Answered step by step

Verified Expert Solution

Question

1 Approved Answer

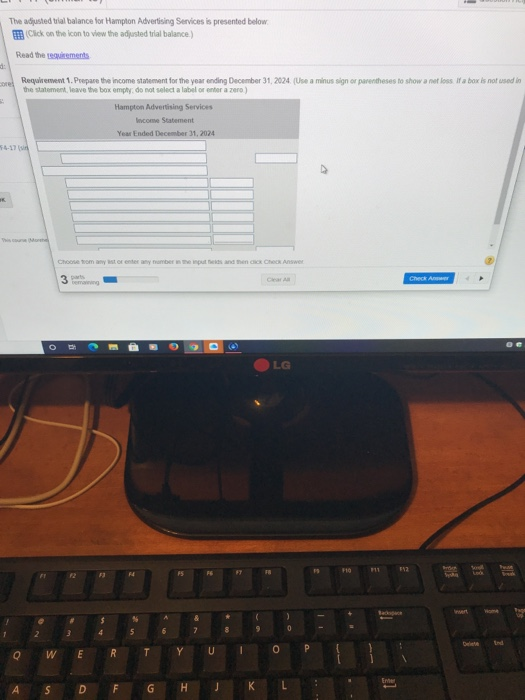

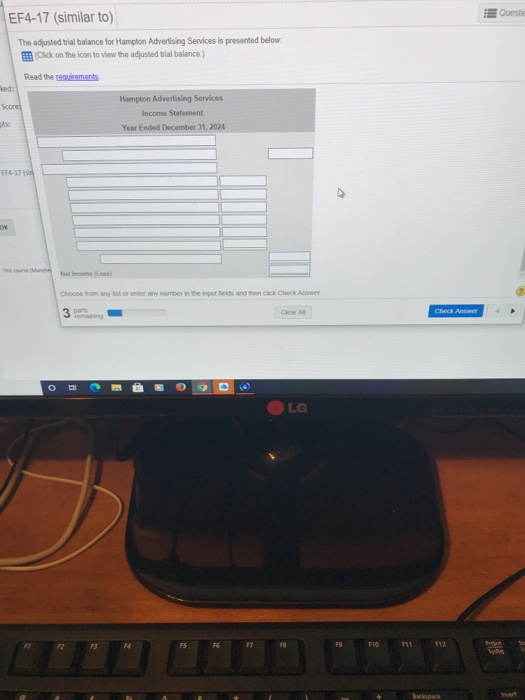

Question #1 Question #2 Please answer both questions in full if you know how to do it! Please allign the answers how the questions are

Question #1

Question #2

Please answer both questions in full if you know how to do it! Please allign the answers how the questions are so it's not confusing for me to figute out where it goes! I will give thumbs up if the answers are correct! If you have trouble reading any of the images please let me know so that I can post another picute! Thank you

