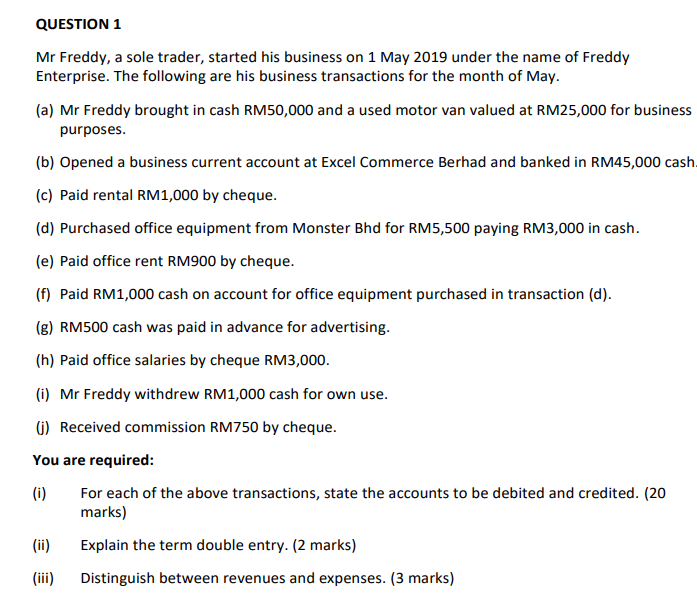

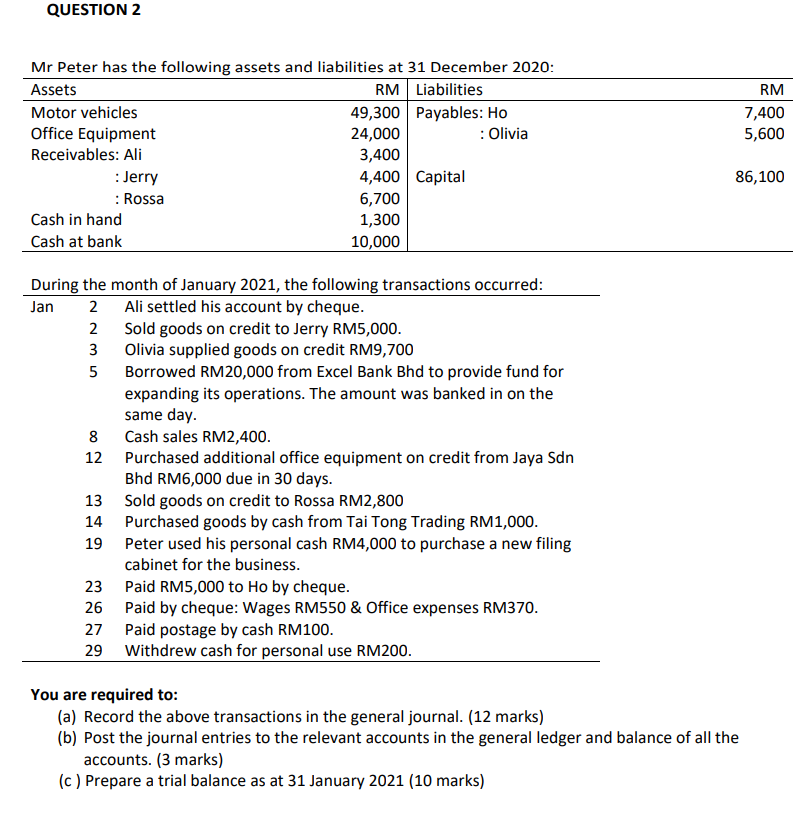

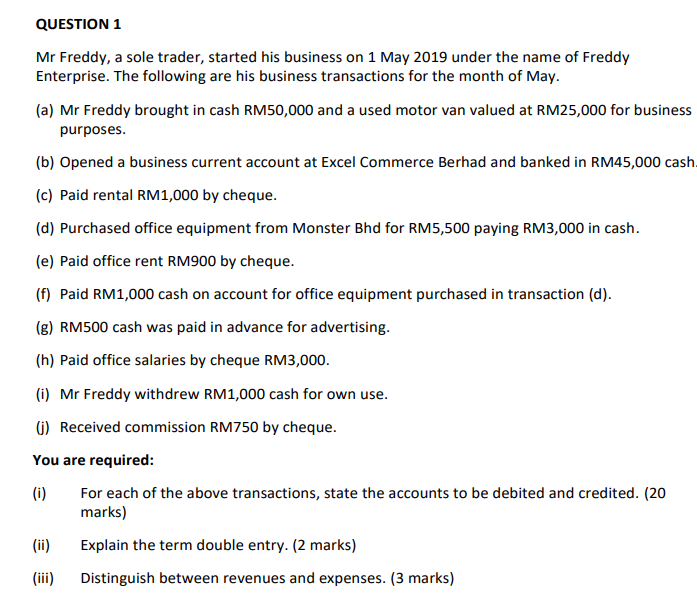

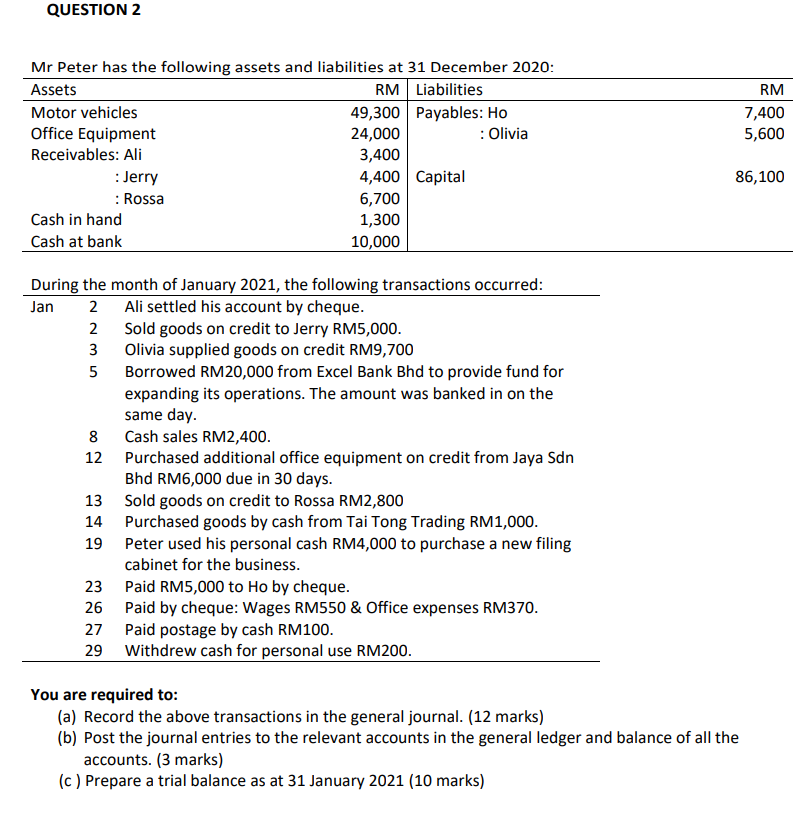

QUESTION 1 Mr Freddy, a sole trader, started his business on 1 May 2019 under the name of Freddy Enterprise. The following are his business transactions for the month of May. (a) Mr Freddy brought in cash RM50,000 and a used motor van valued at RM25,000 for business purposes. (b) Opened a business current account at Excel Commerce Berhad and banked in RM45,000 cash (c) Paid rental RM1,000 by cheque. (d) Purchased office equipment from Monster Bhd for RM5,500 paying RM3,000 in cash. (e) Paid office rent RM900 by cheque. (f) Paid RM1,000 cash on account for office equipment purchased in transaction (d). (g) RM500 cash was paid in advance for advertising. (h) Paid office salaries by cheque RM3,000. (i) Mr Freddy withdrew RM1,000 cash for own use. 6) Received commission RM750 by cheque. You are required: (i) For each of the above transactions, state the accounts to be debited and credited. (20 marks) (ii) Explain the term double entry. (2 marks) (iii) Distinguish between revenues and expenses. (3 marks) QUESTION 2 RM 7,400 5,600 Mr Peter has the following assets and liabilities at 31 