Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1: Jan. 1 Purchased 45, 8%, $1,000 Cotter Company bonds. Interest is payable semiannually on July 1 and January 1. Question 2: July 1

Question 1: Jan. 1 Purchased 45, 8%, $1,000 Cotter Company bonds. Interest is payable semiannually on July 1 and January 1.

Question 2: July 1 Received semiannual interest on Cotter Company bonds.

Question 3: October 1 Sold 22 Cotter Company bonds for $20,000 plus accrued interest.

Question 4: December 31 Prepare the adjusting entry for the accrual of interest on December 31st.

Question 5: Prepare the adjusting entry necessary on December 31st for the preparation of financial statements if the Cotter Company bonds show a market value of $24,550.

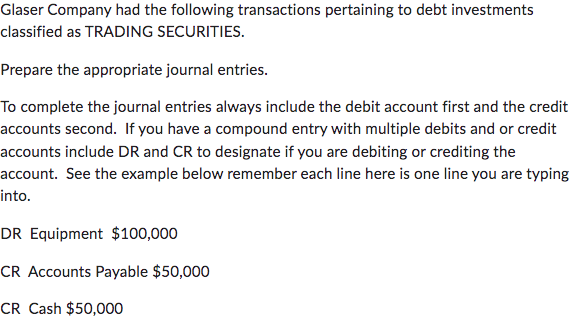

Glaser Company had the following transactions pertaining to debt investments classified as TRADING SECURITIES. Prepare the appropriate journal entries. To complete the journal entries always include the debit account first and the credit accounts second. If you have a compound entry with multiple debits and or credit accounts include DR and CR to designate if you are debiting or crediting the account. See the example below remember each line here is one line you are typing into. DR Equipment $100,000 CR Accounts Payable $50,000 CR Cash $50,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started