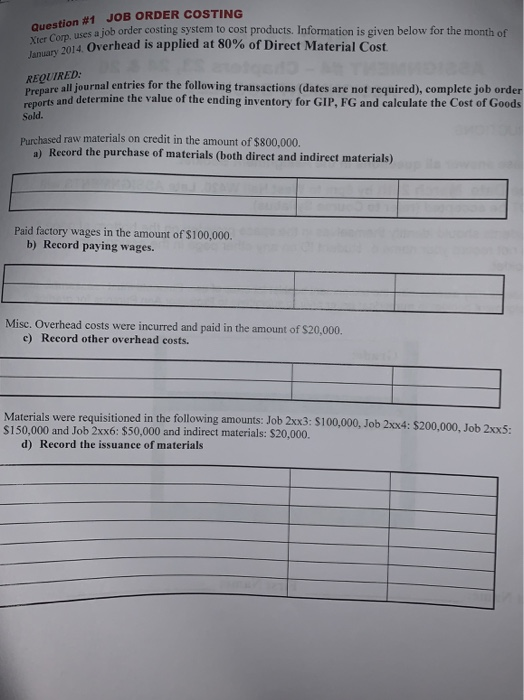

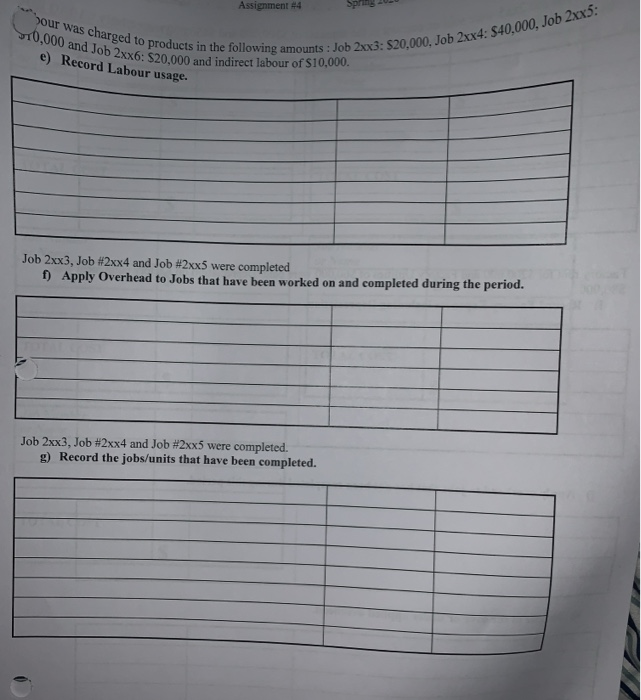

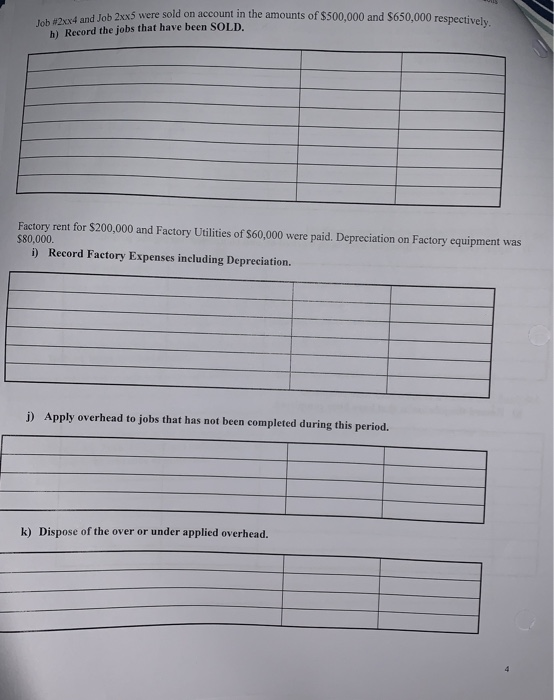

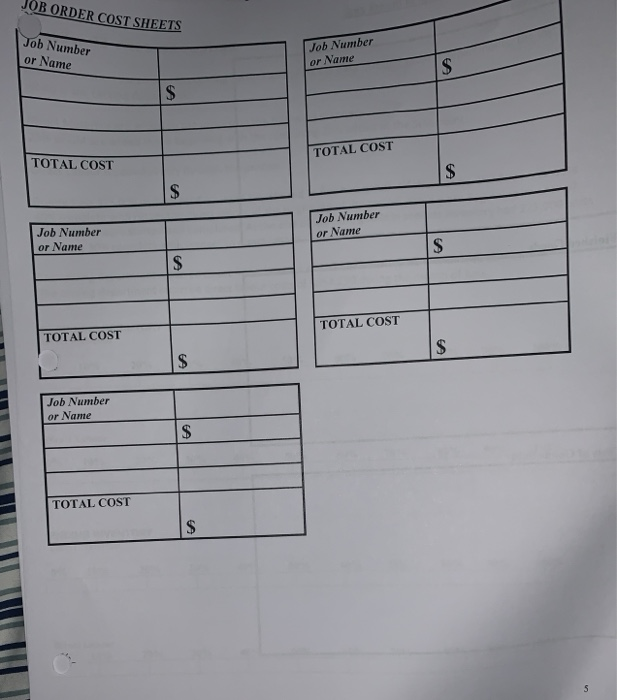

Question #1 JOB ORDER COSTING ses a job order costing system to cost products. Information is given below for the month of 2014. Overhead is applied at 80% of Direct Material Cost REQUIRED: are all journal entries for the following transactions (dates are not required), complete job order reports and and determine the value of the ending inventory for GIP, FG and calculate the cost of Goods Sold. Purchased raw materials on credit in the amount of $800,000. a) Record the purchase of materials (both direct and indirect materials) Paid factory wages in the amount of $100,000 b) Record paying wages. Mise, Overhead costs were incurred and paid in the amount of S20,000. e) Record other overhead costs. Materials were requisitioned in the following amounts: Job 2xx3: S100,000, Job 2.xx4: $200.000. Job 2 $150,000 and Job 2xx6: $50,000 and indirect materials: $20,000. d) Record the issuance of materials 5 . Assignment #4 Spring bour was charged to prod $10,000 and Job 2xx6: $20. sed to products in the following amounts : Job 2 2xX6: $20,000 and indirect labour of $10,000. 20x3: $20,000. Job 2xx4: $40.000, Job 2xx): 3 . e) Record Labour usage. Job 2xx3, Job #2xx4 and Job #2xx5 were completed 1) Apply Overhead to Jobs that have been worked on and completed during the period. Job 2xx3, Job #2xx4 and Job #2xx5 were completed. g) Record the jobs/units that have been completed. 2xx5 were sold on account in the amounts of $500,000 and $650,000 respectively, Job #2x4 and Job 2xx5 were sold on b) Record the jobs that have been SOLD. Factory rent for $200,000 and Factory Utilities of $60,000 were paid. Depreciation on Factory equipment was $80,000 1) Record Factory Expenses including Depreciation. D) Apply overhead to jobs that has not been completed during this period. k) Dispose of the over or under applied overhead. JOB ORDER COST SHEETS Job Number or Name Job Number or Name TOTAL COST TOTAL COST Job Number or Name Job Number or Name TOTAL COST TOTAL COST Job Number or Name TOTAL COST Balances in the following accounts ar month end: Goods in Process Finished Goods Costs of Goods Sold