Question 1: Recreate the journal entry (accounts and amounts) that Del Taco made to record disposals of PP&E during the most recent fiscal year.

Question 2: Recreate the journal entry (accounts and amounts) that Del Taco made to record the most recent fiscal years amortization expense on its finite-life intangible assets.

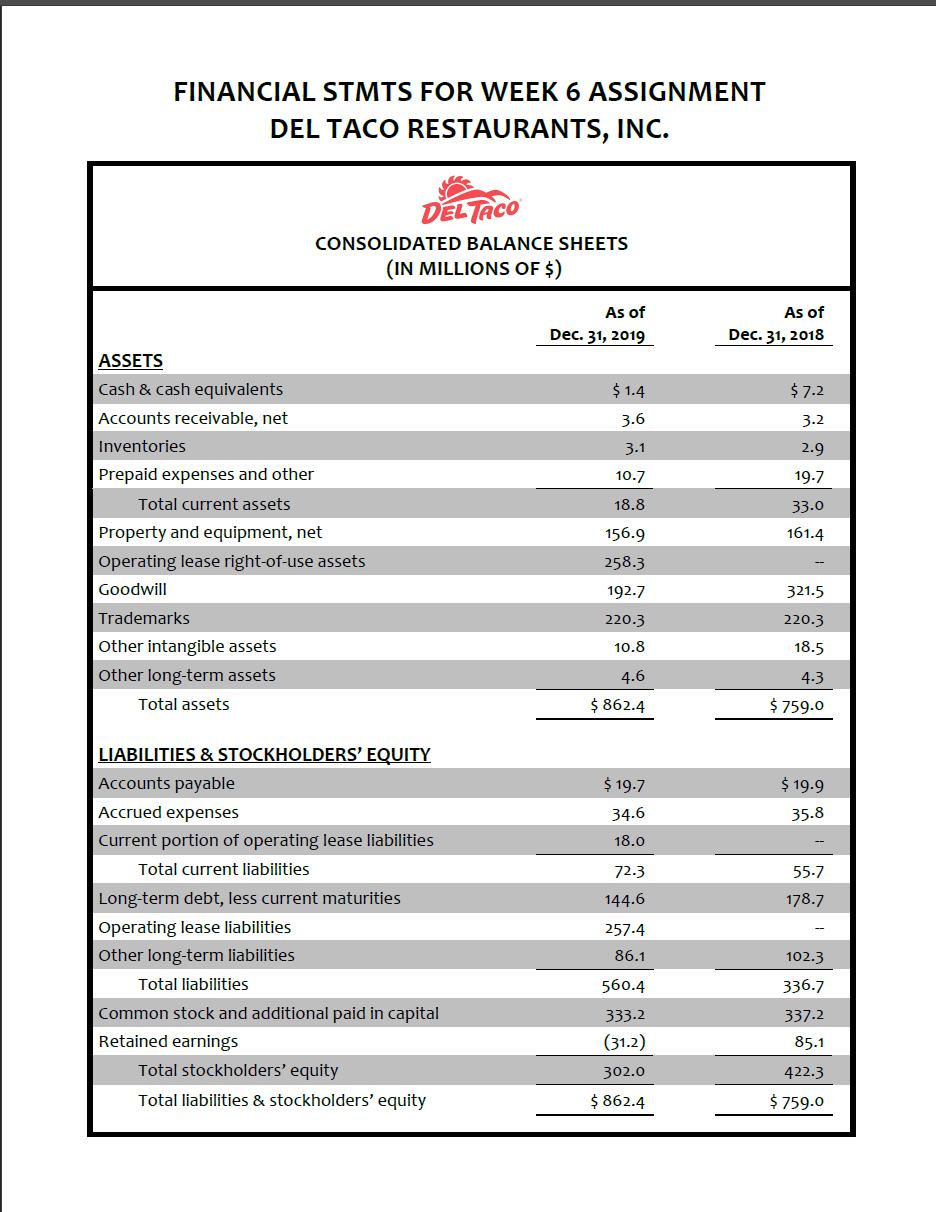

