Answered step by step

Verified Expert Solution

Question

1 Approved Answer

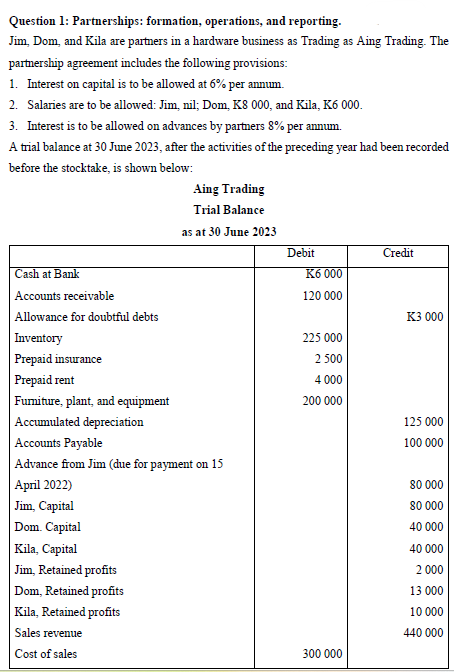

Question 1 : Partnerships: formation, operations, and reporting. Jim, Dom, and Kila are partners in a hardware business as Trading as Aing Trading. The partnership

Question : Partnerships: formation, operations, and reporting.

Jim, Dom, and Kila are partners in a hardware business as Trading as Aing Trading. The

partnership agreement includes the following provisions:

Interest on capital is to be allowed at per annum.

Salaries are to be allowed: Jim, nil; Dom, K and Kila, K

Interest is to be allowed on advances by partners per annum.

A trial balance at June after the activities of the preceding year had been recorded

before the stocktake, is shown below:

Aing Trading

Trial Balance

as at June Additional information:

Merchandise of K purchased on credit was received on June but had not

been recorded in the accounts; nevertheless, it had been included in the physical

stocktake of K

Insurance and rents to be expenses were assessed at K and K respectively.

Depreciation expense to be brought to account, K

Wages owed but not paid amounted to K

Partners Dom's and Kila's salaries had not been brought to account.

Interest on Jim's advance had not been brought to account.

Verification of accounts receivable revealed that the balance of the allowance for

doubtful debts should be increased to K The increase is related to sales revenue

recognized in the current period.

Required:

A Prepare the statement of financial performance for the period June

B Prepare a Profit Distribution account for the same period.

C Prepare statement of financial as at June

NB: All adjustments and calculations be provided to support the answers.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started