December 2020: Assets RM Liabilities Motor vehicles 49,300 Payables: Ho Office Equipment 24,000 : Olivia Receivables: Ali 3,400 : Jerry 4,400 Capital : Rossa 6,700 Cash in hand 1,300 Cash at bank 10,000 86,100 During the month of January 2021, the following transactions occurred: Jan 2 Ali settled his account by cheque. 2 Sold goods on credit to Jerry RM5,000. 3 Olivia supplied goods on credit RM9,700 5 Borrowed RM20,000 from Excel Bank Bhd to provide fund for expanding its operations. The amount was banked in on the same day. 8 Cash sales RM2,400. 12 Purchased additional office equipment on credit from Jaya Sdn Bhd RM6,000 due in 30 days. 13 Sold goods on credit to Rossa RM2,800 14 Purchased goods by cash from Tai Tong Trading RM1,000. Peter used his personal cash RM4,000 to purchase a new filing cabinet for the business. 23 Paid RM5,000 to Ho by cheque. 26 Paid by cheque: Wages RM550 & Office expenses RM370. 27 Paid postage by cash RM100. 29 Withdrew cash for personal use RM200. 19 You are required to: (a) Record the above transactions in the general journal. (12 marks) (b) Post the journal entries to the relevant accounts in the general ledger and balance of all the accounts. (3 marks) (c) Prepare a trial balance as at 31 January 2021 (10 marks)