Question

Question 1 Pest Eliminator Pte Ltd is a pest control company started by Ivan Lim in 2020. All its revenue is derived from ad-hoc jobs

Question 1 Pest Eliminator Pte Ltd is a pest control company started by Ivan Lim in 2020. All its revenue is derived from ad-hoc jobs and annual contracts for pest control work. Ivan approached you for help to finalise the company's accounts for the year ending 31 Dec 2021.

You are given the following additional information where none of which has been taken into consideration in arriving at the figures shown in the trial balance above. (i) On 1 December, the company received from Delight Property Management, a $5,000, 90-day, 8% note in exchange for Delight Property Management's request to allow additional time to settle the amount owing.

(ii) The 31 Dec 2021 inventory count of pest control supplies showed that $22,800 was still available.

(iii) Three months have expired since the 12-month insurance was paid in advance.

(iv) As at 31 Dec 2021, the salaries payable to employees were $5,125.

(v) The pest control equipment was purchased on 1 January 2021. The cost of the equipment included the purchase price of $14,000 and $2,400 being the cost for the first-year maintenance of the machine.

(vi) No depreciation has been charged for the year ended 31 Dec 2021. The company depreciates non-current assets as follows: Pest control equipment at cost - straight line over 5 years. The residual value of the pest control equipment was estimated to be $2,000. Office equipment - the double declining balance method. Office equipment are assumed to have useful life of 5 years and residual value at 10% of the cost.

(vii) On 31 December, the amount paid in advance by clients for annual contracts were $10,500. However, this amount has been included in revenue in the unadjusted Trial Balance.

(viii) It was estimated that 7% of outstanding accounts receivable on 31 December were uncollectible.

Required: Analyse the above information and prepare all necessary adjusting entries. Show narrations and all workings.

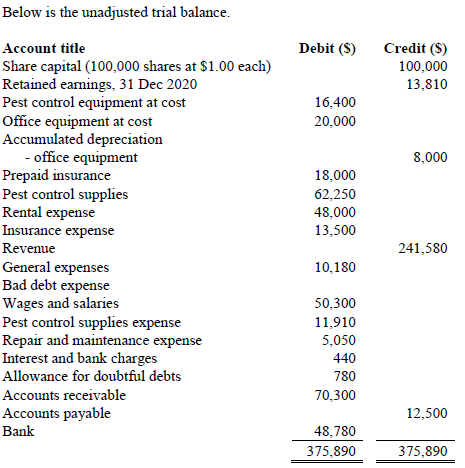

Below is the unadjusted trial balanceStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started