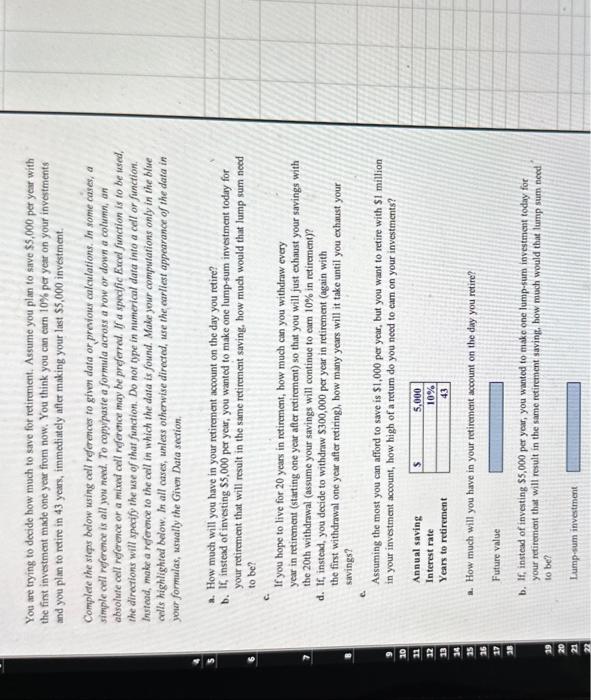

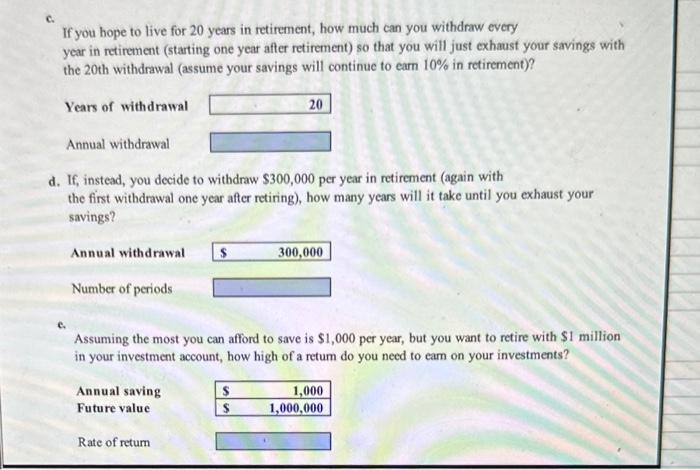

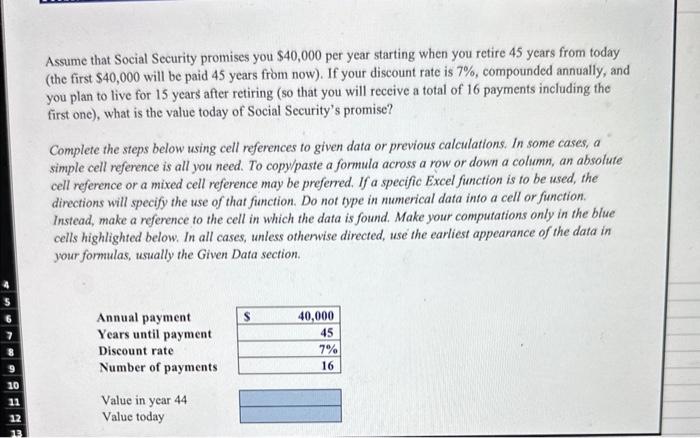

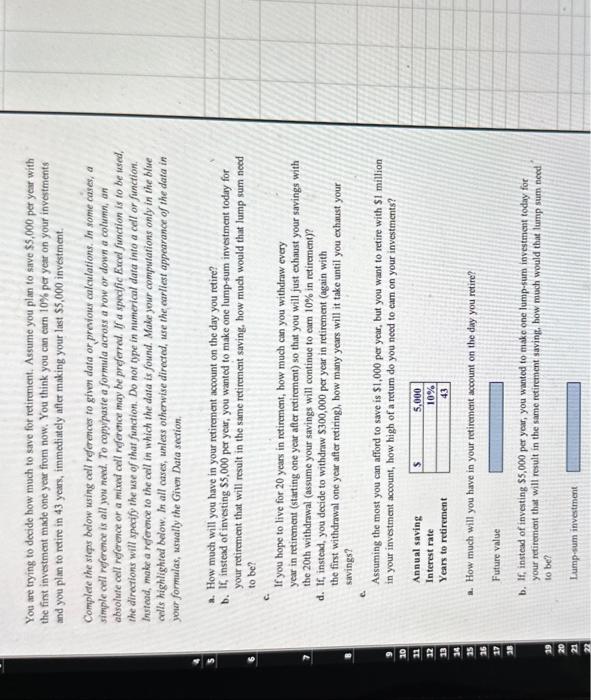

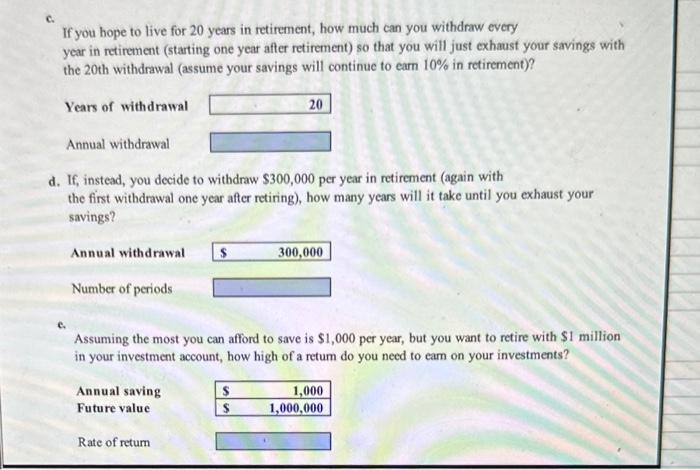

Assume that Social Security promises you $40,000 per year starting when you retire 45 years from today (the first $40,000 will be paid 45 years from now). If your discount rate is 7%, compounded annually, and you plan to live for 15 years after retiring (so that you will receive a total of 16 payments including the first one), what is the value today of Social Security's promise? Complete the steps below using cell references to given data or previous calculations. In some cases, a simple cell reference is all you need. To copy/paste a formula across a row or down a column, an absolute cell reference or a mixed cell reference may be preferred. If a specific Excel function is to be used, the directions will specify the use of that function. Do not type in numerical data into a cell or function. Instead, make a reference to the cell in which the data is found. Make your computations only in the blue cells highlighted below. In all cases, unless othenvise directed, use the earliest appearance of the data in your formulas, usually the Given Data section. Tou are trying to decide how much to save for retirement. Assume you plan to save $5,000 per year with he first investment made one year from now. You think you can cam 10% per year on your investments nd you plan to retire in 43 years, immediately after making your last $5,000 investment. Complete the sieps belowe using oell references to given data or previous culculations. In some cases, a timple cell referenoe is all you need. To copypaste a formula across a row or down a column, an absolute cell reference or a mixed cell reference may be prefored. If a specific Excel function is to be ised, he directions will specify the use of that function. Do not type in numerical data into a cell or function. instad, make a reference to the cell in which the data is found. Make your computations only in the blue alls highlighted below, In all cases, unless othenwise directed, wre the