Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1) Record the transactions in Journal Answer should be similar to the picture below Suppose a scenario of a new startup. Ali and Rashid

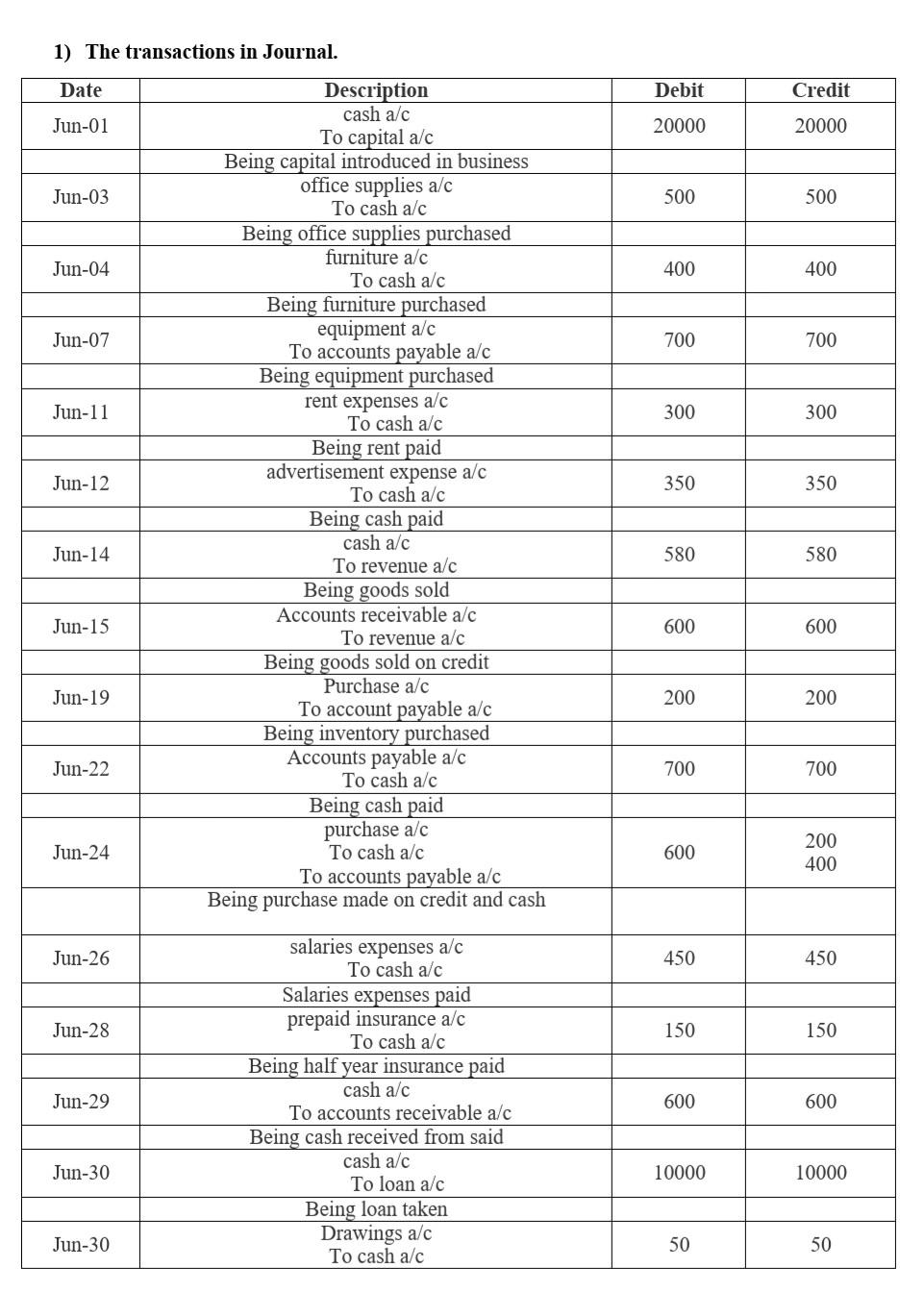

Question 1) Record the transactions in Journal

Answer should be similar to the picture below

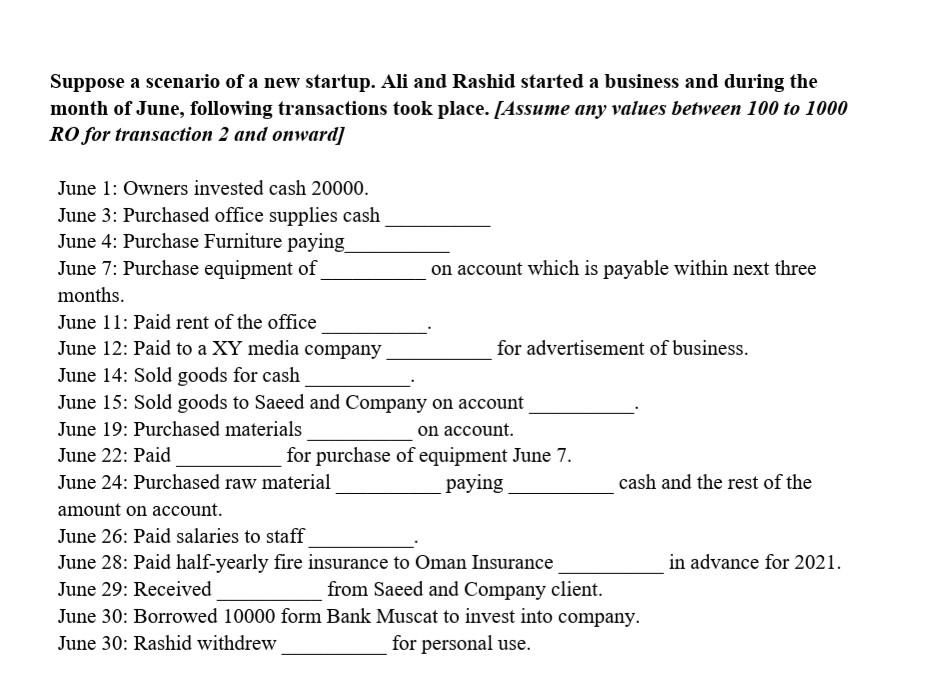

Suppose a scenario of a new startup. Ali and Rashid started a business and during the month of June, following transactions took place. [Assume any values between 100 to 1000 RO for transaction 2 and onward) June 1: Owners invested cash 20000. June 3: Purchased office supplies cash June 4: Purchase Furniture paying June 7: Purchase equipment of on account which is payable within next three months. June 11: Paid rent of the office June 12: Paid to a XY media company for advertisement of business. June 14: Sold goods for cash June 15: Sold goods to Saeed and Company on account June 19: Purchased materials on account. June 22: Paid for purchase of equipment June 7. June 24: Purchased raw material paying cash and the rest of the amount on account. June 26: Paid salaries to staff June 28: Paid half-yearly fire insurance to Oman Insurance in advance for 2021. June 29: Received from Saeed and Company client. June 30: Borrowed 10000 form Bank Muscat to