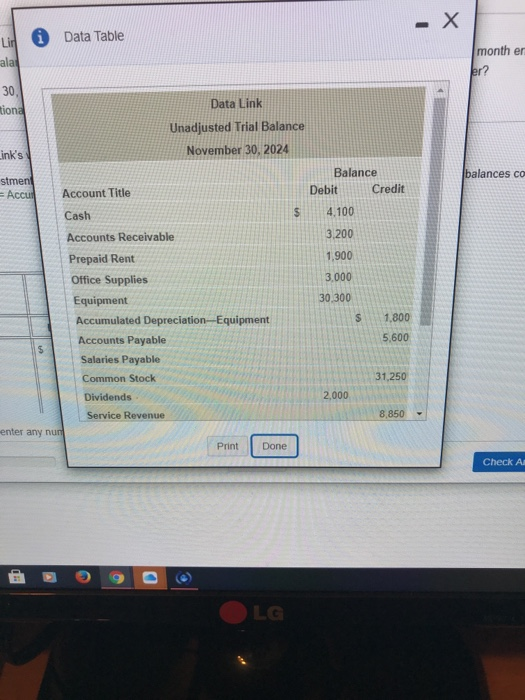

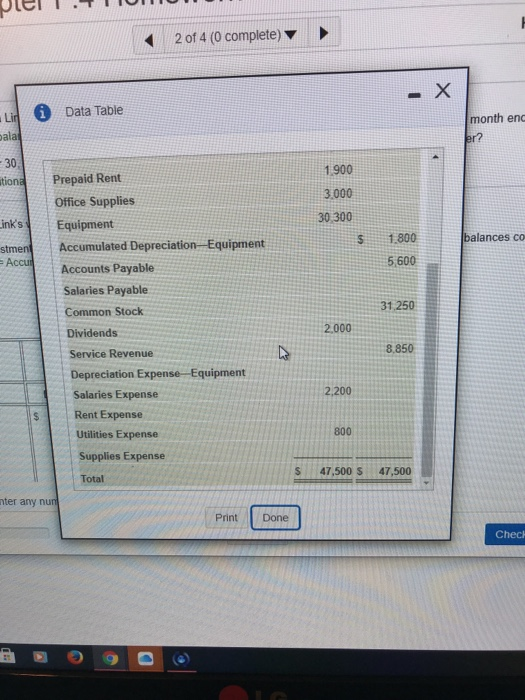

Question #1

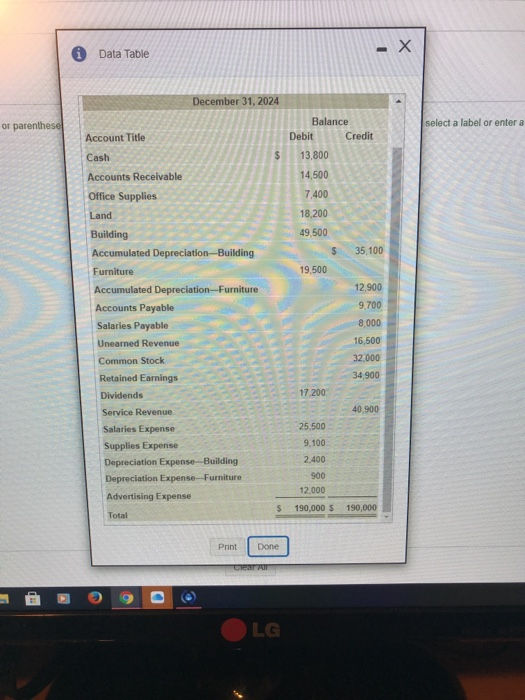

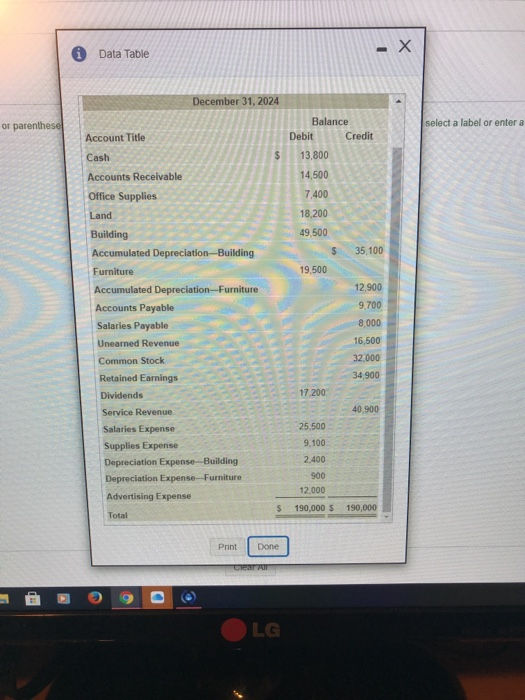

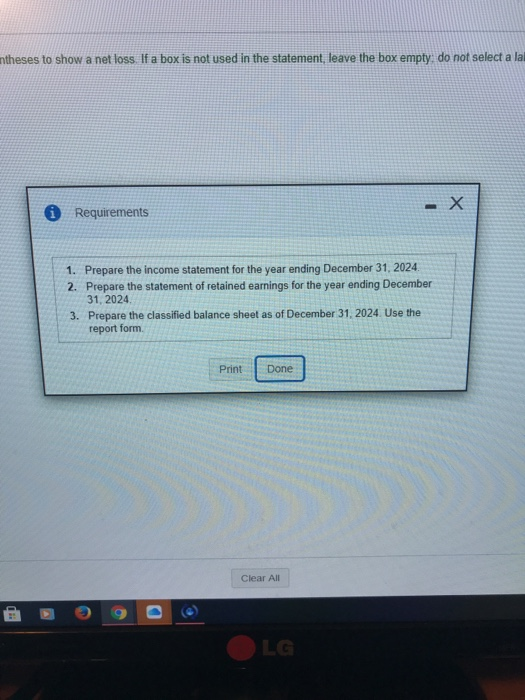

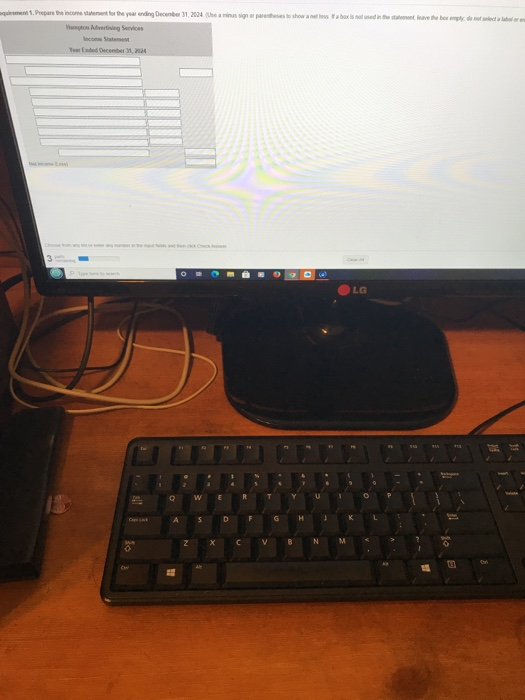

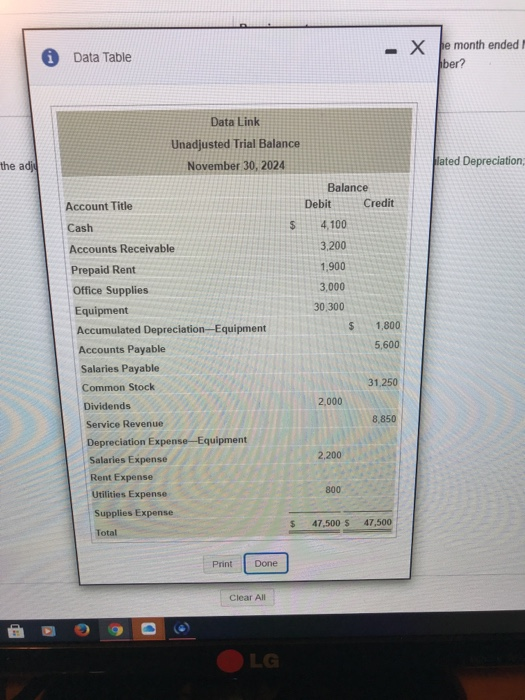

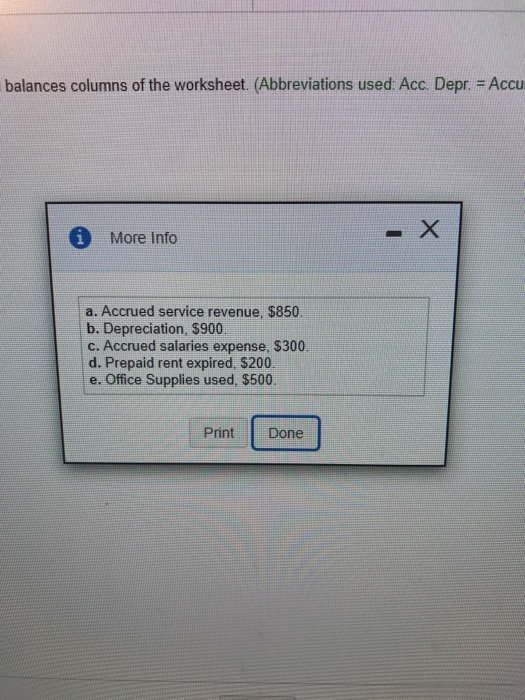

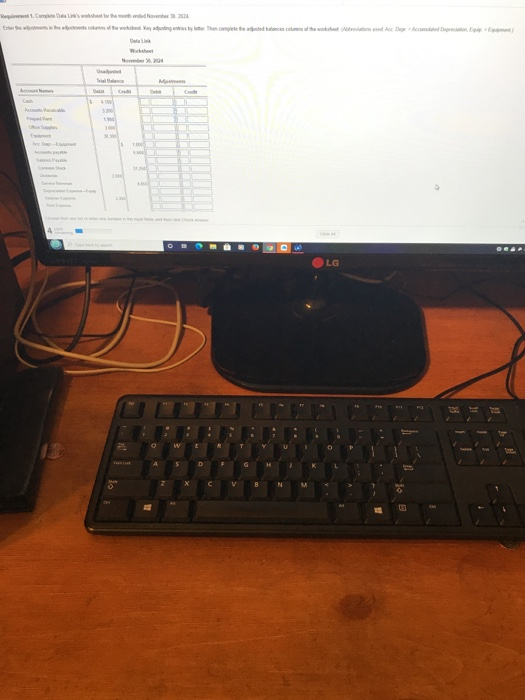

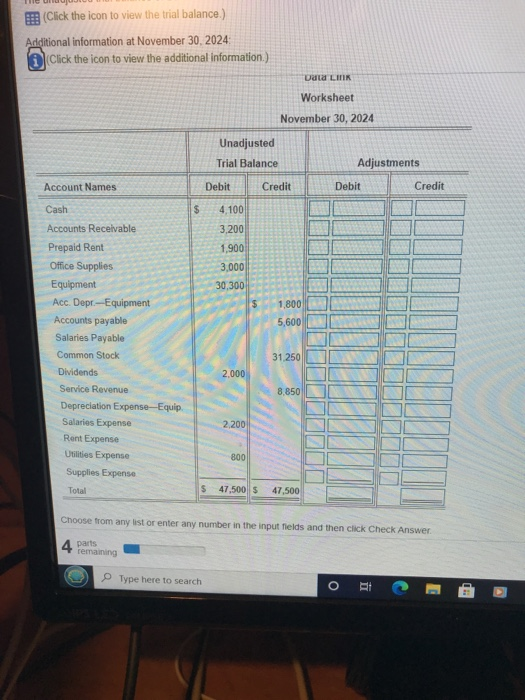

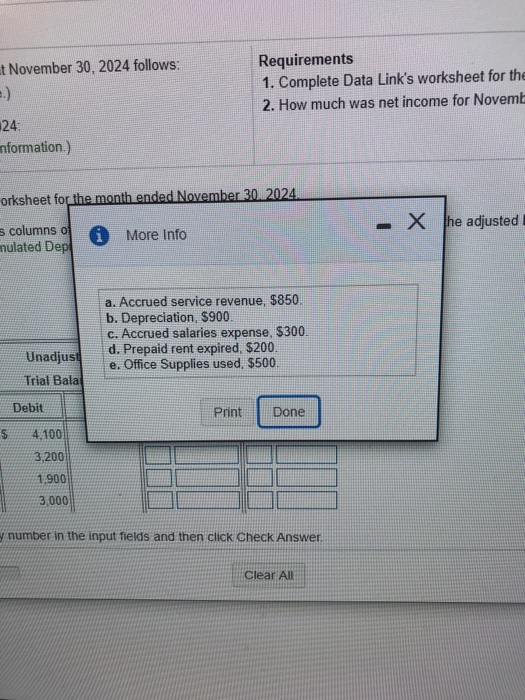

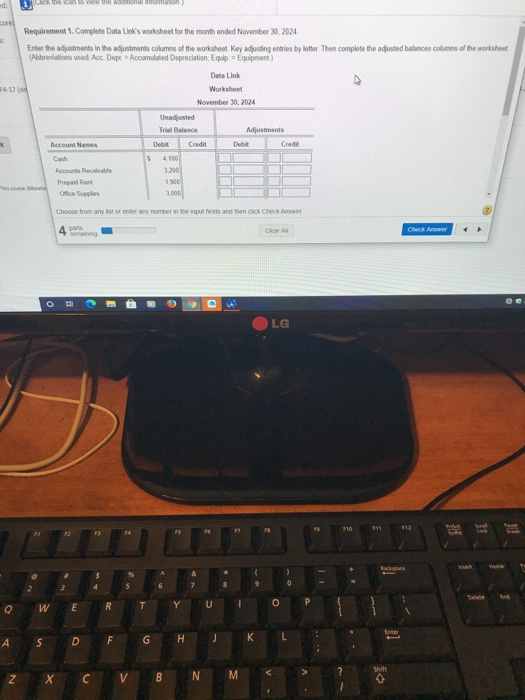

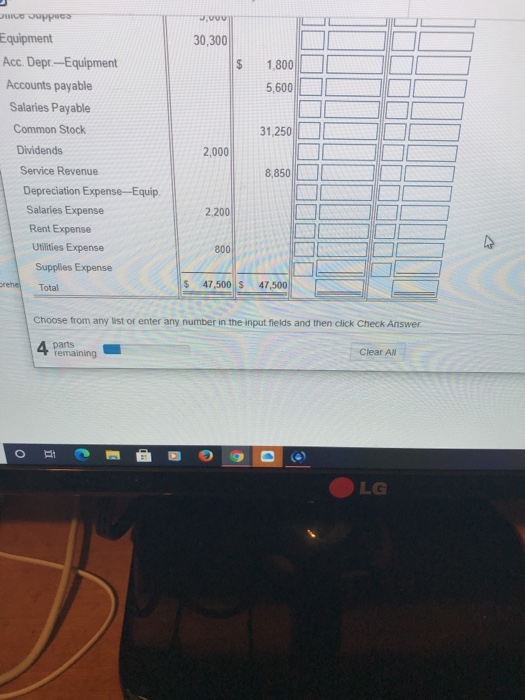

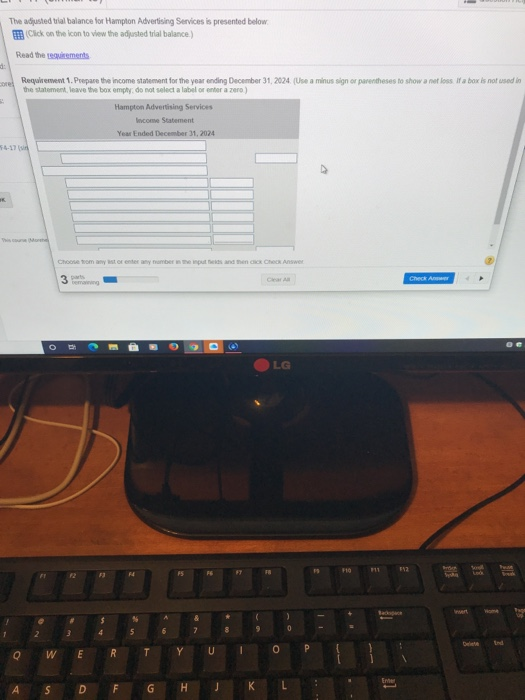

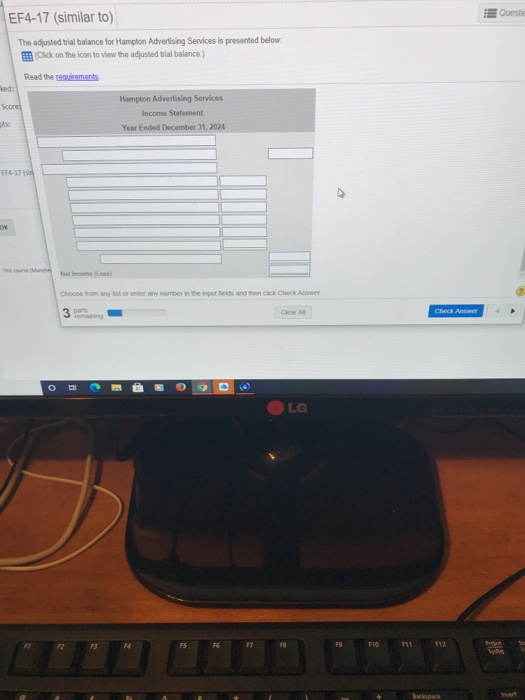

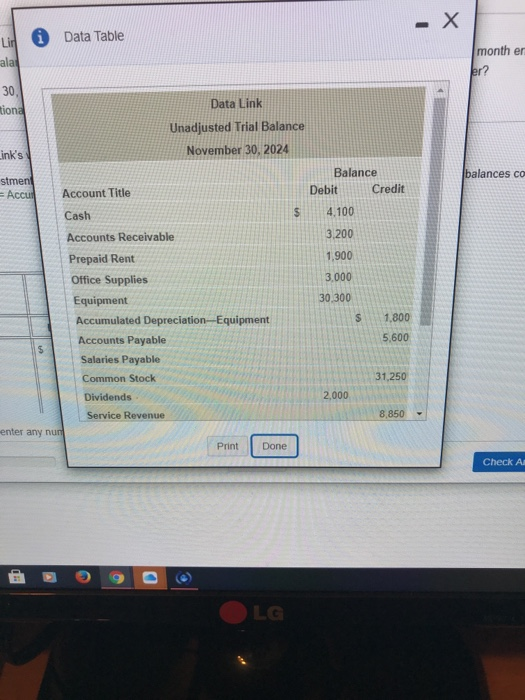

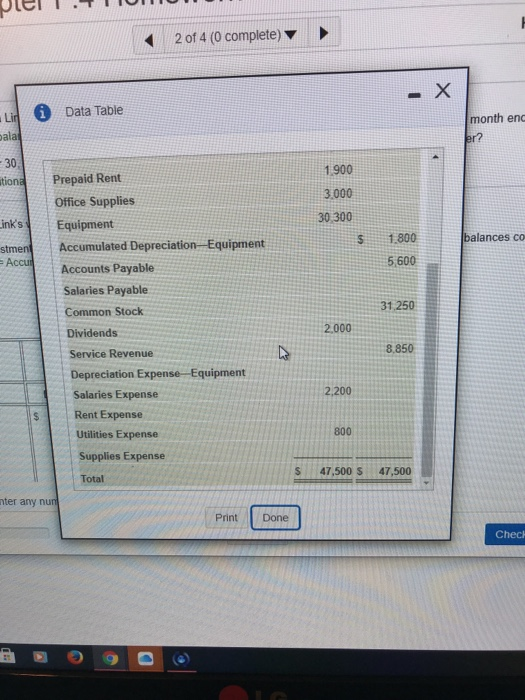

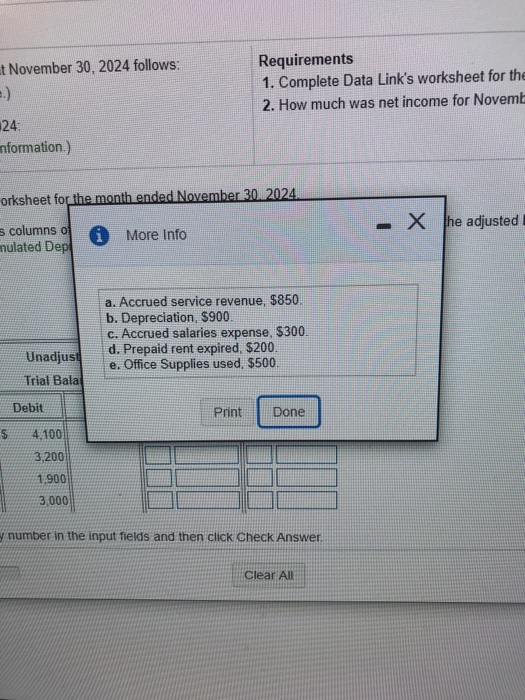

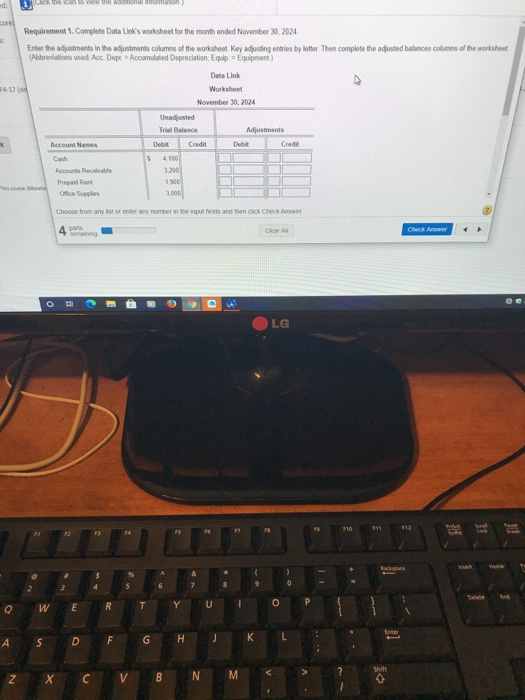

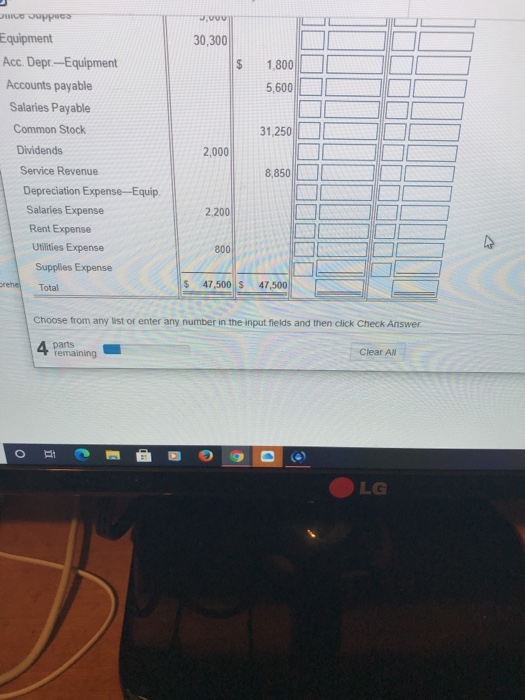

- X Data Table December 31, 2024 or parenthese select a label or enter a Account Title Balance Debit Credit 13,800 $ 14,500 7,400 18.200 49 500 35.100 19,500 12,900 9.700 