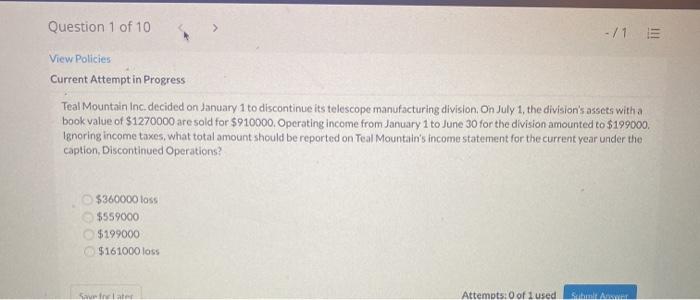

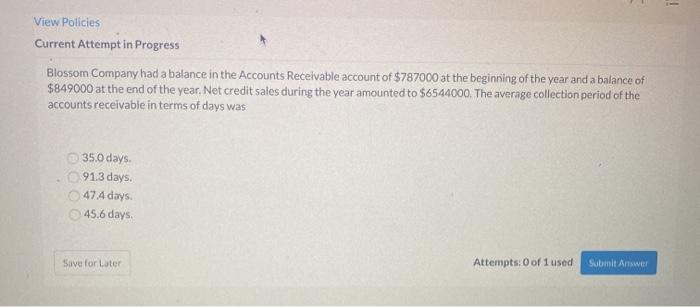

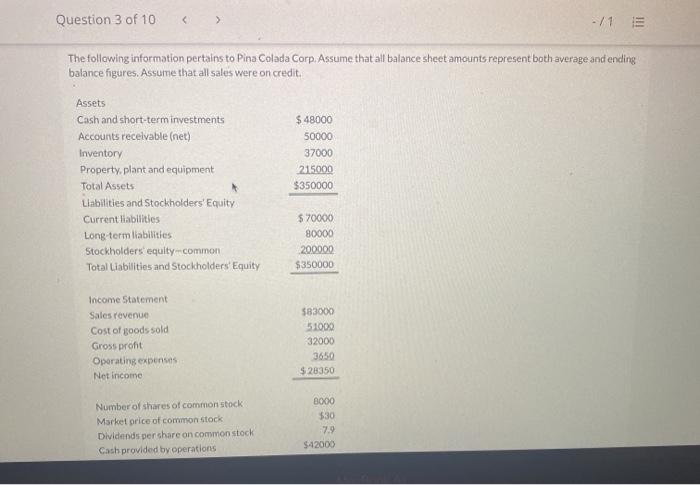

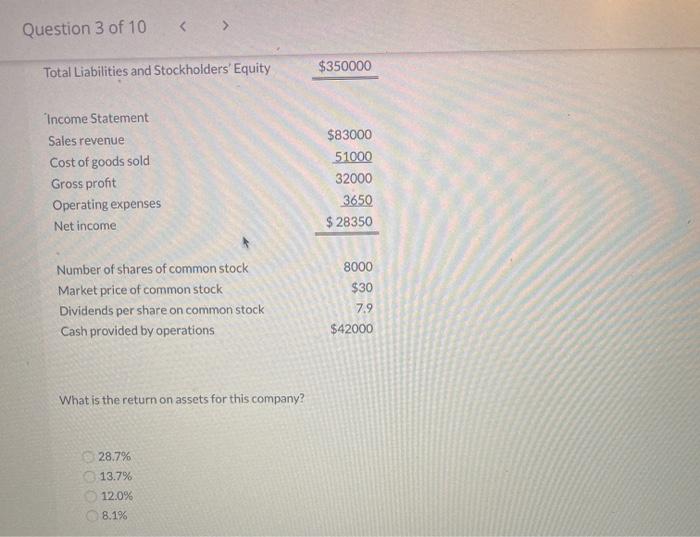

Question 1 of 10 View Policies Current Attempt in Progress Teal Mountain Inc. decided on January 1 to discontinue its telescope manufacturing division, On July 1, the division's assets with a book value of $1270000 are sold for $910000. Operating income from January 1 to June 30 for the division amounted to $199000 Ignoring income taxes, what total amount should be reported on Teal Mountain's income statement for the current year under the caption, Discontinued Operations? $360000 loss $559000 $199000 $161000 loss Salate Attempts:0 of 1 used Street 1 View Policies Current Attempt in Progress Blossom Company had a balance in the Accounts Receivable account of $787000 at the beginning of the year and a balance of $849000 at the end of the year. Net credit sales during the year amounted to $6544000. The average collection period of the accounts receivable in terms of days was 35.0 days 91.3 days. 47.4 days. 45.6 days Save for Later Attempts: 0 of 1 used Submit Answer Question 3 of 10 The following information pertains to Pina Colada Corp. Assume that all balance sheet amounts represent both average and ending balance figures. Assume that all sales were on credit Assets Cash and short-term investments Accounts recevable (net) Inventory Property, plant and equipment Total Assets Liabilities and Stockholders Equity Current liabilities Long-term liabilities Stockholders equity common Total Liabilities and Stockholders Equity $ 48000 50000 37000 2115000 $350000 $70000 80000 200000 $350000 Income Statement Sales revenue Cost of goods sold Gross pront Operating expenses Not income $83000 51000 32000 $28350 8000 $30 Number of shares of common stock Market price of common stock Dividends per share on common stock Cash provided by operations 7.9 $42000 Question 3 of 10 $350000 Total Liabilities and Stockholders' Equity Income Statement Sales revenue Cost of goods sold Gross profit Operating expenses Net income $83000 51000 32000 3650 $ 28350 Number of shares of common stock Market price of common stock Dividends per share on common stock Cash provided by operations 8000 $30 7.9 $42000 What is the return on assets for this company? 28.7% 13.7% 12.0% 8.1%