Question

Question 1 Lumina plc bought a 30% stake in Fusion several years ago when Fusion had reserves of ?50m and when the fair value of

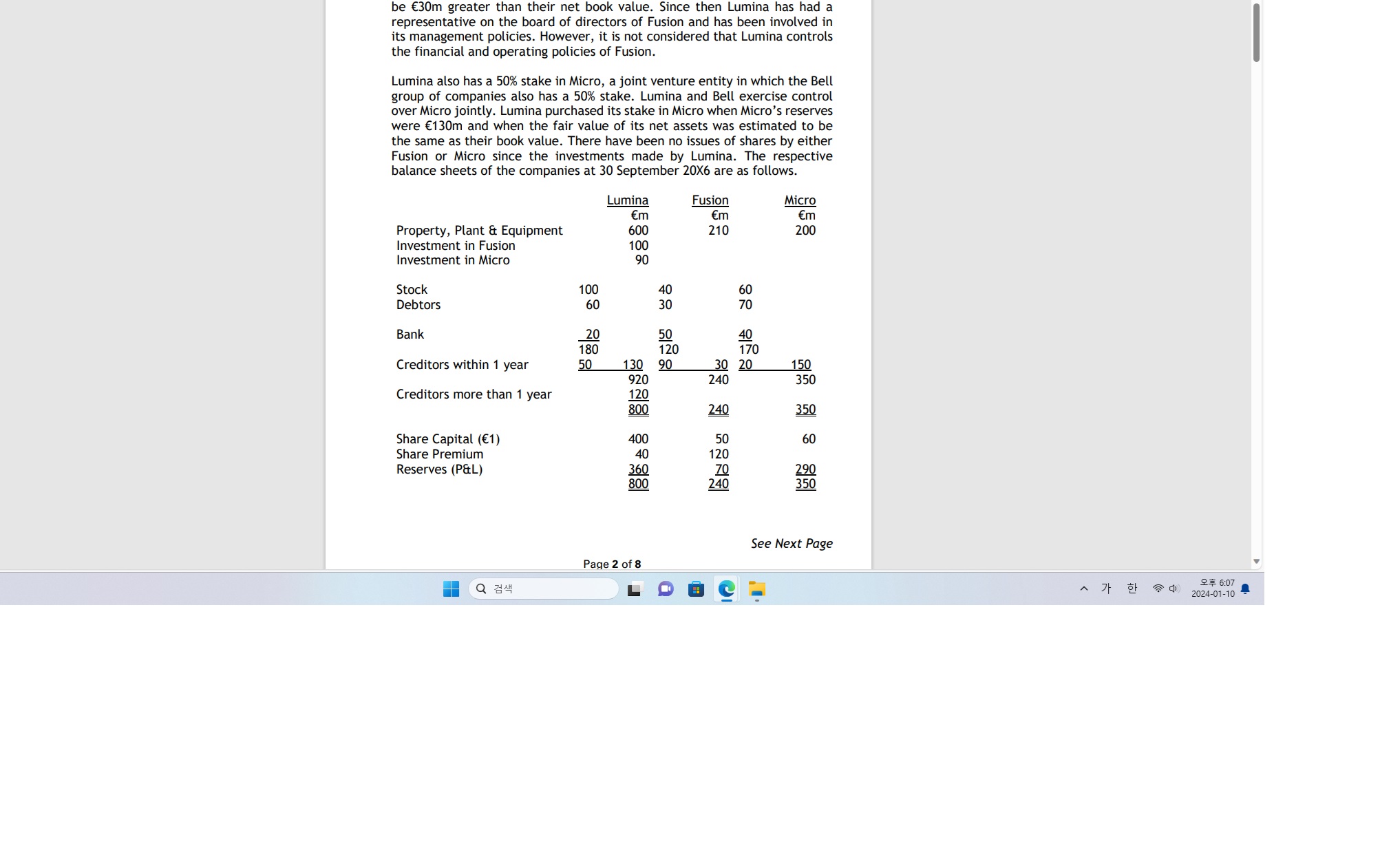

Question 1 Lumina plc bought a 30% stake in Fusion several years ago when Fusion had reserves of ?50m and when the fair value of its fixed assets was estimated to be ?30m greater than their net book value. Since then Lumina has had a representative on the board of directors of Fusion and has been involved in its management policies. However, it is not considered that Lumina controls the financial and operating policies of Fusion. Lumina also has a 50% stake in Micro, a joint venture entity in which the Bell group of companies also has a 50% stake. Lumina and Bell exercise control over Micro jointly. Lumina purchased its stake in Micro when Micro's reserves were ?130m and when the fair value of its net assets was estimated to be the same as their book value. There have been no issues of shares by either Fusion or Micro since the investments made by Lumina. The respective balance sheets of the companies at 30 September 20X6 are as follows.

The respective balance sheets of the companies at 30 September 20X6 are as follows.

Lumina Fusion Micro ?m ?m ?m

Property, Plant & Equipment 600 210 200

Investment in Fusion 100

Investment in Micro 90

Stock 100 40 60

Debtors 60 30 70

Bank 20 50 40

180 120 170

Creditors within 1 year 50 130 90 30 20 150

920 240 350

Creditors more than 1 year 120

800 240 350

Share Capital (?1) 400 50 60

Share Premium 40 120

Reserves (P&L) 360 70 290

800 240 350

be 30m greater than their net book value. Since then Lumina has had a representative on the board of directors of Fusion and has been involved in its management policies. However, it is not considered that Lumina controls the financial and operating policies of Fusion. Lumina also has a 50% stake in Micro, a joint venture entity in which the Bell group of companies also has a 50% stake. Lumina and Bell exercise control over Micro jointly. Lumina purchased its stake in Micro when Micro's reserves were 130m and when the fair value of its net assets was estimated to be the same as their book value. There have been no issues of shares by either Fusion or Micro since the investments made by Lumina. The respective balance sheets of the companies at 30 September 20X6 are as follows. Property, Plant & Equipment Investment in Fusion Investment in Micro Stock Debtors Bank Creditors within 1 year Creditors more than 1 year Share Capital (1) Share Premium Reserves (P&L) [|]] Q 100 60 20 180 50 Lumina m 600 100 90 400 40 360 800 40 30 130 90 920 120 800 Page 2 of 8 50 120 Fusion m 210 240 30 20 240 50 120 60 70 70 240 40 170 Micro m 200 150 350 350 60 290 350 See Next Page ^ Hoj 6:07 2024-01-10

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To proceed with the analysis lets calculate some key figures for Lumina Fusion and Micro based on th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started