8000 Cash Accounts Receivable Office Supplies Land Building Accumulated Depreciation-Building Furniture Accumulated Depreciation-Furniture Accounts Payable Salaries Payable Unearned Revenue Common Stock Retained Earnings Dividends Service Revenue Salaries Expense Supplies Expense Depreciation Expense-Building Depreciation Expense- Furniture Advertising Expense 16,500 32,000 34,900 17200 40.900 25.500 9.100 2.400 900 12.000 $ 190,000 $ 190,000 Total Print Done Done CITA LG entheses to show a net loss. If a box is not used in the statement, leave the box empty, do not select a la Requirements 1. Prepare the income statement for the year ending December 31, 2024 2. Prepare the statement of retained earnings for the year ending December 31, 2024 3. Prepare the classified balance sheet as of December 31, 2024. Use the report form Print Done Clear All D LG 1. Prepare income for the year ending December 31, 2004 si pastosowane sa boxed the statement have the borde lewe Vovering Services co Year December 31, 2024 LG U w E A S D Z X C C C V - Data Table - X he month ended ber? Data Link Unadjusted Trial Balance November 30, 2024 the adi lated Depreciation Balance Debit Credit Account Title $ 4,100 3,200 1,900 3,000 30,300 $ 1,800 5,600 Cash Accounts Receivable Prepaid Rent Office Supplies Equipment Accumulated Depreciation-Equipment Accounts Payable Salaries Payable Common Stock Dividends Service Revenue Depreciation Expense-Equipment Salaries Expense Rent Expense Utilities Expense Supplies Expense Total 31.250 2,000 8.850 2,200 800 $ 47,500 5 47,500 Print Done Clear All LG balances columns of the worksheet. (Abbreviations used: Acc. Depr. = Accu X More Info a. Accrued service revenue, $850. b. Depreciation, $900. c. Accrued salaries expense, $300. d. Prepaid rent expired, $200. e. Office Supplies used, $500. Print Done LG w 4 G C B N (Click the icon to view the trial balance.) Additional information at November 30, 2024 (Click the icon to view the additional information.) DU LIRIK Worksheet November 30, 2024 Unadjusted Trial