Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1: Question 2: Question 3: Question 4: Question 5: Question 6: Question 7: Question 8: Question 9: Question 10: Using bank reconciliation to determine

Question 1:

Question 2:

Question 3:

Question 3:

Question 4:

Question 4:

Question 5:

Question 5:

Question 6:

Question 6:

Question 7:

Question 7:

Question 8:

Question 9:

Question 10:

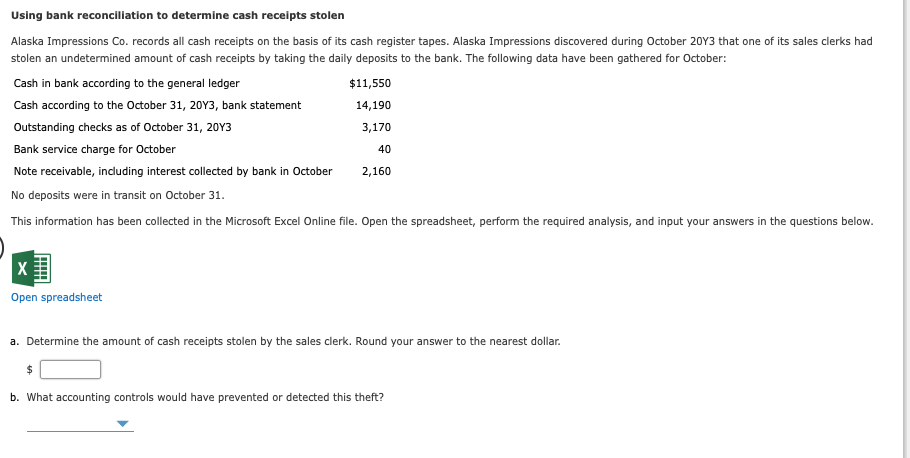

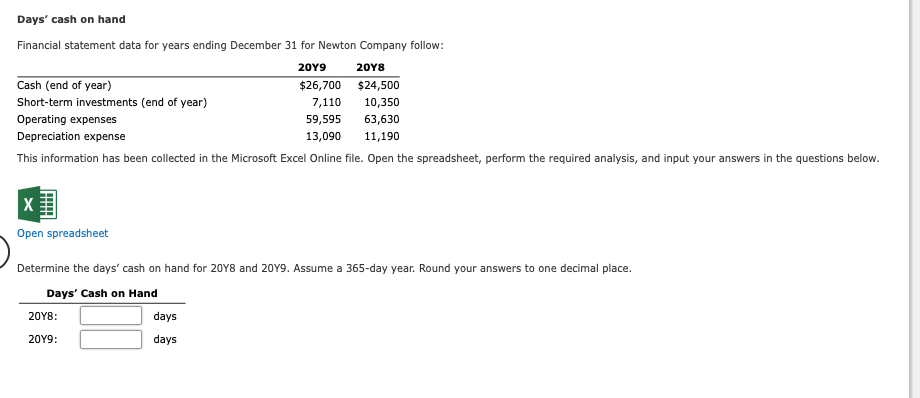

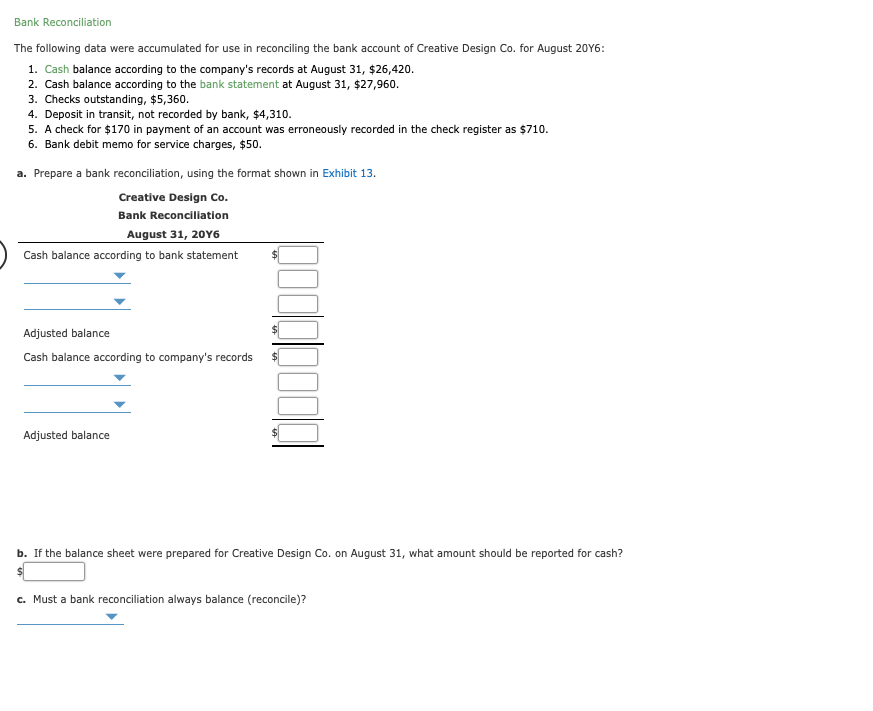

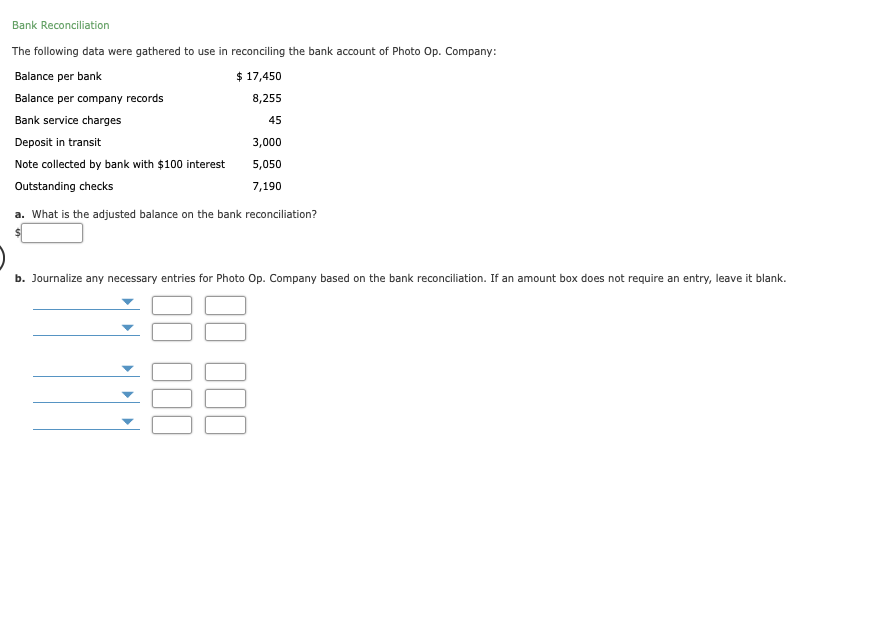

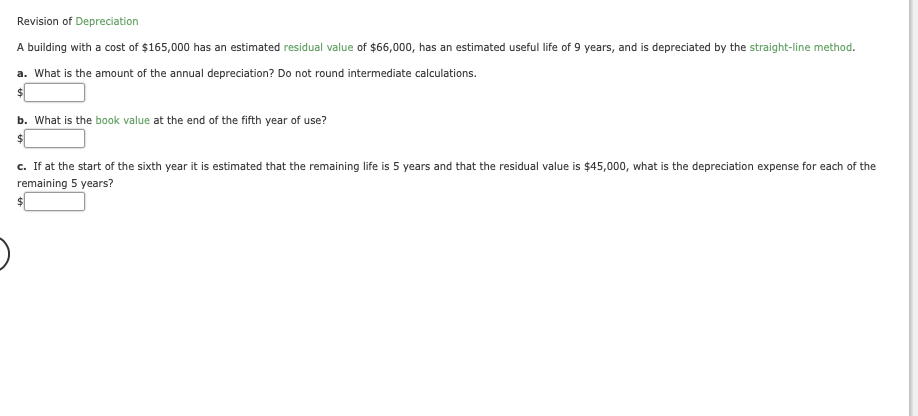

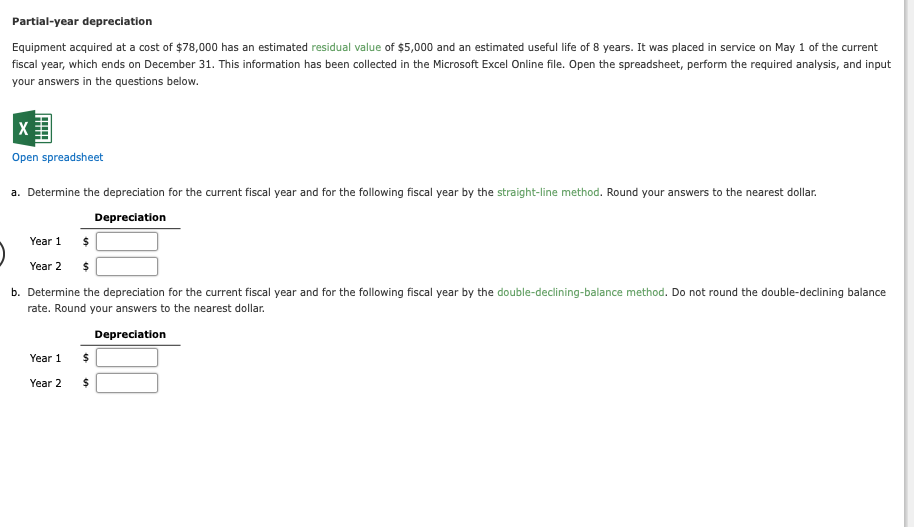

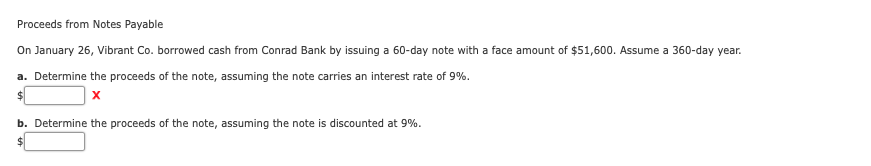

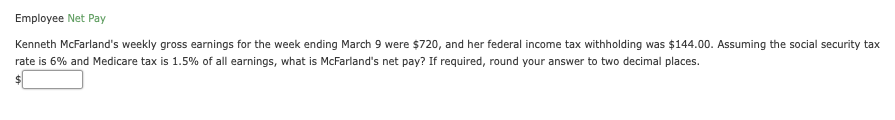

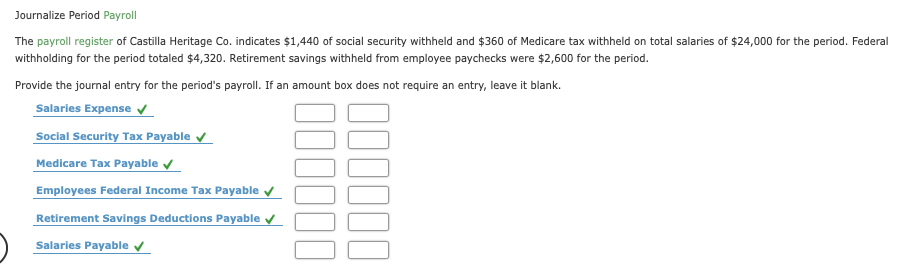

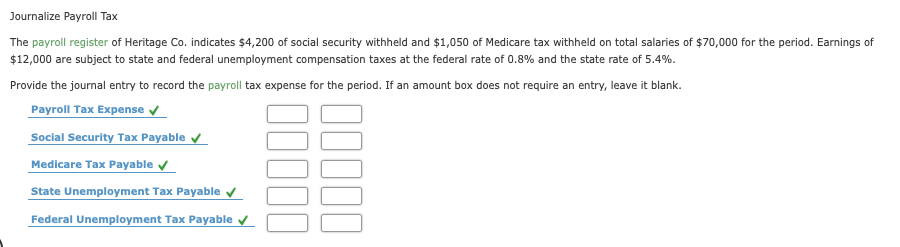

Using bank reconciliation to determine cash receipts stolen Alaska Impressions Co. records all cash receipts on the basis of its cash register tapes. Alaska Impressions discovered during October 20Y3 that one of its sales clerks had stolen an undetermined amount of cash receipts by taking the daily deposits to the bank. The following data have been gathered for October: Cash in bank according to the general ledger $11,550 Cash according to the October 31, 20Y3, bank statement 14,190 Outstanding checks as of October 31, 2013 3,170 Bank service charge for October Note receivable, including interest collected by bank in October 2,160 No deposits were in transit on October 31. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. 