Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 1 On 31 May 2021, Nanti Kepulangan Bhd (NKB) purchased a production machine under hire purchase agreement with Bayangan Semalam Bhd (BSB). The cash

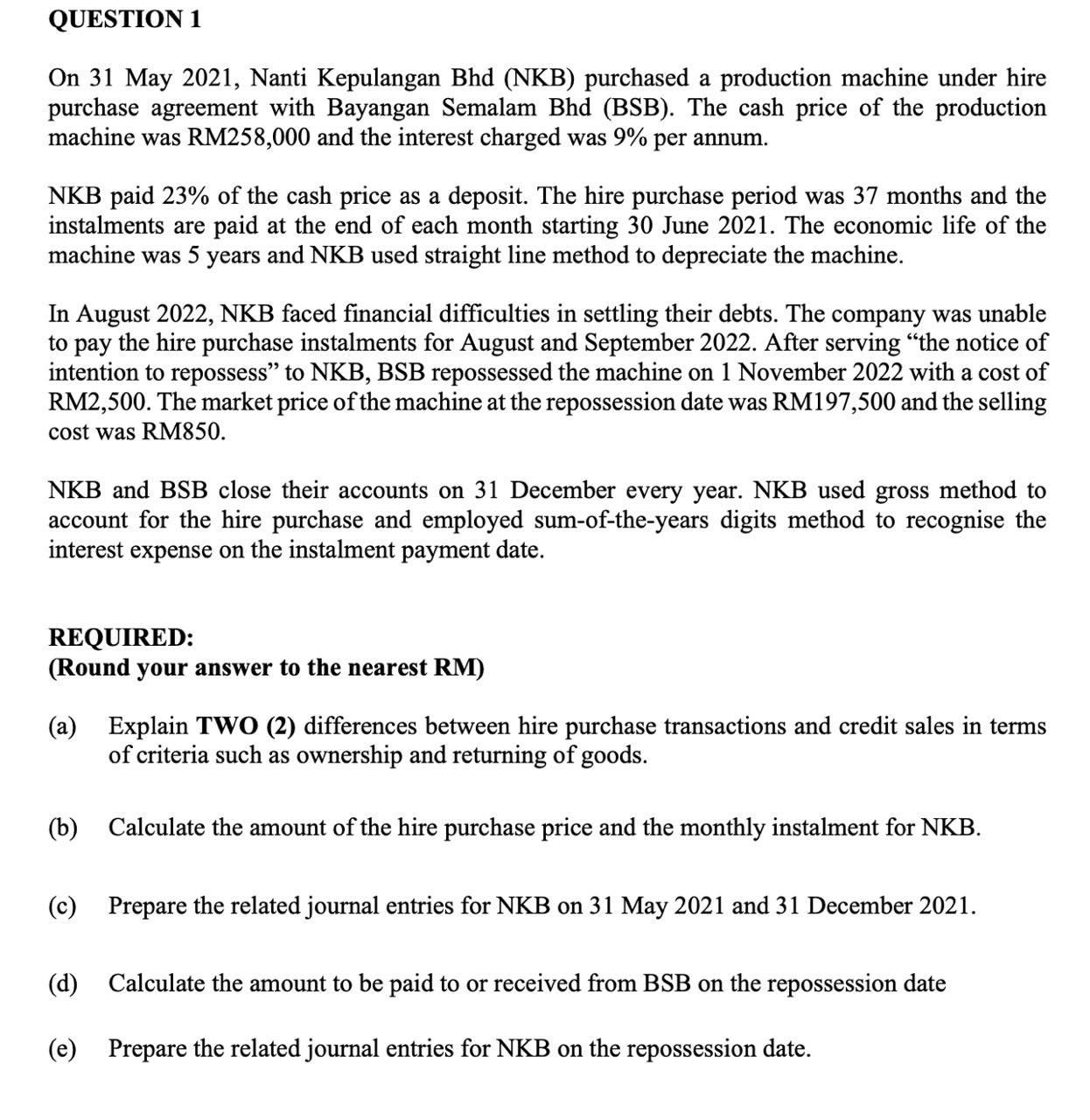

QUESTION 1 On 31 May 2021, Nanti Kepulangan Bhd (NKB) purchased a production machine under hire purchase agreement with Bayangan Semalam Bhd (BSB). The cash price of the production machine was RM258,000 and the interest charged was 9% per annum. NKB paid 23% of the cash price as a deposit. The hire purchase period was 37 months and the instalments are paid at the end of each month starting 30 June 2021. The economic life of the machine was 5 years and NKB used straight line method to depreciate the machine. In August 2022, NKB faced financial difficulties in settling their debts. The company was unable to pay the hire purchase instalments for August and September 2022. After serving "the notice of intention to repossess" to NKB, BSB repossessed the machine on 1 November 2022 with a cost of RM2,500. The market price of the machine at the repossession date was RM197,500 and the selling cost was RM850. NKB and BSB close their accounts on 31 December every year. NKB used gross method to account for the hire purchase and employed sum-of-the-years digits method to recognise the interest expense on the instalment payment date. REQUIRED: (Round your answer to the nearest RM) (a) Explain TWO (2) differences between hire purchase transactions and credit sales in terms of criteria such as ownership and returning of goods. (b) Calculate the amount of the hire purchase price and the monthly instalment for NKB. (c) Prepare the related journal entries for NKB on 31 May 2021 and 31 December 2021. (d) Calculate the amount to be paid to or received from BSB on the repossession date (e) Prepare the related journal entries for NKB on the repossession date

QUESTION 1 On 31 May 2021, Nanti Kepulangan Bhd (NKB) purchased a production machine under hire purchase agreement with Bayangan Semalam Bhd (BSB). The cash price of the production machine was RM258,000 and the interest charged was 9% per annum. NKB paid 23% of the cash price as a deposit. The hire purchase period was 37 months and the instalments are paid at the end of each month starting 30 June 2021. The economic life of the machine was 5 years and NKB used straight line method to depreciate the machine. In August 2022, NKB faced financial difficulties in settling their debts. The company was unable to pay the hire purchase instalments for August and September 2022. After serving "the notice of intention to repossess" to NKB, BSB repossessed the machine on 1 November 2022 with a cost of RM2,500. The market price of the machine at the repossession date was RM197,500 and the selling cost was RM850. NKB and BSB close their accounts on 31 December every year. NKB used gross method to account for the hire purchase and employed sum-of-the-years digits method to recognise the interest expense on the instalment payment date. REQUIRED: (Round your answer to the nearest RM) (a) Explain TWO (2) differences between hire purchase transactions and credit sales in terms of criteria such as ownership and returning of goods. (b) Calculate the amount of the hire purchase price and the monthly instalment for NKB. (c) Prepare the related journal entries for NKB on 31 May 2021 and 31 December 2021. (d) Calculate the amount to be paid to or received from BSB on the repossession date (e) Prepare the related journal entries for NKB on the repossession date Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started