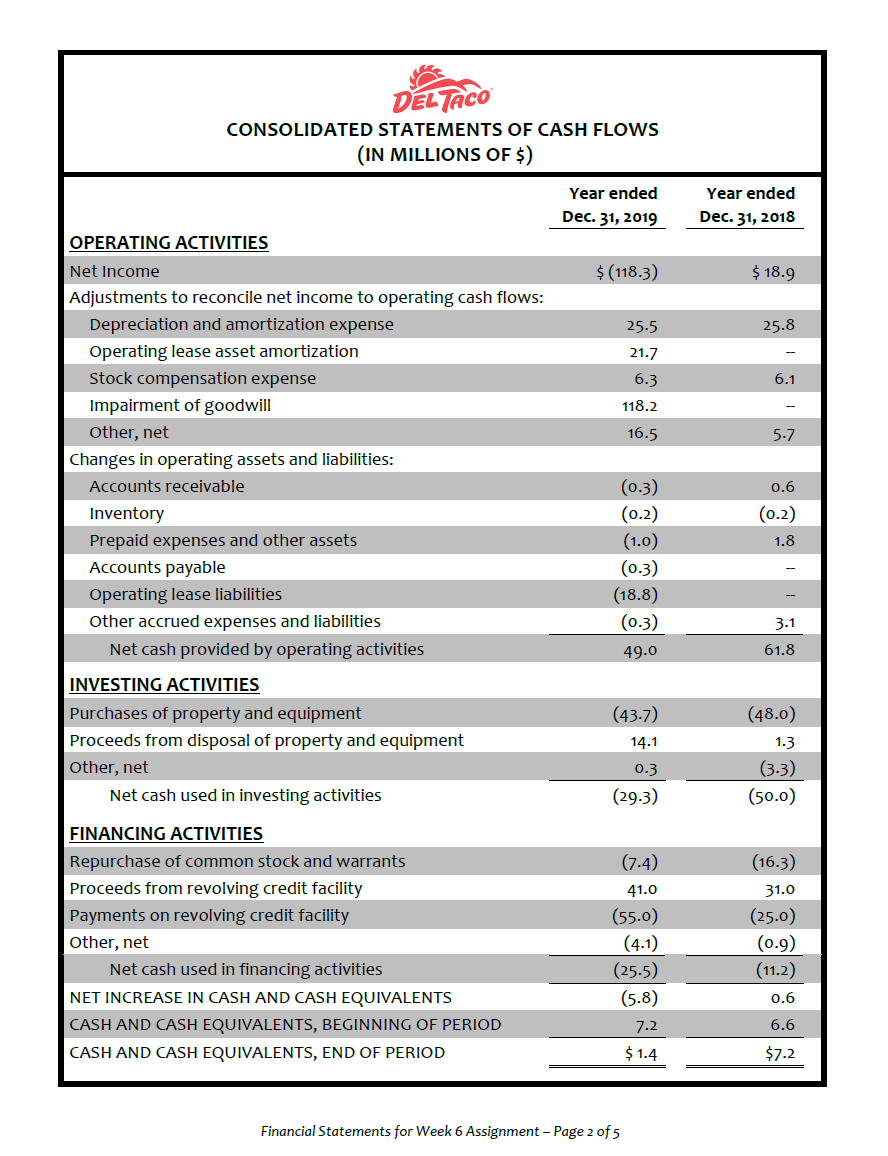

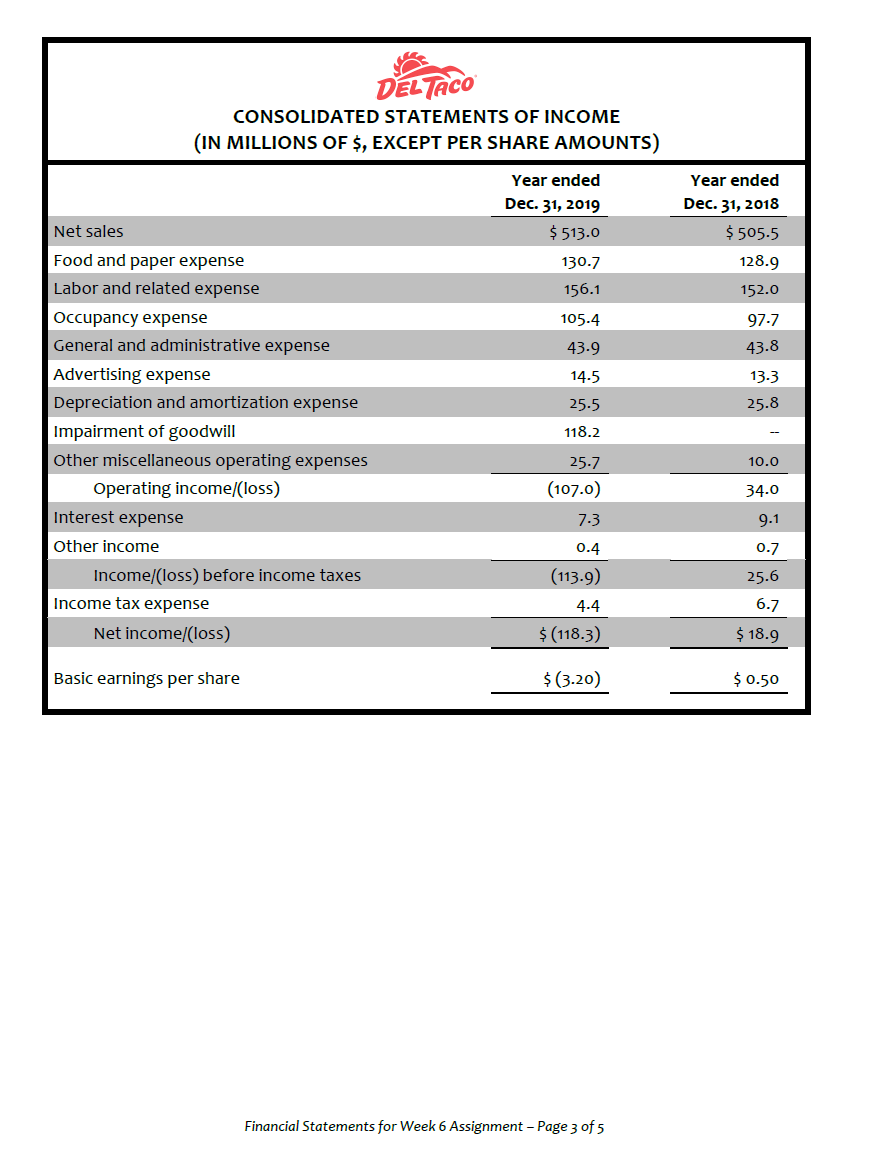

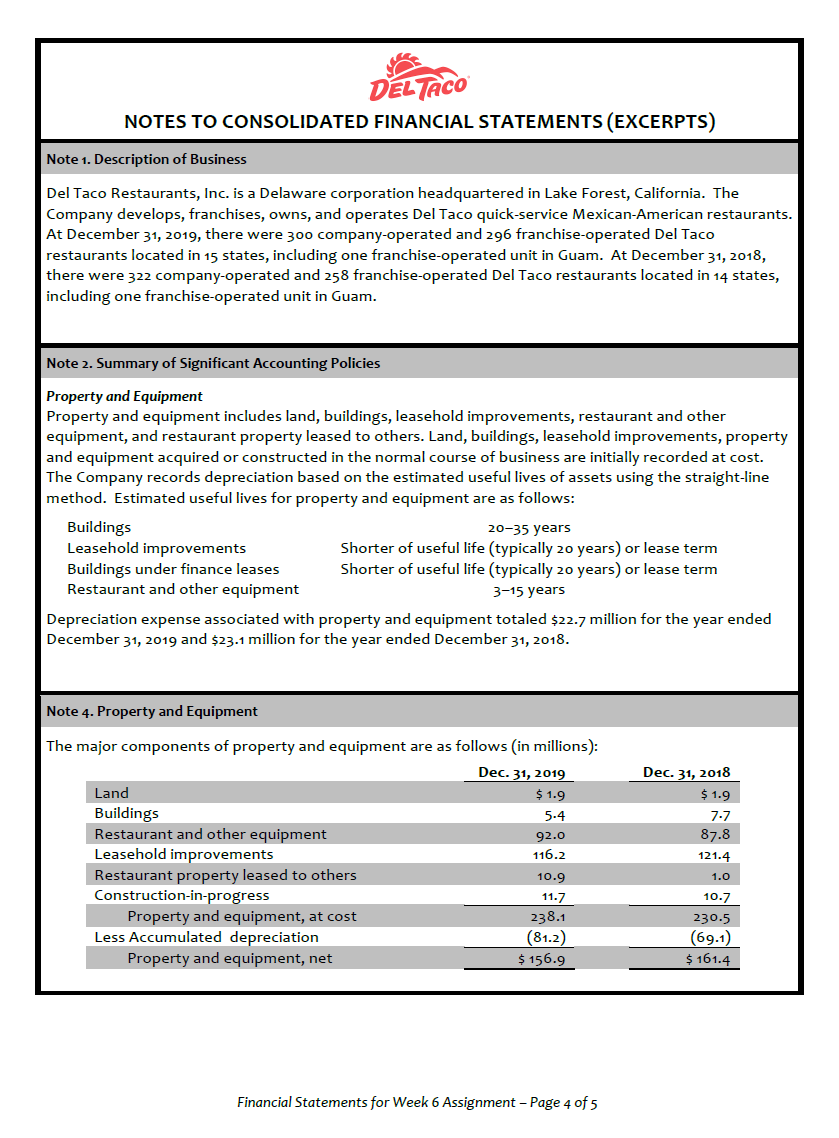

