Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Match each term with the appropriate definition. Not all definitions will be used Term: Convertible Carrying value Discount Callable Maturity Market interest rate Stated

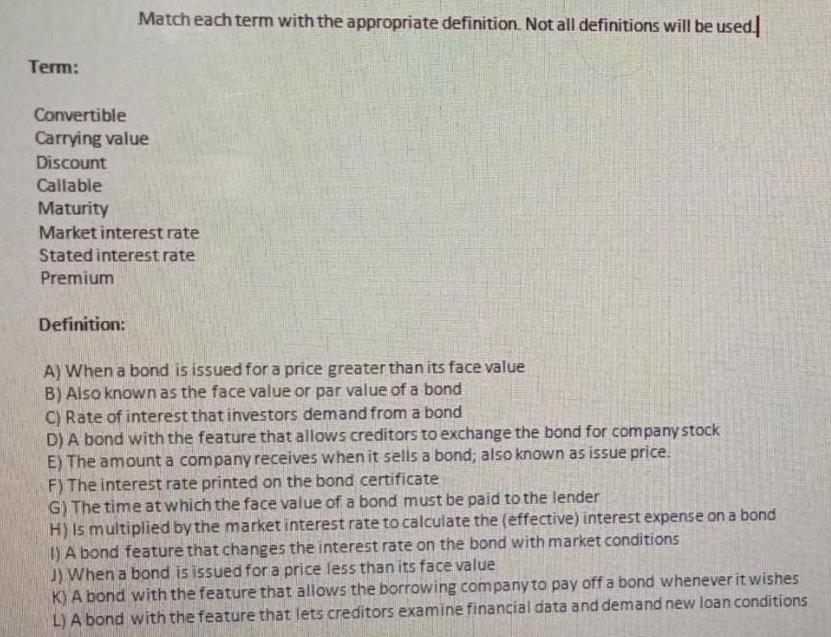

Match each term with the appropriate definition. Not all definitions will be used Term: Convertible Carrying value Discount Callable Maturity Market interest rate Stated interest rate Premium Definition: A) When a bond is issued for a price greater than its face value B) Also known as the face value or par value of a bond C) Rate of interest that investors demand from a bond D) A bond with the feature that allows creditors to exchange the bond for company stock E) The amount a company receives when it sells a bond; also known as issue price. F) The interest rate printed on the bond certificate G) The time at which the face value of a bond must be paid to the lender H) Is multiplied by the market interest rate to calculate the (effective) interest expense on a bond 1)A bond feature that changes the interest rate on the bond with market conditions J) When a bond is issued for a price less than its face value K) A bond with the feature that allows the borrowing company to pay off a bond whenever it wishes L)A bond with the feature that lets creditors examine financial data and demand new loan conditions Match each term with the appropriate definition. Not all definitions will be used Term: Convertible Carrying value Discount Callable Maturity Market interest rate Stated interest rate Premium Definition: A) When a bond is issued for a price greater than its face value B) Also known as the face value or par value of a bond C) Rate of interest that investors demand from a bond D) A bond with the feature that allows creditors to exchange the bond for company stock E) The amount a company receives when it sells a bond; also known as issue price. F) The interest rate printed on the bond certificate G) The time at which the face value of a bond must be paid to the lender H) Is multiplied by the market interest rate to calculate the (effective) interest expense on a bond 1)A bond feature that changes the interest rate on the bond with market conditions J) When a bond is issued for a price less than its face value K) A bond with the feature that allows the borrowing company to pay off a bond whenever it wishes L)A bond with the feature that lets creditors examine financial data and demand new loan conditions Match each term with the appropriate definition. Not all definitions will be used Term: Convertible Carrying value Discount Callable Maturity Market interest rate Stated interest rate Premium Definition: A) When a bond is issued for a price greater than its face value B) Also known as the face value or par value of a bond C) Rate of interest that investors demand from a bond D) A bond with the feature that allows creditors to exchange the bond for company stock E) The amount a company receives when it sells a bond; also known as issue price. F) The interest rate printed on the bond certificate G) The time at which the face value of a bond must be paid to the lender H) Is multiplied by the market interest rate to calculate the (effective) interest expense on a bond 1)A bond feature that changes the interest rate on the bond with market conditions J) When a bond is issued for a price less than its face value K) A bond with the feature that allows the borrowing company to pay off a bond whenever it wishes L)A bond with the feature that lets creditors examine financial data and demand new loan conditions Match each term with the appropriate definition. Not all definitions will be used Term: Convertible Carrying value Discount Callable Maturity Market interest rate Stated interest rate Premium Definition: A) When a bond is issued for a price greater than its face value B) Also known as the face value or par value of a bond C) Rate of interest that investors demand from a bond D) A bond with the feature that allows creditors to exchange the bond for company stock E) The amount a company receives when it sells a bond; also known as issue price. F) The interest rate printed on the bond certificate G) The time at which the face value of a bond must be paid to the lender H) Is multiplied by the market interest rate to calculate the (effective) interest expense on a bond 1)A bond feature that changes the interest rate on the bond with market conditions J) When a bond is issued for a price less than its face value K) A bond with the feature that allows the borrowing company to pay off a bond whenever it wishes L)A bond with the feature that lets creditors examine financial data and demand new loan conditions Match each term with the appropriate definition. Not all definitions will be used Term: Convertible Carrying value Discount Callable Maturity Market interest rate Stated interest rate Premium Definition: A) When a bond is issued for a price greater than its face value B) Also known as the face value or par value of a bond C) Rate of interest that investors demand from a bond D) A bond with the feature that allows creditors to exchange the bond for company stock E) The amount a company receives when it sells a bond; also known as issue price. F) The interest rate printed on the bond certificate G) The time at which the face value of a bond must be paid to the lender H) Is multiplied by the market interest rate to calculate the (effective) interest expense on a bond 1)A bond feature that changes the interest rate on the bond with market conditions J) When a bond is issued for a price less than its face value K) A bond with the feature that allows the borrowing company to pay off a bond whenever it wishes L)A bond with the feature that lets creditors examine financial data and demand new loan conditions

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started