Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1: Question 2: Question 3: Katelyn is the Purchasing Manager for Polo Industries, Inc. She asked you to help her determine what the Ending

Question 1:

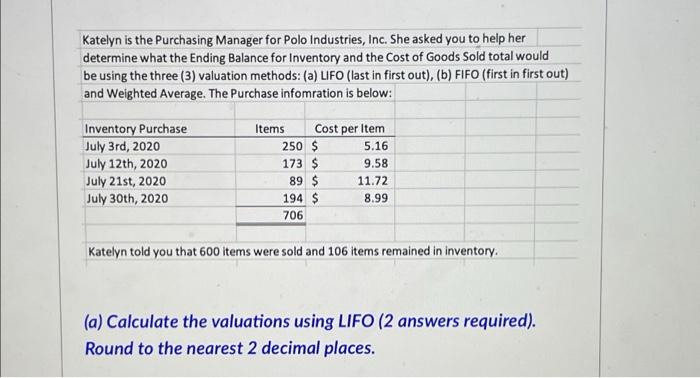

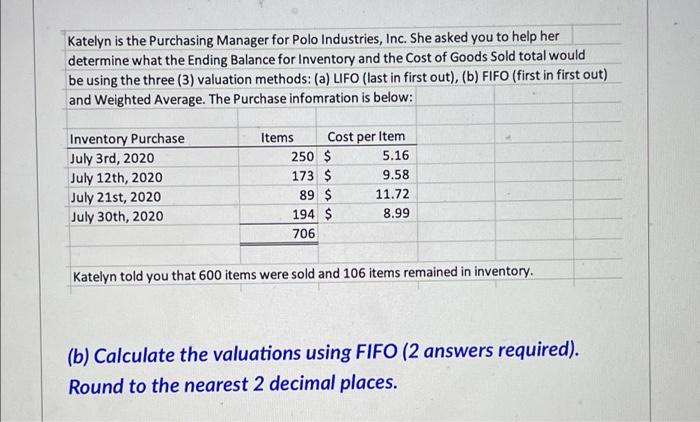

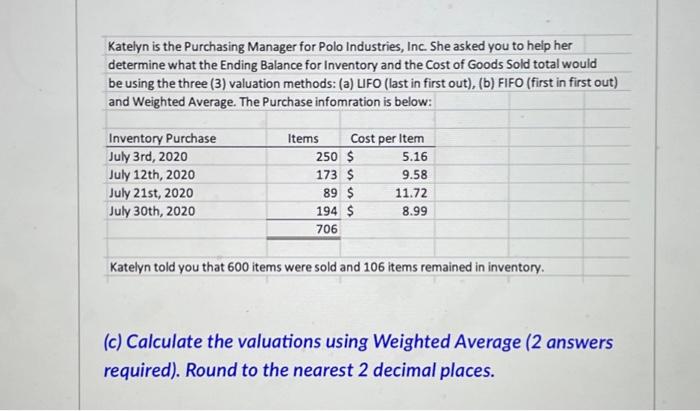

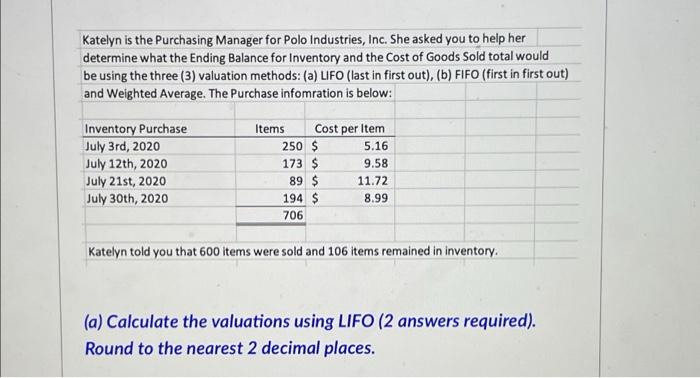

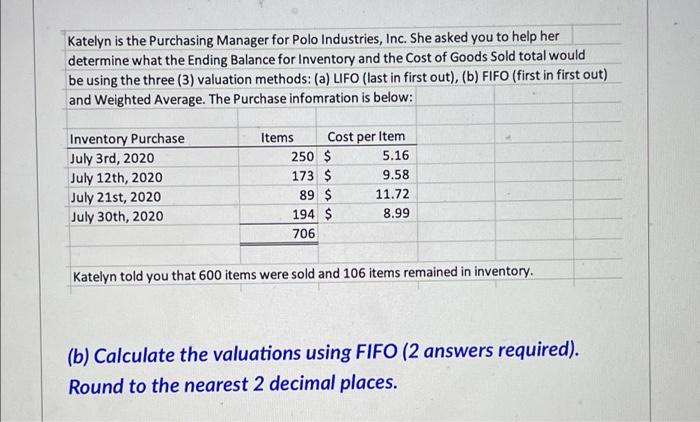

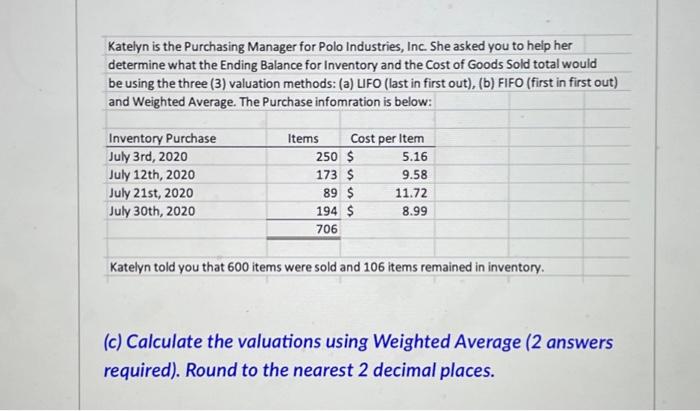

Katelyn is the Purchasing Manager for Polo Industries, Inc. She asked you to help her determine what the Ending Balance for Inventory and the Cost of Goods Sold total would be using the three (3) valuation methods: (a) LIFO (last in first out), (b) FIFO (first in first out) and Weighted Average. The Purchase infomration is below: Inventory Purchase July 3rd, 2020 July 12th, 2020 July 21st, 2020 July 30th, 2020 Items Cost per Item 250 $ 5.16 173 $ 9.58 89 $ 11.72 194 $ 8.99 706 Katelyn told you that 600 items were sold and 106 items remained in inventory. (a) Calculate the valuations using LIFO (2 answers required). Round to the nearest 2 decimal places. Katelyn is the Purchasing Manager for Polo Industries, Inc. She asked you to help her determine what the Ending Balance for Inventory and the cost of