Answered step by step

Verified Expert Solution

Question

1 Approved Answer

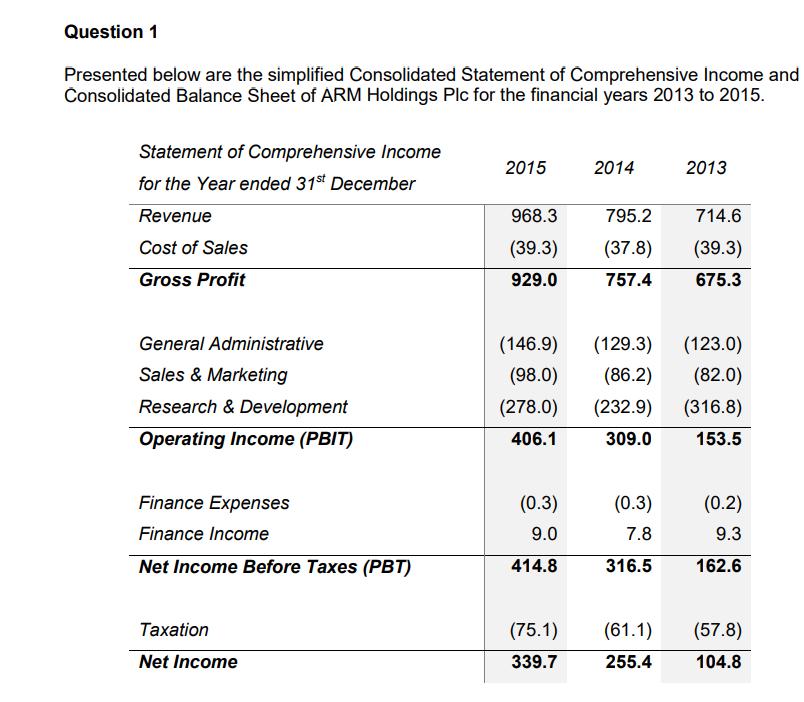

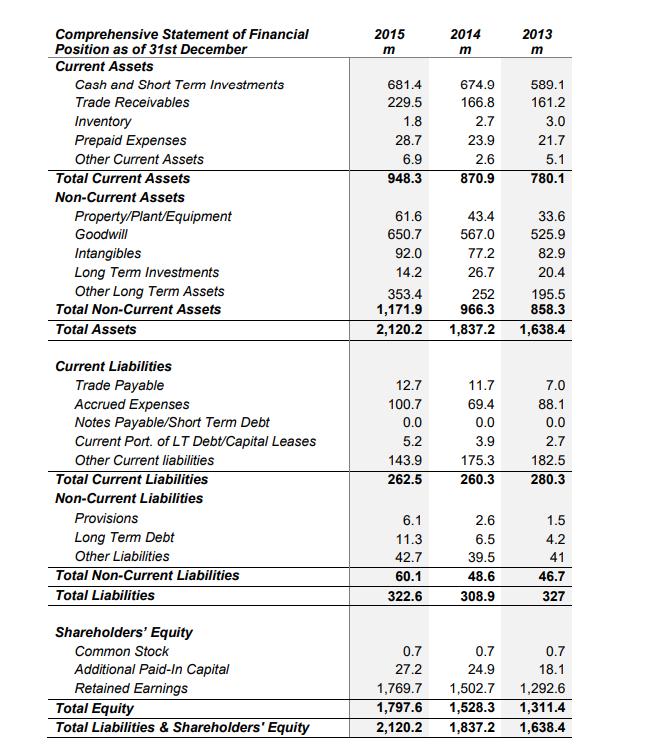

Question 1 Presented below are the simplified Consolidated Statement of Comprehensive Income and Consolidated Balance Sheet of ARM Holdings Plc for the financial years

