Question 1

Question 2

Question 3

Indicate by choosing the correct option whether the following statement is true or false: To determine the closing inventory amount when an entity uses the periodic inventory system, a physical inventory stock count is done at the end of the financial period.

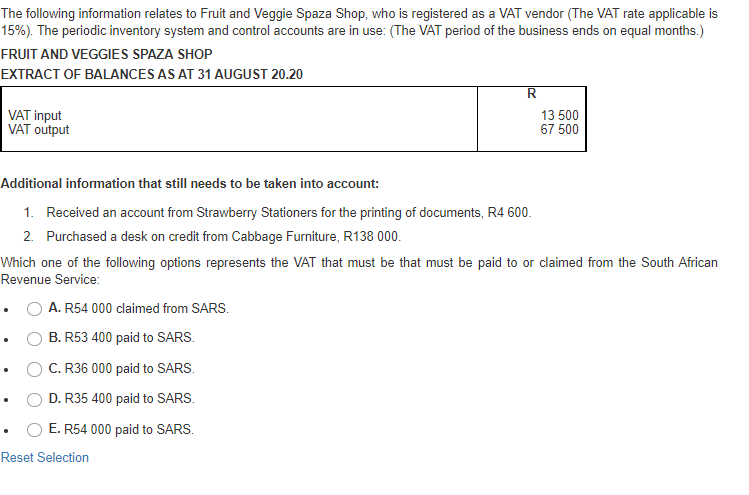

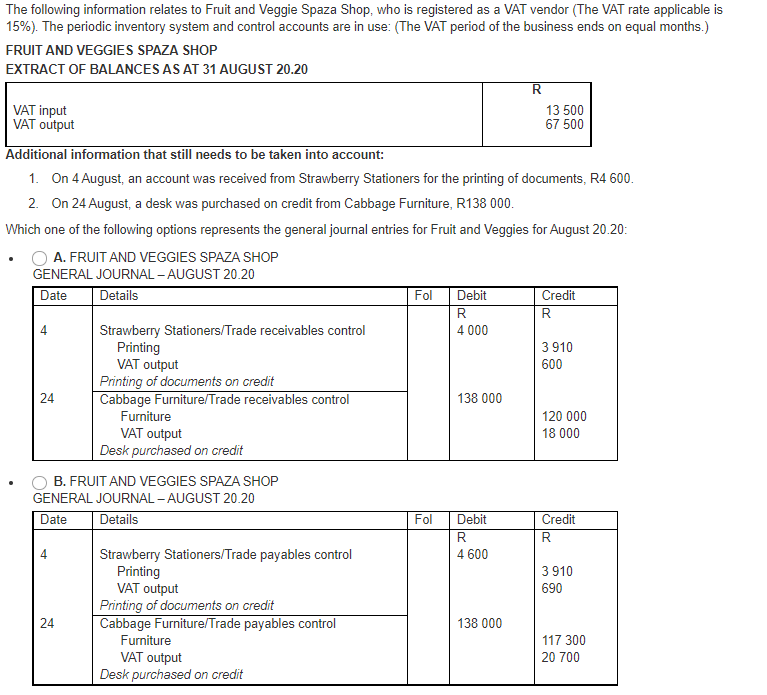

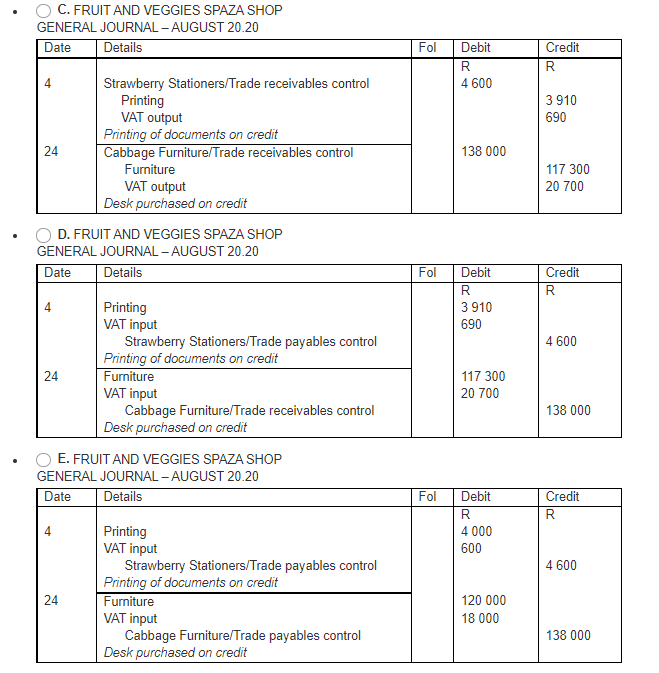

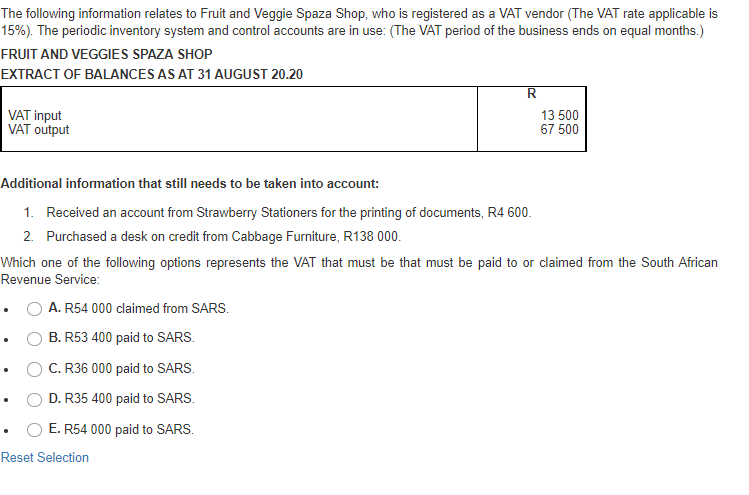

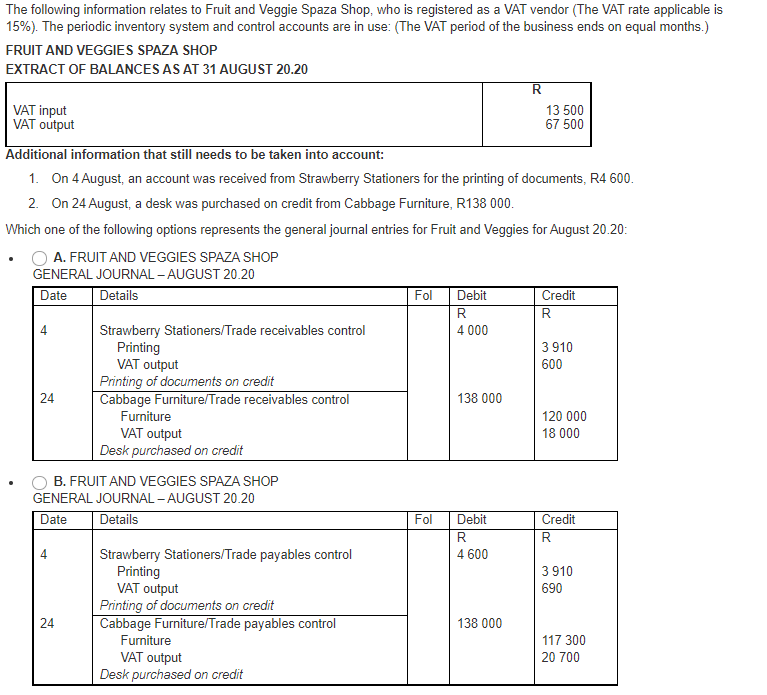

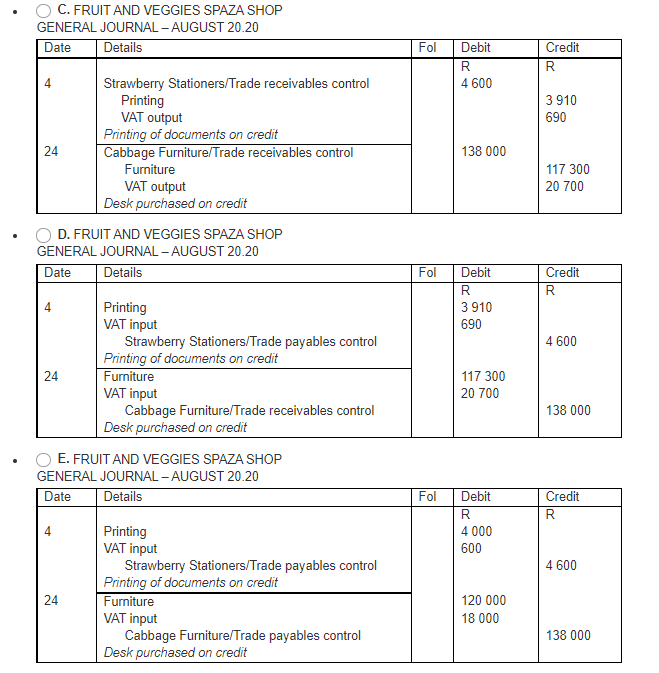

The following information relates to Fruit and Veggie Spaza Shop, who is registered as a VAT vendor (The VAT rate applicable is 15%). The periodic inventory system and control accounts are in use: (The VAT period of the business ends on equal months.) FRUIT AND VEGGIES SPAZA SHOP EXTRACT OF BALANCES AS AT 31 AUGUST 20.20 R VAT input 13 500 VAT output 67 500 Additional information that still needs to be taken into account: 1. Received an account from Strawberry Stationers for the printing of documents, R4 600. 2. Purchased a desk on credit from Cabbage Furniture, R138 000. Which one of the following options represents the VAT that must be that must be paid to or claimed from the South African Revenue