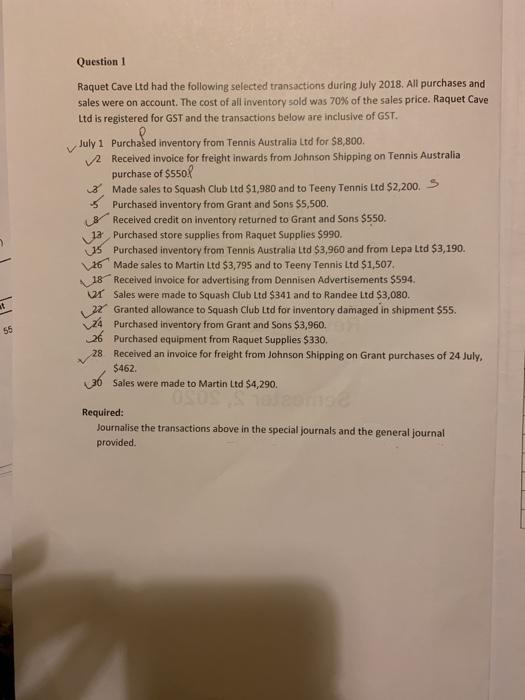

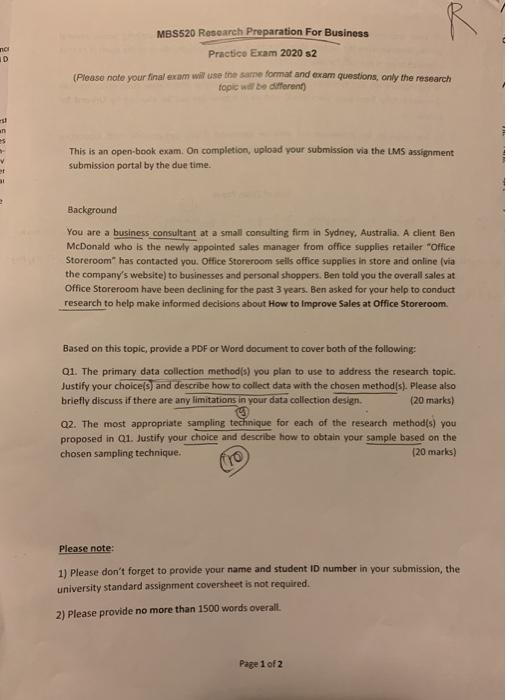

Question 1 Raquet Cave Ltd had the following selected transactions during July 2018. All purchases and sales were on account. The cost of all inventory sold was 70% of the sales price. Raquet Cave Ltd is registered for GST and the transactions below are inclusive of GST. July 1 Purchased inventory from Tennis Australia Ltd for $8,800. Received invoice for freight inwards from Johnson Shipping on Tennis Australia purchase of $550P Made sales to Squash Club Ltd $1,980 and to Teeny Tennis Ltd $2,200.5 Purchased inventory from Grant and Sons $5,500. Received credit on inventory returned to Grant and Sons $550. 12 Purchased store supplies from Raquet Supplies $990. 15 Purchased inventory from Tennis Australia Ltd $3,960 and from Lepa Ltd $3,190. 26 Made sales to Martin Ltd $3,795 and to Teeny Tennis Ltd $1,507. 18 Received invoice for advertising from Dennisen Advertisements $594. Sales were made to Squash Club Ltd $341 and to Randee Ltd $3,080. 22 Granted allowance to Squash Club Ltd for inventory damaged in shipment $55. 24 Purchased inventory from Grant and Sons $3,960, 26 Purchased equipment from Raquet Supplies $330. 28 Received an invoice for freight from Johnson Shipping on Grant purchases of 24 July. $462. 36 Sales were made to Martin Ltd $4,290. st 55 Required: Journalise the transactions above in the special journals and the general Journal provided. R MBS520 Research Preparation For Business Practice Exam 2020 s2 no 10 (Please note your final exam will use the same format and exam questions, only the research fopic will be different an V This is an open-book exam. On completion, upload your submission via the LMS assignment submission portal by the due time. 31 Background You are a business consultant at a small consulting firm in Sydney, Australia. A client Ben McDonald who is the newly appointed sales manager from office supplies retailer office Storeroom" has contacted you. Office Storeroom seils office supplies in store and online (via the company's website) to businesses and personal shoppers. Ben told you the overall sales at Office Storeroom have been declining for the past 3 years. Ben asked for your help to conduct research to help make informed decisions about How to improve Sales at Office Storeroom. Based on this topic provide a PDF or Word document to cover both of the following: Q1. The primary data collection method(s) you plan to use to address the research topic. Justify your choice(s) and describe how to collect data with the chosen methods). Please also briefly discuss if there are any limitations in your data collection design. (20 marks) 02. The most appropriate sampling technique for each of the research method(s) you proposed in 01. Justify your choice and describe how to obtain your sample based on the chosen sampling technique. 120 marks) 10 Please note: 1) Please don't forget to provide your name and student ID number in your submission, the university standard assignment coversheet is not required. 