40 X Open spreadsheet a. Determine the amount of cash receipts stolen by the sales clerk. Round your answer to the nearest dollar. $ b. What accounting controls would have prevented or detected this theft? Days' cash on hand Financial statement data for years ending December 31 for Newton Company follow: 2049 20Y8 Cash (end of year) $26,700 $24,500 Short-term investments (end of year) 7,110 10,350 Operating expenses 59,595 63,630 Depreciation expense 13,090 11,190 This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. X Open spreadsheet Determine the days' cash on hand for 2018 and 2019. Assume a 365-day year. Round your answers to one decimal place. Days' Cash on Hand 2048: days 20Y9: days Bank Reconciliation The following data were accumulated for use in reconciling the bank account of Creative Design Co. for August 2016: 1. Cash balance according to the company's records at August 31, $26,420. 2. Cash balance according to the bank statement at August 31, $27,960. 3. Checks outstanding, $5,360. 4. Deposit in transit, not recorded by bank, $4,310. 5. A check for $170 in payment of an account was erroneously recorded in the check register as $710. 6. Bank debit memo for service charges, $50. a. Prepare a bank reconciliation, using the format shown in Exhibit 13. Creative Design Co. Bank Reconciliation August 31, 2046 Cash balance according to bank statement Adjusted balance Cash balance according to company's records Adjusted balance b. If the balance sheet were prepared for Creative Design Co. on August 31, what amount should be reported for cash? $ c. Must a bank reconciliation always balance (reconcile)? Bank Reconciliation The following data were gathered to use in reconciling the bank account of Photo Op. Company: Balance per bank $ 17,450 Balance per company records 8,255 Bank service charges Deposit in transit 3,000 Note collected by bank with $100 interest 