Question

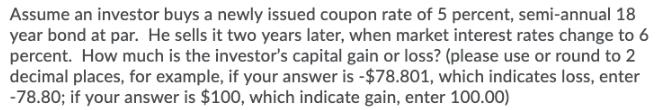

Assume an investor buys a newly issued coupon rate of 5 percent, semi-annual 18 year bond at par. He sells it two years later,

Assume an investor buys a newly issued coupon rate of 5 percent, semi-annual 18 year bond at par. He sells it two years later, when market interest rates change to 6 percent. How much is the investor's capital gain or loss? (please use or round to 2 decimal places, for example, if your answer is -$78.801, which indicates loss, enter -78.80; if your answer is $100, which indicate gain, enter 100.00)

Step by Step Solution

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Purchase price of bond par value as the yield and interest rate is same purcha...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Cost Accounting A Managerial Emphasis

Authors: Charles T. Horngren, Srikant M. Datar, Madhav V. Rajan

15th edition

978-0133428858, 133428850, 133428702, 978-0133428704

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App