2) Please provide no more than 1500 words overall Page 1 of 2 Question 1 Raquet Cave Ltd had the following selected transactions during July 2018. All purchases and sales were on account. The cost of all inventory sold was 70% of the sales price. Raquet Cave Ltd is registered for GST and the transactions below are inclusive of GST. July 1 Purchased inventory from Tennis Australia Ltd for $8,800. Received invoice for freight inwards from Johnson Shipping on Tennis Australia purchase of $550P Made sales to Squash Club Ltd $1,980 and to Teeny Tennis Ltd $2,200.5 Purchased inventory from Grant and Sons $5,500. Received credit on inventory returned to Grant and Sons $550. 12 Purchased store supplies from Raquet Supplies $990. 15 Purchased inventory from Tennis Australia Ltd $3,960 and from Lepa Ltd $3,190. 26 Made sales to Martin Ltd $3,795 and to Teeny Tennis Ltd $1,507. 18 Received invoice for advertising from Dennisen Advertisements $594. Sales were made to Squash Club Ltd $341 and to Randee Ltd $3,080. 22 Granted allowance to Squash Club Ltd for inventory damaged in shipment $55. 24 Purchased inventory from Grant and Sons $3,960, 26 Purchased equipment from Raquet Supplies $330. 28 Received an invoice for freight from Johnson Shipping on Grant purchases of 24 July. $462. 36 Sales were made to Martin Ltd $4,290. st 55 Required: Journalise the transactions above in the special journals and the general Journal provided. R MBS520 Research Preparation For Business Practice Exam 2020 s2 no 10 (Please note your final exam will use the same format and exam questions, only the research fopic will be different an V This is an open-book exam. On completion, upload your submission via the LMS assignment submission portal by the due time. 31 Background You are a business consultant at a small consulting firm in Sydney, Australia. A client Ben McDonald who is the newly appointed sales manager from office supplies retailer office Storeroom" has contacted you. Office Storeroom seils office supplies in store and online (via the company's website) to businesses and personal shoppers. Ben told you the overall sales at Office Storeroom have been declining for the past 3 years. Ben asked for your help to conduct research to help make informed decisions about How to improve Sales at Office Storeroom. Based on this topic provide a PDF or Word document to cover both of the following: Q1. The primary data collection method(s) you plan to use to address the research topic. Justify your choice(s) and describe how to collect data with the chosen methods). Please also briefly discuss if there are any limitations in your data collection design. (20 marks) 02. The most appropriate sampling technique for each of the research method(s) you proposed in 01. Justify your choice and describe how to obtain your sample based on the chosen sampling technique. 120 marks) 10 Please note: 1) Please don't forget to provide your name and student ID number in your submission, the university standard assignment coversheet is not required. 2) Please provide no more than 1500 words overall Page 1 of 2