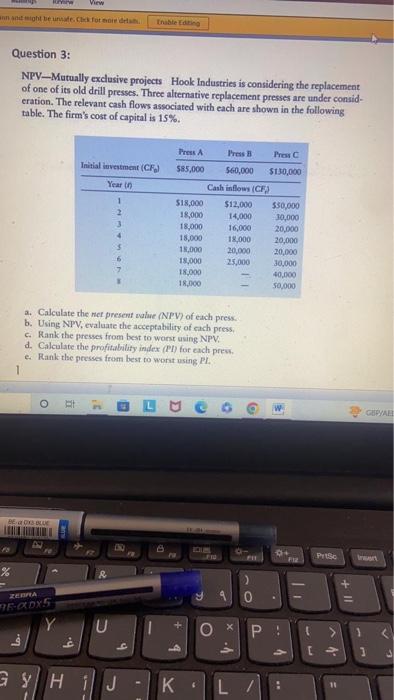

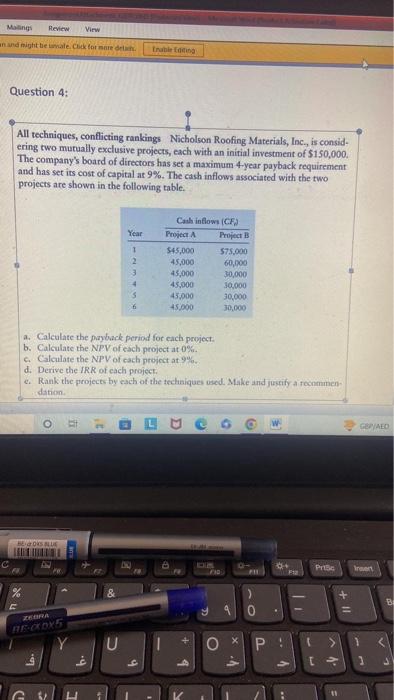

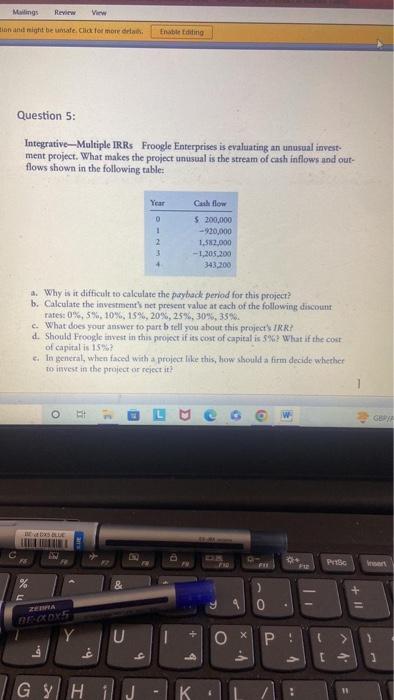

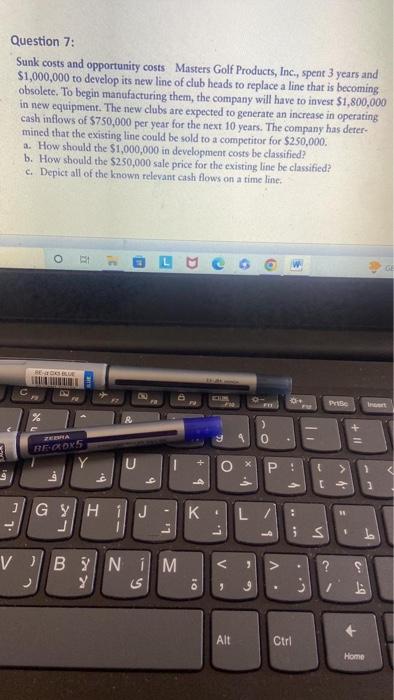

Question 1: Payback comparisons Nova Products has a S-year maximum acceptable payback period. The firm is considering the purchase of a new machine and must choose between two alternative ones. The first machine requires an initial investment of $14,000 and generates annual after-tax cash inflows of $3,000 for each of the next 7 years. The second machine requires an initial investment of $21,000 and provides an annual cash inflow after taxes of $4,000 for 20 years. a. Determine the paryback period for each machine. b. Comment on the acceptability of the machines, assuming that they are independent projects. c. Which machine should the firm accept? Why? d. Do the machines in this problem illustrate any of the weaknesses of using payback? Discuss. NPV Calculate the net present value (NPV) for the following 20-year projects. Comment on the acceptability of each. Assume that the firm has an opportunity cost of 14%. a. Initial investment is $10,000; cash inflows are $2,000 per year. b. Initial investment is $25,000; cash inflows are $3,000 per year: c. Initial investment is $30,000; cash inflows are $5,000 per year. NPV-Mutually exclusive projects Hook Industries is considering the replacement of one of its old drill presses. Three alternative replacement presses are under consideration. The relevant cash flows associated with each are shown in the following table. The firm's cost of capital is 15%. a. Calculate the net present walue (NPV) of exch press. b. Using NPV, evaluate the acceptability of each press. c. Rank the presses from best to worst using NPV. d. Calculate the profitabilaty index (PI) for each prew. e. Rank the presses from best to worst using PI. All techniques, conflicting rankings Nicholson Roofing Materials, Inc, is consid. ering two mutually exclusive projects, each with an initial investment of $150,000. The company's board of directors has set a maximum 4-year payback requirement and has set its cost of capital at 9%. The cash inflows associated with the two projects are shown in the following table. a. Calculate the paybuack period for each project. b. Calculate the NPV of each project at 0%. c. Calculate the NPV of each project at 9% d. Derive the IRR of each project. e. Rank the projects by each of the techaiques vaed. Make and justify a rocommendation. Integrative-Multiple IRRs Froogle Enterprises is evaluating an unusual investment project. What makes the project unusual is the stream of cash inflows and outflows shown in the following table: a. Why is it difficule to calculate the payback period for this project? b. Calculate the investment'k net present value at each of the following discount rates: 0%,5%,10%,15%,20%,25%,30%,35%. c. What does your answer to part b tell you about this project 3 IKK? d. Should Froogle invest in thin projest if its cost of capital is 5% ? What if the coit of capiral is is 8 ? c. In general, when faced wiah a project like this, how should a firm decide wherher wo invest in the project or reject it? Question 7: Sunk costs and opportunity costs: Masters Golf Products, Inc., spent 3 years and $1,000,000 to develop its new line of club heads to replace a line that is becoming obsolete. To begin manufacturing them, the company will have to invest $1,800,000 in new equipment. The new clubs are expected to generate an increase in operating cash inflows of $750,000 per year for the next 10 years. The company has determined that the existing line could be sold to a competitor for $250,000. a. How should the $1,000,000 in development costs be classified? b. How should the $250,000 sale price for the existing line be classified? c. Depict all of the known relevant cash flows on a time line