Question

West Corp. owned 70% of the voting common stock of East Co. East owned 60% of Compass Co. West and East both used the initial

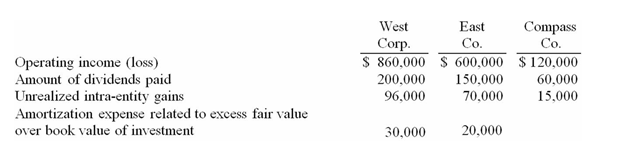

West Corp. owned 70% of the voting common stock of East Co. East owned 60% of Compass Co. West and East both used the initial value method to account for their investments. The following information was available from the financial statements and records of the three companies:  Operating income included unrealized intra-entity gains (which are related to inventory transfers) but did not include dividend income from investment in subsidiary.

Operating income included unrealized intra-entity gains (which are related to inventory transfers) but did not include dividend income from investment in subsidiary.

The accrual-based income of West Corp. is calculated to be

| A. | $734,000. |

| B. | $1,261,000. |

| C. | $1,123,900. |

| D. | $1,140,700. |

| E. | $1,149,700. |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started