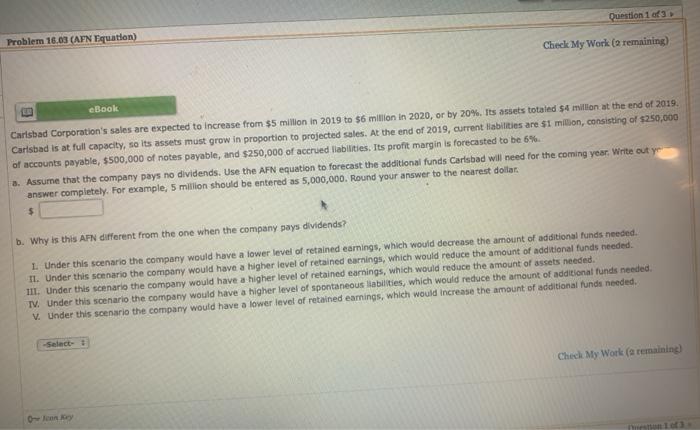

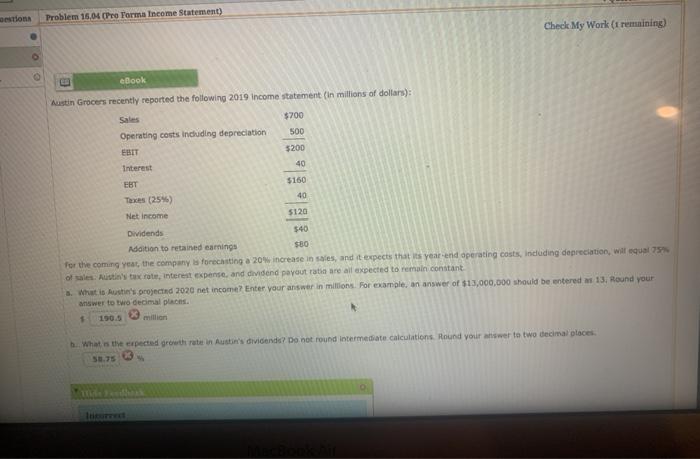

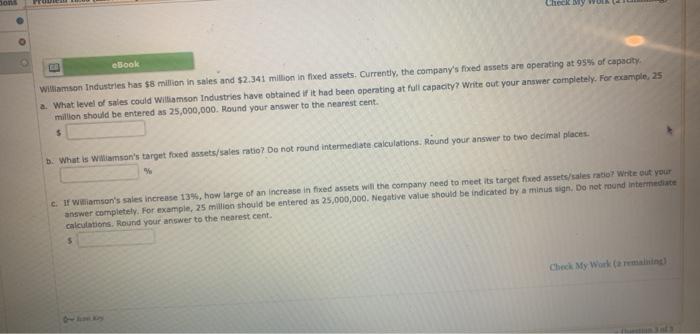

Question 1 of 3 Problem 16.03 (AFN Equation) Check My Work (2 remaining) B eBook Carlsbad Corporation's sales are expected to increase from $5 million in 2019 to $6 million in 2020, or by 20%. Its assets totaled $1 million at the end of 2019. Carlsbad is at full capacity, so its assets must grow in proportion to projected sales. At the end of 2019, current Habilities are $1 million, consisting of $250,000 of accounts payable, $500,000 of notes payable, and $250,000 of accrued liabilities. Its profit margin is forecasted to be 6%. 3. Assume that the company pays no dividends. Use the AFN equation to forecast the additional funds Carlsbad will need for the coming year. Write out yo answer completely. For example, 5 million should be entered as 5,000,000. Round your answer to the nearest dollar $ b. Why is this AFN different from the one when the company pays dividends? 1. Under this scenario the company would have a lower level of retained earnings, which would decrease the amount of additional funds needed 11. Under this scenario the company would have a higher level of retained earnings, which would reduce the amount of additional funds needed. II. Under this scenario the company would have a higher level of retained earnings, which would reduce the amount of assets needed IV. Under this scenario the company would have a higher level of spontaneous liabilities, which would reduce the amount of additional funds needed V. Under this scenario the company would have a lower level of retained earnings, which would increase the amount of additional funds needed. -Select- + Check My Work (a remaining) onton Problem 16.04 (Pre Forma Income Statement) Check My Work (1 remaining) eBook 5160 Austin Grocers recently reported the following 2019 Income statement (in millions of dollars): Sales $700 Operating costs including depreciation 500 ERIT $200 Interest 40 EBT Ta KHAI (256) 40 Net Income Dividends Addition to retained earnings for the coming year, the company is forecasting a 20% increase in sales, and it expects that its year-end operating costs, including depreciation, will equal 75 of Austin's tax rate, interest Expense and dividend payout ratio are all expected to remain constant What is Austin's projected 2020 net income? Enter your answer in millions. For example, an answer of $13,000,000 should be entered 13. Round your answer to two decimal places 1 190.5 million $120 $40 580 h. What is the expected growth rate in Austin's dividends? Do not round Intermediate calculations. Round your answer to two decimal places Check my eBook Williamson Industries has $8 million in sales and $2.341 million in fixed assets. Currently, the company's fixed assets are operating at 95% of capodty. a. What level of sales could Williamson Industries have obtained if it had been operating at full capacity? Write out your answer completely. For sample 25 million should be entered as 25,000,000. Round your answer to the nearest cent. $ b. What is Williamson's target foed assets/sales ratio? Do not round intermediate calculations. Round your answer to two decimal places c. If Williamson's sales increase 13%, how large of an increase in fixed assets will the company need to meet its target fixed assets/sales ratio? write out your answer completely. For example, 25 million should be entered as 25,000,000. Negative value should be indicated by a minus sign. Do not mund Intermediate calculations. Round your answer to the nearest cent. 5 Check My Work (ml)