Balance Adjustments Account Names Debit Credit Debit Credit $ 4,100 3,200 1,900 3,000 30,300 1,800 5,600 Cash Accounts Receivable Prepaid Rent Office Supplies Equipment Acc Depr.-Equipment Accounts payable Salaries Payable Common Stock Dividends Service Revenue Depreciation Expense--Equip Salaries Expense Rent Expense Utilities Expense Supplies Expense Total 31 250 2.000 8,850 2,200 800 47,500 $ 47,500 Choose from any list or enter any number in the input fields and then click Check Answer 4 parts remaining Type here to search o BH The adjusted til balance for Hampton Advertising Services is presented below. Click on the con to view the adjusted trial balance) Read the requirements Requirement. 1. Prepare the income statement for the year ending December 31, 2024. (Use a minus sign or parentheses to show a net loss a box is not used in the statement, leave the box emply do not select a label or enter a zero) Hampton Advertising Services Income Statement Year Ended December 31, 2024 Choose mom any store any amber memputes and men cox check Answer Demag Check O LG 0 FIO 592 und Q W E R 0 T Y U EN S D F G H K EF4-17 (similar to) Quest The adjusted trial balance for Hampton Advertising Services is presented below Click on the icon to view the adjusted trial balance) Read the requirements Score Hampton Advertising Services Income Statement Year Ended December 31, 2024 EF-17 OK Choose from any store bein the inputs and then cack Check Answer 3 parte Clear Check Answer LG F9 F10 111 512 Backspace - X Lin Data Table alat month er er? 30 tiona Data Link Unadjusted Trial Balance November 30, 2024 Link's Ibalances co stment = Accur Balance Debit Credit Account Title $ 4,100 3,200 1,900 3,000 30,300 Cash Accounts Receivable Prepaid Rent Office Supplies Equipment Accumulated Depreciation-Equipment Accounts Payable Salaries Payable Common Stock Dividends s 1,800 5,600 31,250 2,000 Service Revenue 8,850 enter any nun Print Done Done Check AI . ILG 2 of 4 (0 complete) - X month enc Lip Data Table pala er? - 30 ation 1.900 Prepaid Rent 