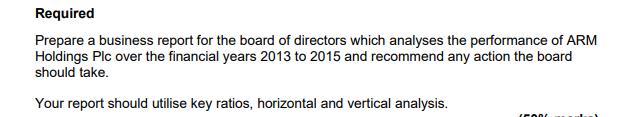

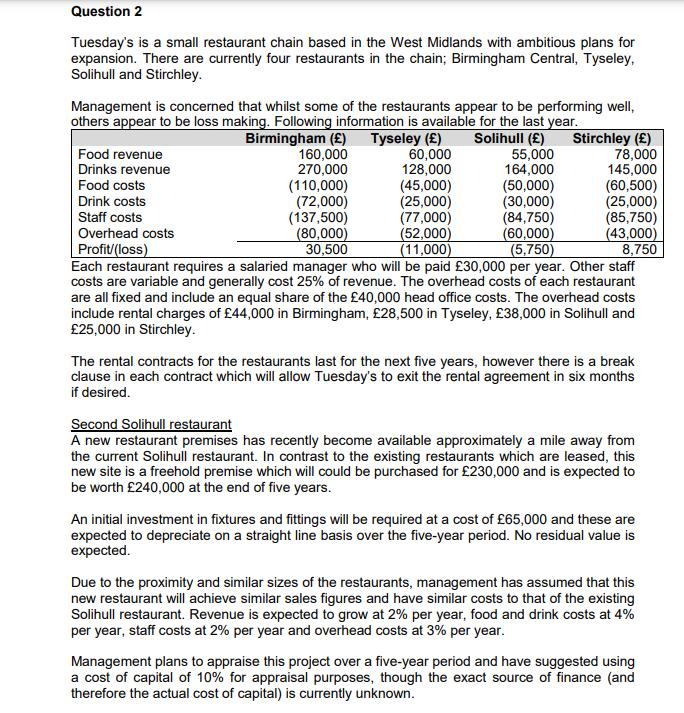

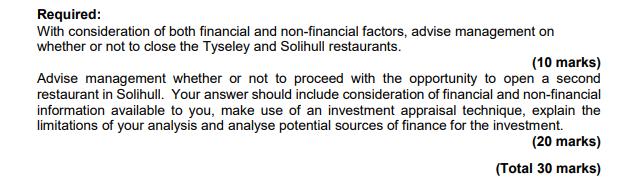

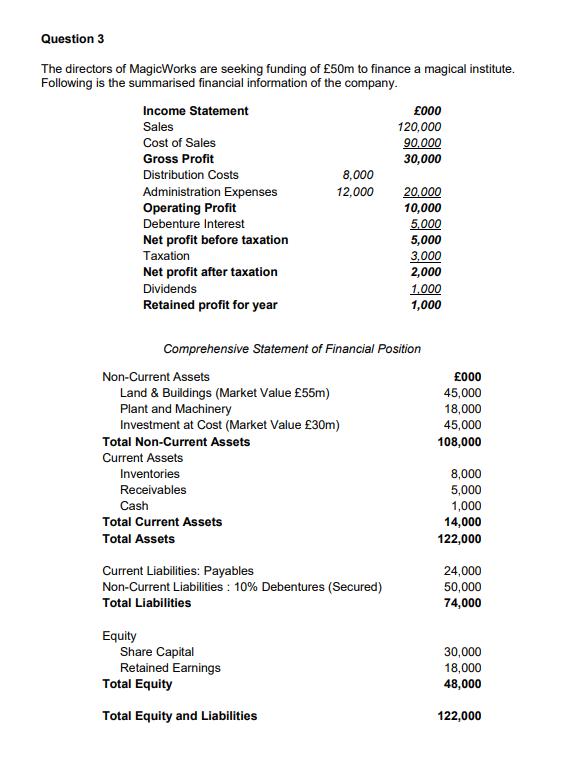

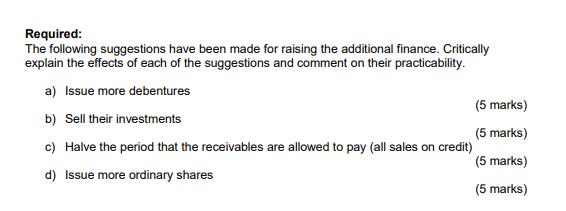

Question 1 Presented below are the simplified Consolidated Statement of Comprehensive Income and Consolidated Balance Sheet of ARM Holdings Plc for the financial years 2013 to 2015. Statement of Comprehensive Income for the Year ended 31st December Revenue Cost of Sales Gross Profit General Administrative Sales & Marketing Research & Development Operating Income (PBIT) Finance Expenses Finance Income Net Income Before Taxes (PBT) Taxation Net Income 2015 968.3 (39.3) 929.0 (146.9) (98.0) (278.0) 406.1 (0.3) 9.0 414.8 (75.1) 339.7 2014 795.2 (37.8) 757.4 (0.3) 7.8 316.5 2013 (129.3) (123.0) (86.2) (82.0) (232.9) (316.8) 309.0 153.5 (61.1) 255.4 714.6 (39.3) 675.3 (0.2) 9.3 162.6 (57.8) 104.8 Comprehensive Statement of Financial Position as of 31st December Current Assets Cash and Short Term Investments Trade Receivables Inventory Prepaid Expenses Other Current Assets Total Current Assets Non-Current Assets Property/Plant/Equipment Goodwill Intangibles Long Term Investments Other Long Term Assets Total Non-Current Assets Total Assets Current Liabilities Trade Payable Accrued Expenses Notes Payable/Short Term Debt Current Port. of LT Debt/Capital Leases Other Current liabilities Total Current Liabilities Non-Current Liabilities Provisions Long Term Debt Other Liabilities Total Non-Current Liabilities Total Liabilities Shareholders' Equity Common Stock Additional Paid-In Capital Retained Earnings Total Equity Total Liabilities & Shareholders' Equity 2015 m 681.4 229.5 1.8 28.7 6.9 948.3 61.6 650.7 92.0 14.2 12.7 100.7 0.0 5.2 143.9 262.5 2014 m 6.1 11.3 42.7 60.1 322.6 674.9 166.8 353.4 1,171.9 2,120.2 1,837.2 2.7 23.9 2.6 870.9 43.4 567.0 77.2 26.7 252 966.3 11.7 69.4 0.0 3.9 175.3 260.3 2.6 6.5 39.5 48.6 308.9 0.7 24.9 2013 m 589.1 161.2 3.0 21.7 5.1 780.1 33.6 525.9 82.9 20.4 195.5 858.3 1,638.4 7.0 88.1 0.0 2.7 182.5 280.3 1.5 4.2 41 46.7 327 0.7 27.2 1,769.7 1,502.7 1,292.6 1,797.6 1,528.3 1,311.4 2,120.2 1,837.2 1,638.4 0.7 18.1 Required Prepare a business report for the board of directors which analyses the performance of ARM Holdings Plc over the financial years 2013 to 2015 and recommend any action the board should take. Your report should utilise key ratios, horizontal and vertical analysis. (500 Question 2 Tuesday's is a small restaurant chain based in the West Midlands with ambitious plans for expansion. There are currently four restaurants in the chain; Birmingham Central, Tyseley, Solihull and Stirchley. Management is concerned that whilst some of the restaurants appear to be performing well, others appear to be loss making. Following information is available for the last year. Solihull () Food revenue Drinks revenue Food costs Drink costs Staff costs Overhead costs Profit/(loss) Birmingham () 160,000 270,000 (110,000) (72,000) (137,500) (80,000) 30,500 Tyseley () 60,000 128,000 (45,000) (25,000) (77,000) (52,000) (11,000) 55,000 164,000 (50,000) (30,000) (84,750) (60,000) (5,750) Stirchley () 78,000 145,000 (60,500) (25,000) (85,750) (43,000) 8,750 Each restaurant requires a salaried manager who will be paid 30,000 per year. Other staff costs are variable and generally cost 25% of revenue. The overhead costs of each restaurant are all fixed and include an equal share of the 40,000 head office costs. The overhead costs include rental charges of 44,000 in Birmingham, 28,500 in Tyseley, 38,000 in Solihull and 25,000 in Stirchley. The rental