5,050 Outstanding checks 7,190 45 a. What is the adjusted balance on the bank reconciliation? b. Journalize any necessary entries for Photo Op. Company based on the bank reconciliation. If an amount box does not require an entry, leave it blank. II Revision of Depreciation A building with a cost of $165,000 has an estimated residual value of $66,000, has an estimated useful life of 9 years, and is depreciated by the straight-line method. a. What is the amount of the annual depreciation? Do not round intermediate calculations. $ b. What is the book value at the end of the fifth year of use? $ c. If at the start of the sixth year it is estimated that the remaining life is 5 years and that the residual value is $45,000, what is the depreciation expense for each of the remaining 5 years? Partial-year depreciation Equipment acquired at a cost of $78,000 has an estimated residual value of $5,000 and an estimated useful life of 8 years. It was placed in service on May 1 of the current fiscal year, which ends on December 31. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. Open spreadsheet a. Determine the depreciation for the current fiscal year and for the following fiscal year by the straight-line method. Round your answers to the nearest dollar. Depreciation Year 1 $ Year 2 $ b. Determine the depreciation for the current fiscal year and for the following fiscal year by the double-declining-balance method. Do not round the double-declining balance rate. Round your answers to the nearest dollar. Depreciation Year 1 $ Year 2 $ Proceeds from Notes Payable On January 26, Vibrant Co. borrowed cash from Conrad Bank by issuing a 60-day note with a face amount of $51,600. Assume a 360-day year. a. Determine the