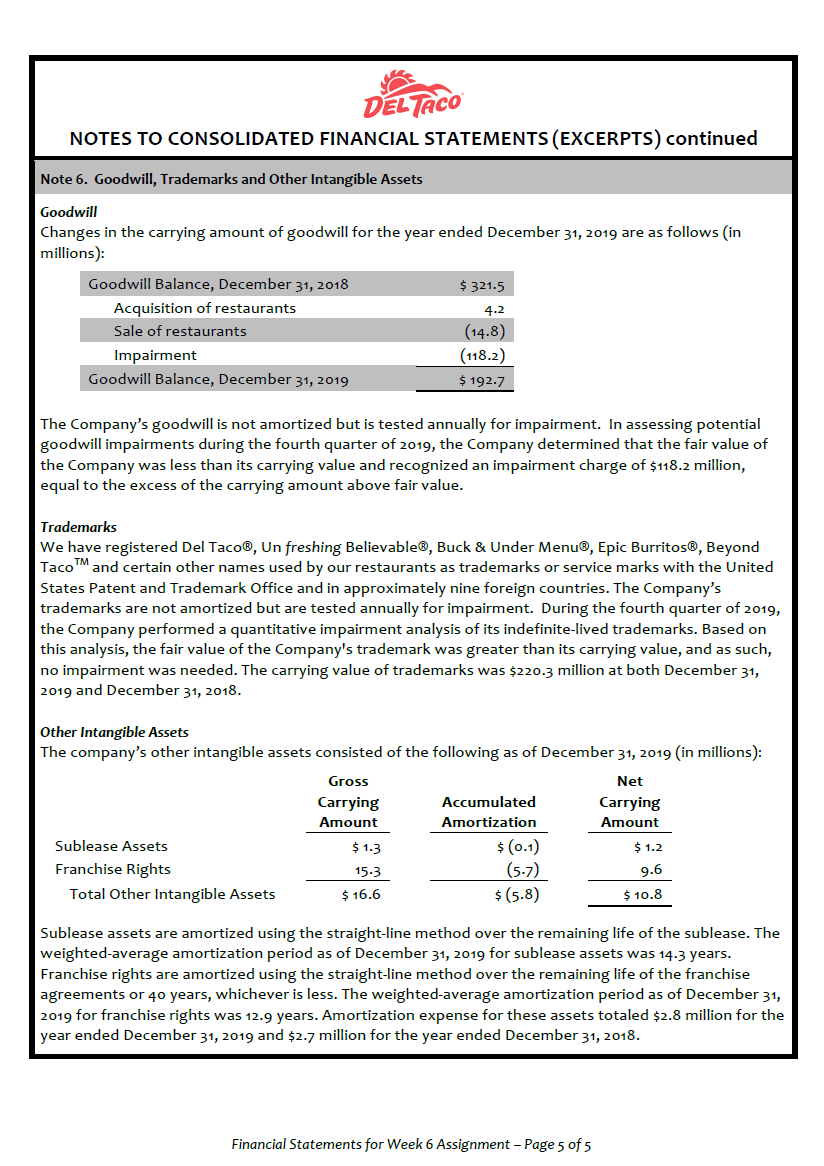

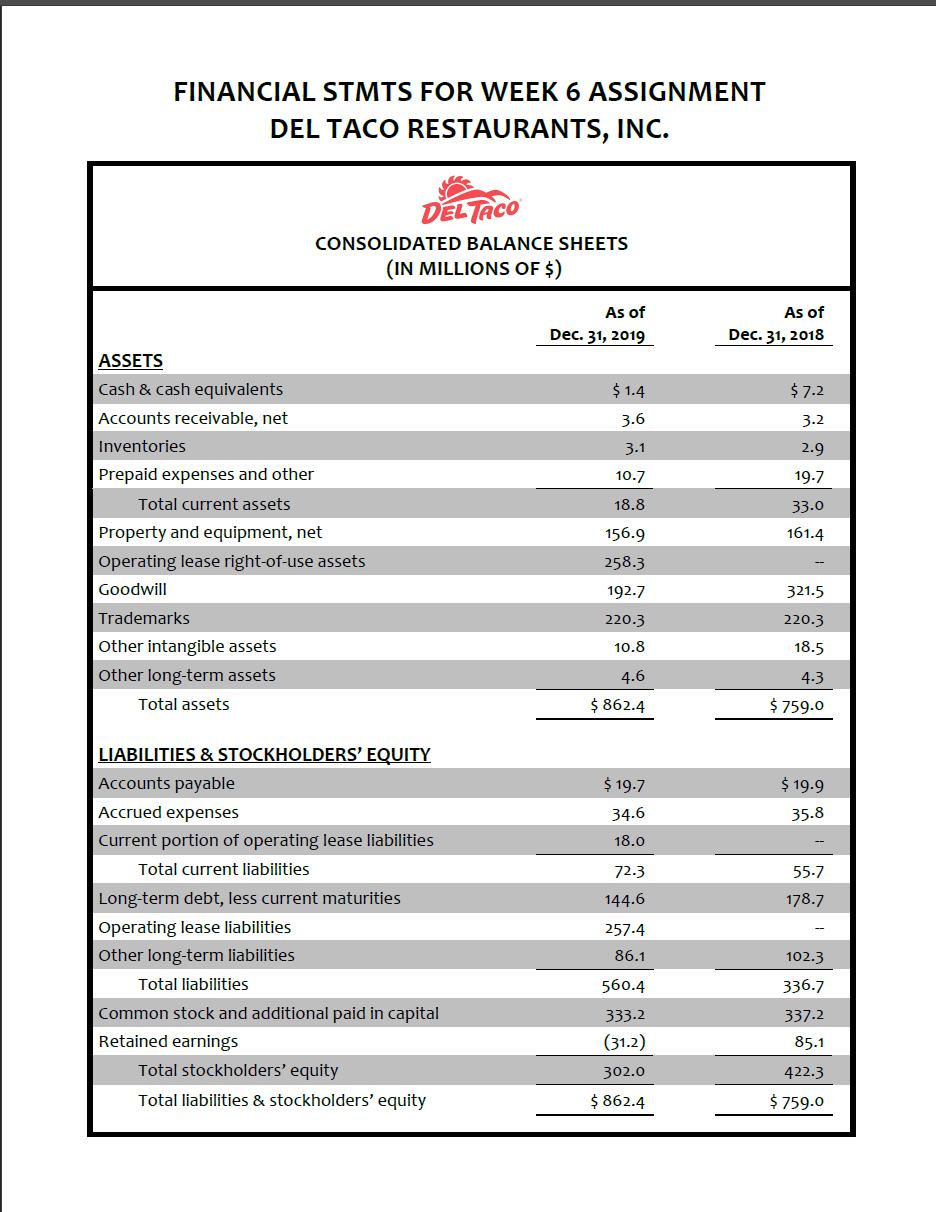