earliest appearance of the data in. vour formulas, wstally the Given Data section. a. How much will you have in your retirement account on the day you retire? b. If, instead of investing $5,000 per year, you wanted to make one lump-sum investment today for your retirement that will result in the same retirement saving, how much would that lump sum need to be? Cu If you hope to live for 20 years in retirement, how much can you withdraw every year in retirement (starting one year after retirement) so that you will just exhaust your savings with the 20 th witbdrawal (assume your savings will continue to earn 10% in retirement)? d. If, instead, you decide to withdrww $300,000 per year in retirement (again with the first withdrawal one year after retiring), bow many years will it take until you exhaust your savings? C. Assuming the most you can aftord to save is $1,000 per year, but you want to retire with $1 million in your investment account, how high of a retum do you need to cam on your investments? a. How much will you have in your retirement aceount on the day you retire? Future value b. If, instead of investing $5,000 per year, you wanted to make one lump-sum investment today for your retirement that will result in the same retirement saving. how much would that lump sum need. to be? If you hope to live for 20 years in retirement, how much can you withdraw every year in retirement (starting one year after retirement) so that you will just exhaust your savings with the 20 th withdrawal (assume your savings will continue to earn 10% in retirement)? Years of withdrawal Annual withdrawal d. If, instead, you decide to withdraw $300,000 per year in retirement (again with the first withdrawal one year after retiring), how many years will it take until you exhaust your savings? Annual withdrawal Number of periods c. Assuming the most you can afford to save is $1,000 per year, but you want to retire with $1 million in your investment account, how high of a retum do you need to eam on your investments? Annual saving Future value question is part 2 A-C

use the formula please

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started