Answered step by step

Verified Expert Solution

Question

1 Approved Answer

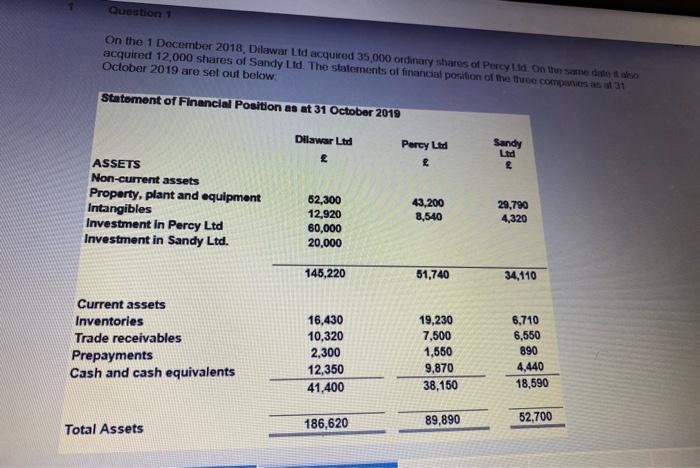

Question 1 On the 1 December 2018, Dilawar Ltd acquired 35,000 ordinary shares of Percy Ltd. On the same date it also acquired 12,000

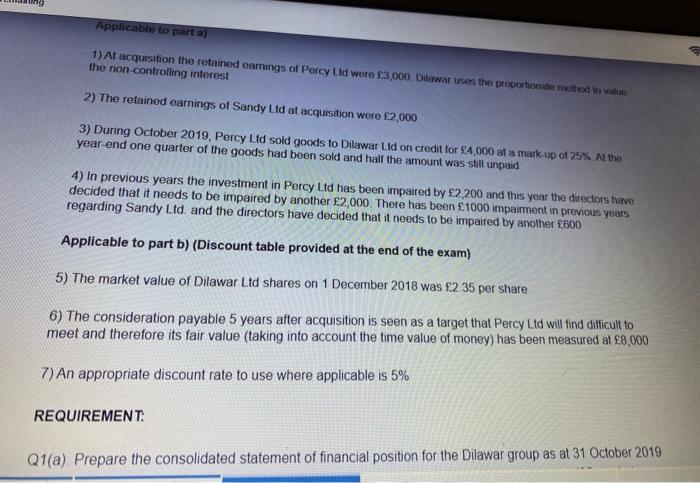

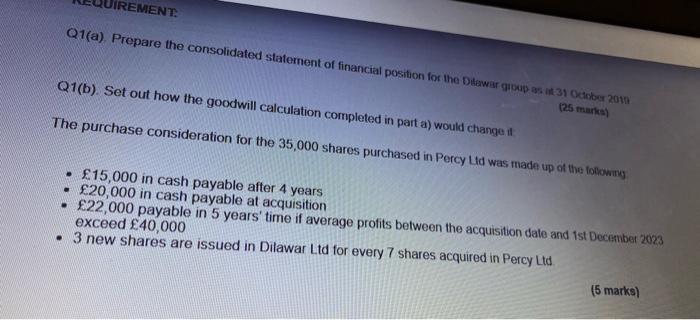

Question 1 On the 1 December 2018, Dilawar Ltd acquired 35,000 ordinary shares of Percy Ltd. On the same date it also acquired 12,000 shares of Sandy Ltd. The statements of financial position of the three companies as at 31 October 2019 are set out below Statement of Financial Position as at 31 October 2019 ASSETS Non-current assets Property, plant and equipment Intangibles Investment in Percy Ltd Investment in Sandy Ltd. Current assets Inventories Trade receivables Prepayments Cash and cash equivalents Total Assets Dilawar Ltd 52,300 12,920 60,000 20,000 145,220 16,430 10,320 2,300 12,350 41,400 186,620 Percy Ltd 43,200 8,540 51,740 19,230 7,500 1,550 9,870 38,150 89,890 Sandy Ltd 29,790 4,320 34,110 6,710 6,550 890 4,440 18,590 52,700 Applicable to part a) 1) At acquisition the retained earnings of Percy Ltd were 3,000. Dilawar uses the proportional method to value the non-controlling interest 2) The retained earnings of Sandy Ltd at acquisition were 2,000 3) During October 2019, Percy Ltd sold goods to Dilawar Ltd on credit for 4,000 at a mark-up of 25%. At the year-end one quarter of the goods had been sold and half the amount was still unpaid 4) In previous years the investment in Percy Ltd has been impaired by 2,200 and this year the directors have decided that it needs to be impaired by another 2,000. There has been 1000 impairment in previous years regarding Sandy Ltd. and the directors have decided that it needs to be impaired by another 600 Applicable to part b) (Discount table provided at the end of the exam) 5) The market value of Dilawar Ltd shares on 1 December 2018 was 2.35 per share 6) The consideration payable 5 years after acquisition is seen as a target that Percy Ltd will find difficult to meet and therefore its fair value (taking into account the time value of money) has been measured at 8,000 7) An appropriate discount rate to use where applicable is 5% REQUIREMENT: Q1(a). Prepare the consolidated statement of financial position for the Dilawar group as at 31 October 2019 Q1(a). Prepare the consolidated statement of financial position for the Dilawar group as at 31 October 2010 (25 marks) UIREMENT Q1(b). Set out how the goodwill calculation completed in part a) would change if The purchase consideration for the 35,000 shares purchased in Percy Ltd was made up of the following 15,000 in cash payable after 4 years 20,000 in cash payable at acquisition 22,000 payable in 5 years' time if average profits between the acquisition date and 1st December 2023 exceed 40,000 . 3 new shares are issued in Dilawar Ltd for every 7 shares acquired in Percy Ltd. . . (5 marks)

Step by Step Solution

★★★★★

3.48 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Dilawar Group Consolidated statement of financial position as at 31 Oc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started