Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 . Mergers and Acquisition Analysis [ 1 2 ] A healthcare company NORTHEN CARE is considering expanding its operations by acquiring one of

Question Mergers and Acquisition Analysis

A healthcare company "NORTHEN CARE" is considering expanding its operations by acquiring one of

two firms: Firm A a pharmaceutical research company, or Firm B a medical device manufacturer. The

company wants to ensure that the acquisition will generate a positive return. Analysts have estimated that

there is a chance that the company will acquire Firm A and if they do there is an chance that the

acquisition will succeed ie generate positive returns According to the market research there is that

the acquisition will succeed if the company acquire Firm B

Using the given information about the acquisitions possibilities:

a Find the probability that the company's acquisition will generate a positive return.

b If the acquisition was successful, what is the probability that the company acquired Firm A

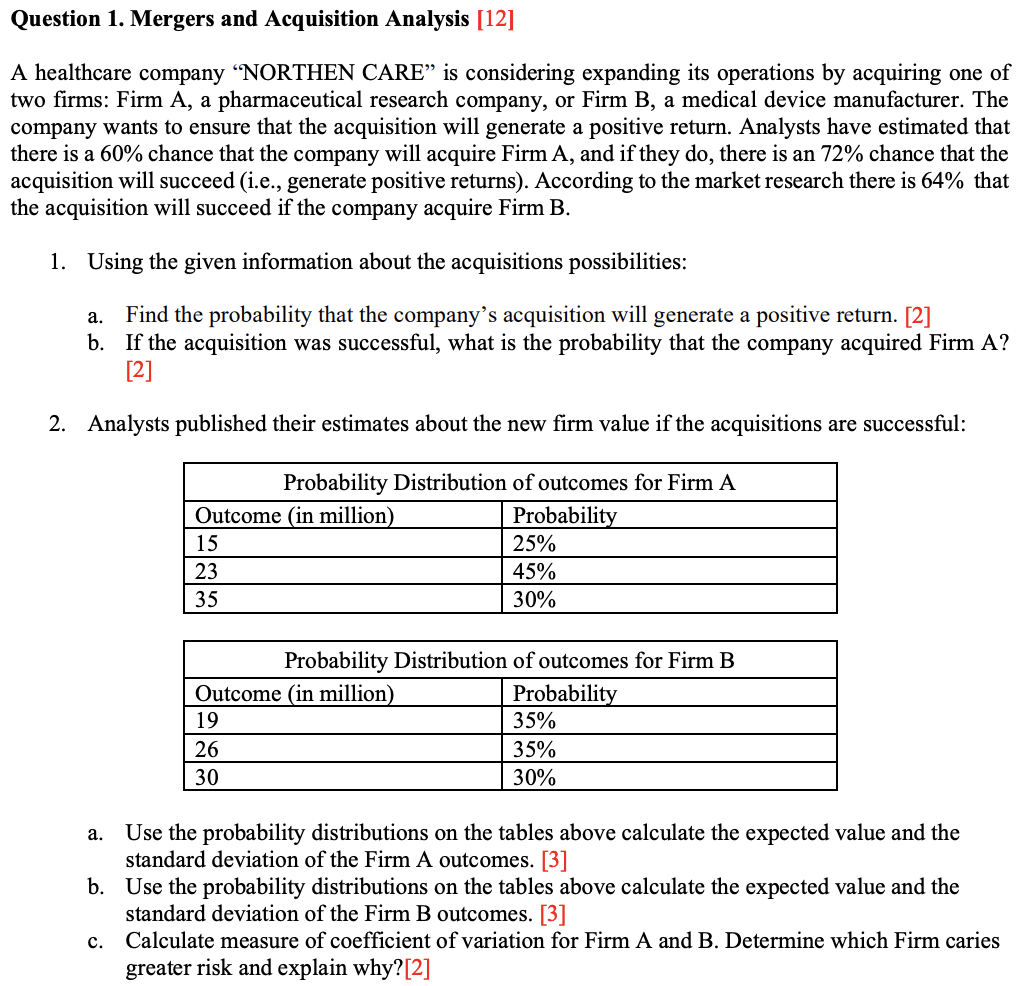

Analysts published their estimates about the new firm value if the acquisitions are successful:

a Use the probability distributions on the tables above calculate the expected value and the

standard deviation of the Firm A outcomes.

b Use the probability distributions on the tables above calculate the expected value and the

standard deviation of the Firm B outcomes.

c Calculate measure of coefficient of variation for Firm A and B Determine which Firm caries

greater risk and explain why?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started