invest into company. June 30: Rashid withdrew for personal use. 1) The transactions in Journal. Date Debit Credit Jun-01 20000 20000 Jun-03 500 500 Jun-04 400 400 Jun-07 700 700 Jun-11 300 300 Jun-12 350 350 Description cash a/c To capital a/c Being capital introduced in business office supplies a/c To cash a/c Being office supplies purchased furniture a/c To cash a/c Being furniture purchased equipment a/c To accounts payable a/c Being equipment purchased rent expenses a/c To cash a/c Being rent paid advertisement expense a/c To cash a/c Being cash paid cash a/c To revenue a/c Being goods sold Accounts receivable a/c To revenue a/c Being goods sold on credit Purchase a/c To account payable a/c Being inventory purchased Accounts payable a/c To cash a/c Being cash paid purchase a/c To cash a/c To accounts payable a/c Being purchase made on credit and cash Jun-14 580 580 Jun-15 600 600 Jun-19 200 200 Jun-22 700 700 Jun-24 600 200 400 Jun-26 450 450 Jun-28 150 150 Jun-29 salaries expenses a/c To cash a/c Salaries expenses paid prepaid insurance a/c To cash a/c Being half year insurance paid cash a/c To accounts receivable a/c Being cash received from said cash a/c To loan a/c Being loan taken Drawings a/c To cash a/c 600 600 Jun-30 10000 10000 Jun-30 50 50

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started