Answered step by step

Verified Expert Solution

Question

1 Approved Answer

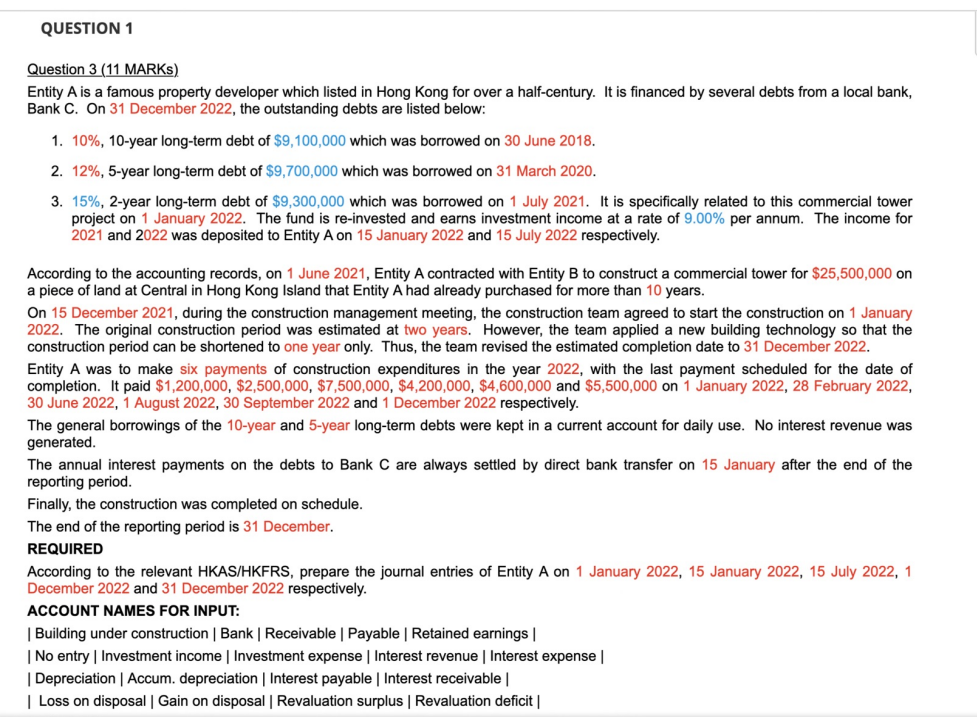

QUESTION 1 Question 3 ( 1 1 MARKs ) Entity A is a famous property developer which listed in Hong Kong for over a half

QUESTION

Question MARKs

Entity A is a famous property developer which listed in Hong Kong for over a halfcentury. It is financed by several debts from a local bank,

Bank C On December the outstanding debts are listed below:

year longterm debt of $ which was borrowed on June

year longterm debt of $ which was borrowed on March

year longterm debt of $ which was borrowed on July It is specifically related to this commercial tower

project on January The fund is reinvested and earns investment income at a rate of per annum. The income for

and was deposited to Entity A on January and July respectively.

According to the accounting records, on June Entity A contracted with Entity B to construct a commercial tower for $ on

a piece of land at Central in Hong Kong Island that Entity A had already purchased for more than years.

On December during the construction management meeting, the construction team agreed to start the construction on January

The original construction period was estimated at two years. However, the team applied a new building technology so that the

construction period can be shortened to one year only. Thus, the team revised the estimated completion date to December

Entity A was to make six payments of construction expenditures in the year with the last payment scheduled for the date of

completion. It paid $$$$$ and $ on January February

June August September and December respectively.

The general borrowings of the year and year longterm debts were kept in a current account for daily use. No interest revenue was

generated.

The annual interest payments on the debts to Bank are always settled by direct bank transfer on January after the end of the

reporting period.

Finally, the construction was completed on schedule.

The end of the reporting period is December.

REQUIRED

According to the relevant HKASHKFRS prepare the journal entries of Entity A on January January July

December and December respectively.

ACCOUNT NAMES FOR INPUT:

Building under construction Bank Receivable Payable Retained earnings

No entry Investment income Investment expense Interest revenue Interest expense

Depreciation Accum. depreciation Interest payable Interest receivable

Loss on disposal Gain on disposal Revaluation surplus Revaluation deficit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started