proceeds of the note, assuming the note carries an interest rate of 9%. X $ b. Determine the proceeds of the note, assuming the note is discounted at 9%. Employee Net Pay Kenneth McFarland's weekly gross earnings for the week ending March 9 were $720, and her federal income tax withholding was $144.00. Assuming the social security tax rate is 6% and Medicare tax is 1.5% of all earnings, what is McFarland's net pay? If required, round your answer to two decimal places. Journalize Period Payroll The payroll register of Castilla Heritage Co. indicates $1,440 of social security withheld and $360 of Medicare tax withheld on total salaries of $24,000 for the period. Federal withholding for the period totaled $4,320. Retirement savings with held from employee paychecks were $2,600 for the period. Provide the journal entry for the period's payroll. If an amount box does not require an entry, leave it blank. Salaries Expense Social Security Tax Payable Medicare Tax Payable Employees Federal Income Tax Payable Retirement Savings Deductions Payable Salaries Payable Journalize Payroll Tax The payroll register of Heritage Co. indicates $4,200 of social security withheld and $1,050 of Medicare tax withheld on total salaries of $70,000 for the period. Earnings of $12,000 are subject to state and federal unemployment compensation taxes at the federal rate of 0.8% and the state rate of 5.4%. Provide the journal entry to record the payroll tax expense for the period. If an amount box does not require an entry, leave it blank. Payroll Tax Expense Social Security Tax Payable Medicare Tax Payable State Unemployment Tax Payable Federal Unemployment Tax Payable 10

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started