contracts for the restaurants last for the next five years, however there is a break clause in each contract which will allow Tuesday's to exit the rental agreement in six months if desired. Second Solihull restaurant A new restaurant premises has recently become available approximately a mile away from the current Solihull restaurant. In contrast to the existing restaurants which are leased, this new site is a freehold premise which will could be purchased for 230,000 and is expected to be worth 240,000 at the end of five years. An initial investment in fixtures and fittings will be required at a cost of 65,000 and these are expected to depreciate on a straight line basis over the five-year period. No residual value is expected. Due to the proximity and similar sizes of the restaurants, management has assumed that this new restaurant will achieve similar sales figures and have similar costs to that of the existing Solihull restaurant. Revenue is expected to grow at 2% per year, food and drink costs at 4% per year, staff costs at 2% per year and overhead costs at 3% per year. Management plans to appraise this project over a five-year period and have suggested using a cost of capital of 10% for appraisal purposes, though the exact source of finance (and therefore the actual cost of capital) is currently unknown. Required: With consideration of both financial and non-financial factors, advise management on whether or not to close the Tyseley and Solihull restaurants. (10 marks) Advise management whether or not to proceed with the opportunity to open a second restaurant in Solihull. Your answer should include consideration of financial and non-financial information available to you, make use of an investment appraisal technique, explain the limitations of your analysis and analyse potential sources of finance for the investment. (20 marks) (Total 30 marks) Question 3 The directors of MagicWorks are seeking funding of 50m to finance a magical institute. Following is the summarised financial information of the company. Income Statement Sales Cost of Sales Gross Profit Distribution Costs Administration Expenses Operating Profit Debenture Interest Net profit before taxation Taxation Net profit after taxation Dividends Retained profit for year Non-Current Assets Land & Buildings (Market Value 55m) Plant and Machinery Investment at Cost (Market Value 30m) Total Non-Current Assets Current Assets Equity Inventories Receivables Cash Total Current Assets Total Assets Comprehensive Statement of Financial Position 8,000 12,000 Current Liabilities: Payables Non-Current Liabilities: 10% Debentures (Secured) Total Liabilities Share Capital Retained Earnings Total Equity Total Equity and Liabilities 000 120,000 90,000 30,000 20,000 10,000 5.000 5,000 3,000 2,000 1.000 1,000 000 45,000 18,000 45,000 108,000 8,000 5,000 1,000 14,000 122,000 24,000 50,000 74,000 30,000 18,000 48,000 122,000 Required: The following suggestions have been made for raising the additional finance. Critically explain the effects of each of the suggestions and comment on their practicability. a) Issue more debentures b) Sell their investments c) Halve the period that the receivables are allowed to pay (all sales on credit) d) Issue more ordinary shares (5 marks) (5 marks) (5 marks) (5 marks)

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Question 1 Birmingham is the most profitable restaurant generating a profit of 30500 Stirchley is also profitable generating a profit of 8750 Tyseley and Solihull are both lossmaking generating losses ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started