Goods Sold total would be using the three (3) valuation methods: (a) LIFO (last in first out), (b) FIFO (first in first out) and Weighted Average. The Purchase infomration is below: Inventory Purchase July 3rd, 2020 July 12th, 2020 July 21st, 2020 July 30th, 2020 Items Cost per Item 250 $ 5.16 173 $ 9.58 89 $ 11.72 194 $ 8.99 706 Katelyn told you that 600 items were sold and 106 items remained in inventory. (b) Calculate the valuations using FIFO (2 answers required). Round to the nearest 2 decimal places. Katelyn is the Purchasing Manager for Polo Industries, Inc. She asked you to help her determine what the Ending Balance for Inventory and the Cost of Goods Sold total would be using the three (3) valuation methods: (a) LIFO (last in first out), (b) FIFO (first in first out) and Weighted Average. The Purchase infomration is below: Inventory Purchase July 3rd, 2020 July 12th, 2020 July 21st, 2020 July 30th, 2020 Items Cost per Item 250 $ 5.16 173 $ 9.58 89 $ 11.72 194 $ 8.99 706 Katelyn told you that 600 items were sold and 106 items remained in inventory. (c) Calculate the valuations using Weighted Average (2 answers required). Round to the nearest 2 decimal places

Question 2:

Question 3:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started