Service: A. R54 000 claimed from SARS. B. R53 400 paid to SARS. C.R36 000 paid to SARS. D. R35 400 paid to SARS. E. R54 000 paid to SARS. Reset Selection . . The following information relates to Fruit and Veggie Spaza Shop, who is registered as a VAT vendor (The VAT rate applicable is 15%). The periodic inventory system and control accounts are in use: (The VAT period of the business ends on equal months.) FRUIT AND VEGGIES SPAZA SHOP EXTRACT OF BALANCES AS AT 31 AUGUST 20.20 R VAT input VAT output 13 500 67 500 Additional information that still needs to be taken into account: 1. On 4 August, an account was received from Strawberry Stationers for the printing of documents, R4 600. 2. On 24 August, a desk was purchased on credit from Cabbage Furniture, R138 000. Which one of the following options represents the general journal entries for Fruit and Veggies for August 20.20 A. FRUIT AND VEGGIES SPAZA SHOP GENERAL JOURNAL - AUGUST 20.20 Date Details Fol Debit Credit R R Strawberry Stationers/Trade receivables control 4 000 Printing 3910 VAT output 600 Printing of documents on credit 24 Cabbage Furniture/Trade receivables control 138 000 Furniture 120 000 VAT output 18 000 Desk purchased on credit B. FRUIT AND VEGGIES SPAZA SHOP GENERAL