Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1. Question 1 To be useful, financial information must be relevant and faithfully represent a business's economic activities. This requires ethics, beliefs that help

Question 1.

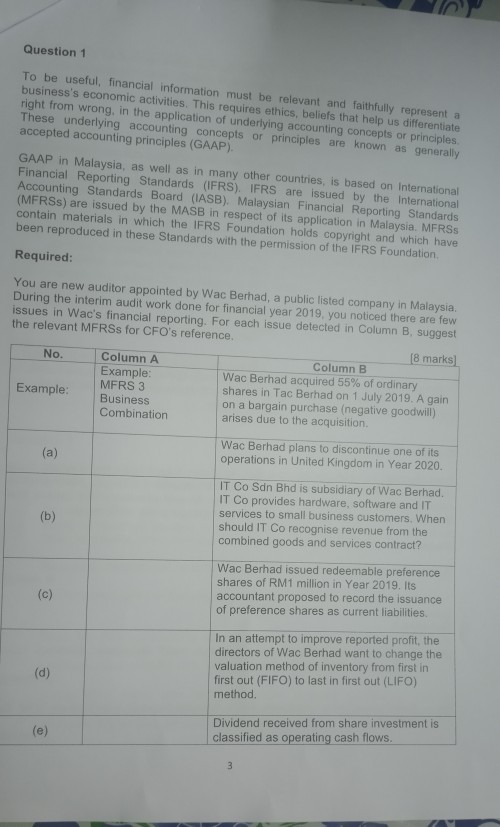

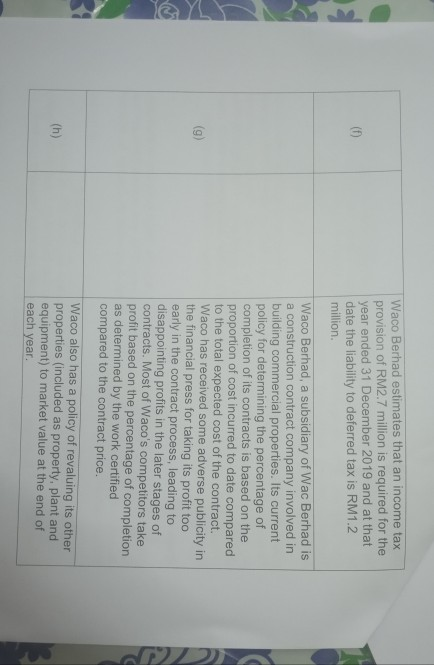

Question 1 To be useful, financial information must be relevant and faithfully represent a business's economic activities. This requires ethics, beliefs that help us differentiate right from wrong, in the application of underlying accounting concepts or principles These underlying accounting concepts or principles are known as generally accepted accounting principles (GAAP). GAAP in Malaysia, as well as in many other countries, is based on international Financial Reporting Standards (IFRS). IFRS are issued by the International Accounting Standards Board (ASB). Malaysian Financial Reporting Standards (MFRSs) are issued by the MASB in respect of its application in Malaysia. MFRSs contain materials in which the IFRS Foundation holds copyright and which have been reproduced in these Standards with the permission of the IFRS Foundation Required: You are new auditor appointed by Wac Berhad, a public listed company in Malaysia. During the interim audit work done for financial year 2019. you noticed there are few issues in Wac's financial reporting. For each issue detected in Column B, suggest the relevant MFRSs for CFO's reference. (8 marks) No. Column A Column B Example: Wac Berhad acquired 55% of ordinary MFRS 3 Example: shares in Tac Berhad on 1 July 2019. A gain Business on a bargain purchase (negative goodwill) Combination arises due to the acquisition (a) Wac Berhad plans to discontinue one of its operations in United Kingdom in Year 2020. (b) IT Co Sdn Bhd is subsidiary of Wac Berhad. IT Co provides hardware, software and IT services to small business customers. When should IT Co recognise revenue from the combined goods and services contract? (c) Wac Berhad issued redeemable preference shares of RM1 million in Year 2019. Its accountant proposed to record the issuance of preference shares as current liabilities (d) In an attempt to improve reported profit, the directors of Wac Berhad want to change the valuation method of inventory from first in first out (FIFO) to last in first out (LIFO) method. (e) Dividend received from share investment is classified as operating cash flows. 3 Waco Berhad estimates that an income tax provision of RM2.7 million is required for the year ended 31 December 2019 and at that date the liability to deferred tax is RM1.2 million (0) (9) Waco Berhad, a subsidiary of Wac Berhad is a construction contract company involved in building commercial properties. Its current policy for determining the percentage of completion of its contracts is based on the proportion of cost incurred to date compared to the total expected cost of the contract. Waco has received some adverse publicity in the financial press for taking its profit too early in the contract process, leading to disappointing profits in the later stages of contracts. Most of Waco's competitors take profit based on the percentage of completion as determined by the work certified compared to the contract price. 12 (h) Waco also has a policy of revaluing its other properties (included as property, plant and equipment) to market value at the end of each year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started