3.000 30 300 Link's $ balances co stmen = Accu 1.800 5600 31.250 Office Supplies Equipment Accumulated Depreciation Equipment Accounts Payable Salaries Payable Common Stock Dividends Service Revenue Depreciation Expense Equipment Salaries Expense Rent Expense Utilities Expense Supplies Expense 2000 8.850 2,200 $ 800 $ 47,500 5 47,500 Total nter any nun Print Done Check D et November 30, 2024 follows: Requirements 1. Complete Data Link's worksheet for the 2. How much was net income for Novemb 24 mnformation.) orksheet for the month ended November 30, 2024 - X he adjusted 5 columns 0 mulated Depl More Info a. Accrued service revenue, $850. b. Depreciation, $900. c. Accrued salaries expense, $300. d. Prepaid rent expired, $200. e. Office Supplies used, $500. Unadjust Trial Bala Debit Print Done 4,100 3,200 1.900 3,000 y number in the input fields and then click Check Answer Clear All d: 1 the con www.mmon Requirement 1. Complete Data Link's worksheet for the month ended November 30, 2024 Enter the adjustments in the adjustments Columns of the worksheet Key adjusting entries by letter. The complete the aqusted balances columns of the worksheet Abbreviations Ace Dep Accumulated Depreciation Equip - Equipment 4-17 Data Link Worksheet November 30, 2024 Unadjusted Trial Balance Adjustments Debit Credit Credit S 4100 3200 1900 3.000 Account Names Cash Accuecable Prepaid Ofic Choose from any list or enter any number in the input fields and then click Check Answer 4 Demi Clear Check O LG FO 511 112 3 0 U Q R W E 0 P T . F K I S D G Shutt v A Z X C V B N M Juu 30,300 $ 1.800 5,600 31,250 Equipment Acc. Depr.-Equipment Accounts payable Salaries Payable Common Stock Dividends Service Revenue Depreciation Expense-Equip. Salaries Expense Rent Expense Utilities Expense 2,000 8,850 2,200 800 Supplies Expense brenel Total $ 47,500 $ 47,500 Choose from any list or enter any number in the input fields and then click Check Answer 4 parts remaining Clear AN O BI a LG

Question #2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started