JOURNAL - AUGUST 20.20 Date Details Fol Debit Credit R R Strawberry Stationers/Trade payables control 4 600 Printing 3910 VAT output 690 Printing of documents on credit Cabbage Furniture/Trade payables control 138 000 Furniture 117 300 VAT output 20 700 Desk purchased on credit 24 C. FRUIT AND VEGGIES SPAZA SHOP GENERAL JOURNAL - AUGUST 20.20 Date Details Fol Debit R 4 600 Credit R 4 3910 690 138 000 Strawberry Stationers/Trade receivables control Printing VAT output Printing of documents on credit 24 Cabbage Furniture/Trade receivables control Furniture VAT output Desk purchased on credit D. FRUIT AND VEGGIES SPAZA SHOP GENERAL JOURNAL - AUGUST 20.20 Date Details 117 300 20 700 . Fol Credit R Debit R 3910 690 4 4600 Printing VAT input Strawberry Stationers/Trade payables control Printing of documents on credit Furniture VAT input Cabbage Furniture/Trade receivables control Desk purchased on credit 24 117 300 20 700 138 000 . E. FRUIT AND VEGGIES SPAZA SHOP GENERAL JOURNAL - AUGUST 20.20 Date Details Fol Credit R Debit R 4000 600 4 4 600 24 Printing VAT input Strawberry Stationers/Trade payables control Printing of documents on credit Furniture VAT input Cabbage Furniture/Trade payables control Desk purchased on credit 120 000 18 000 138 000