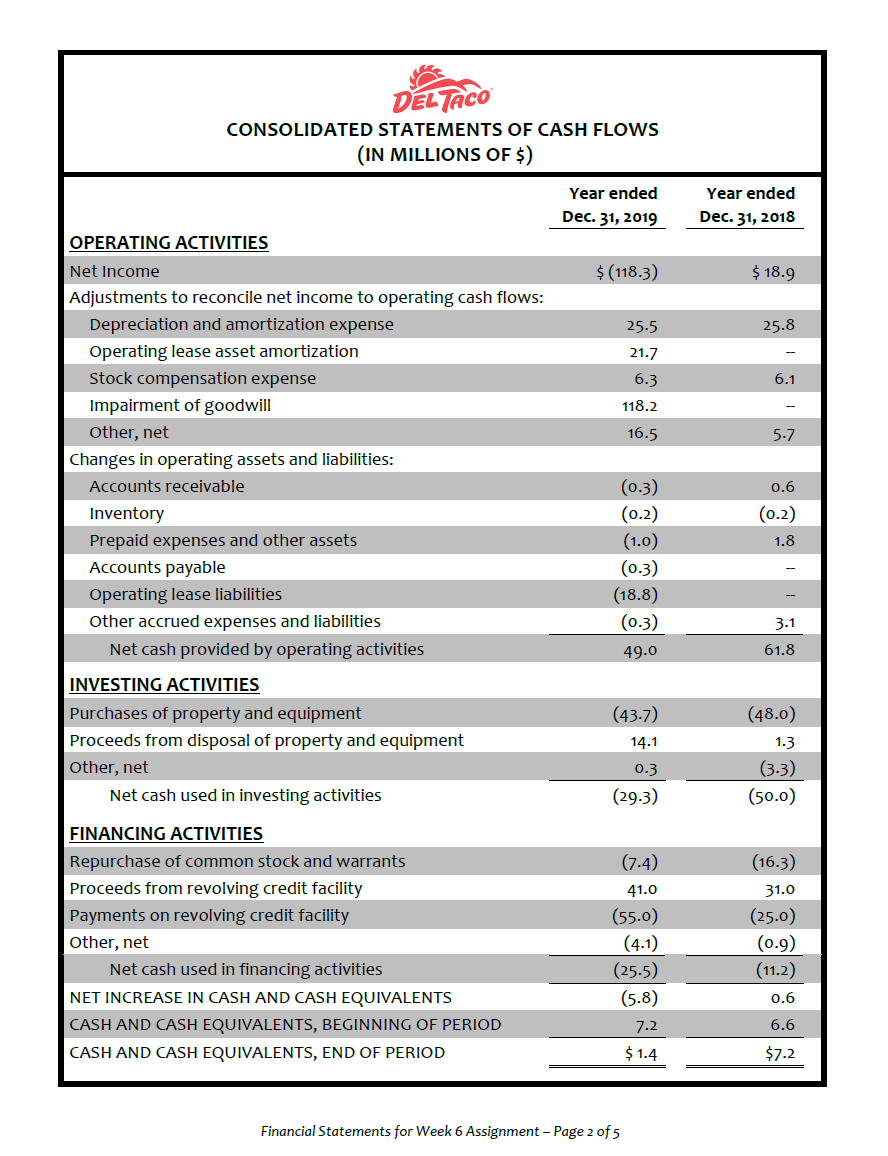

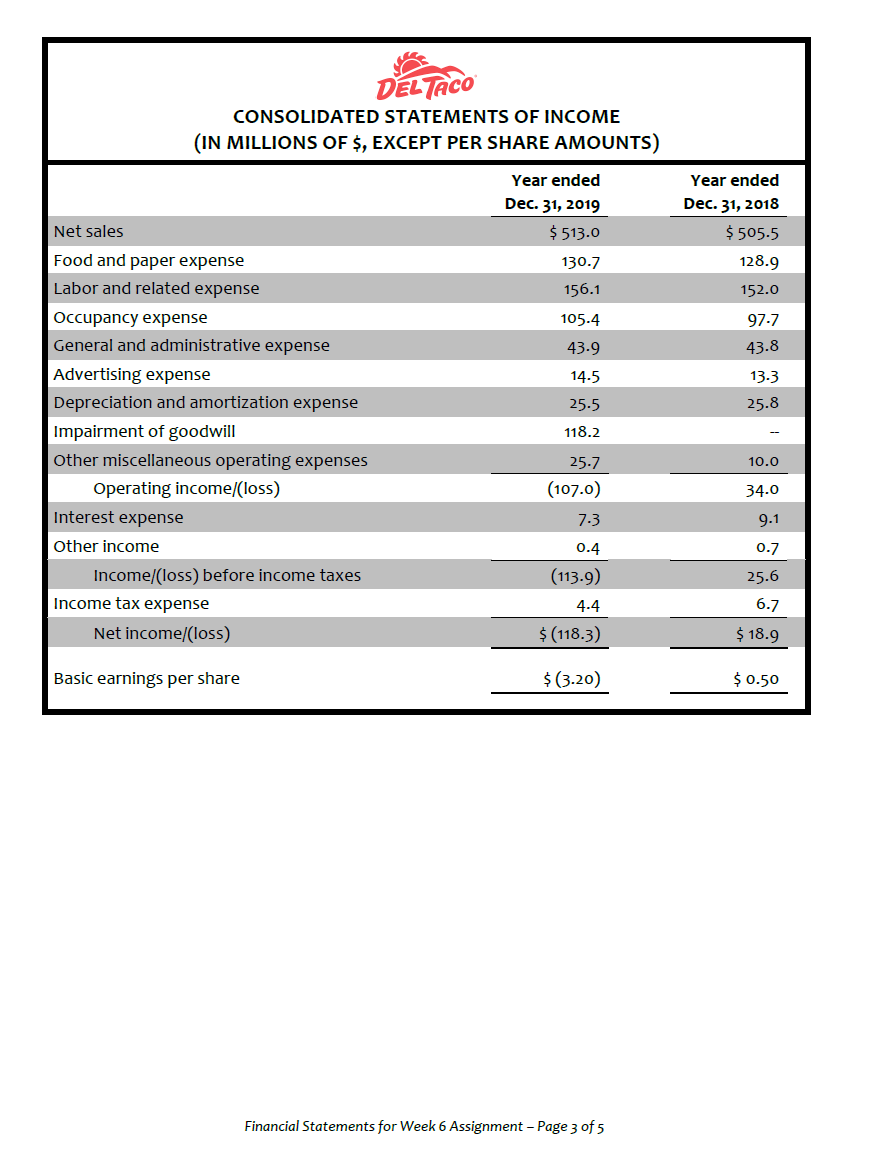

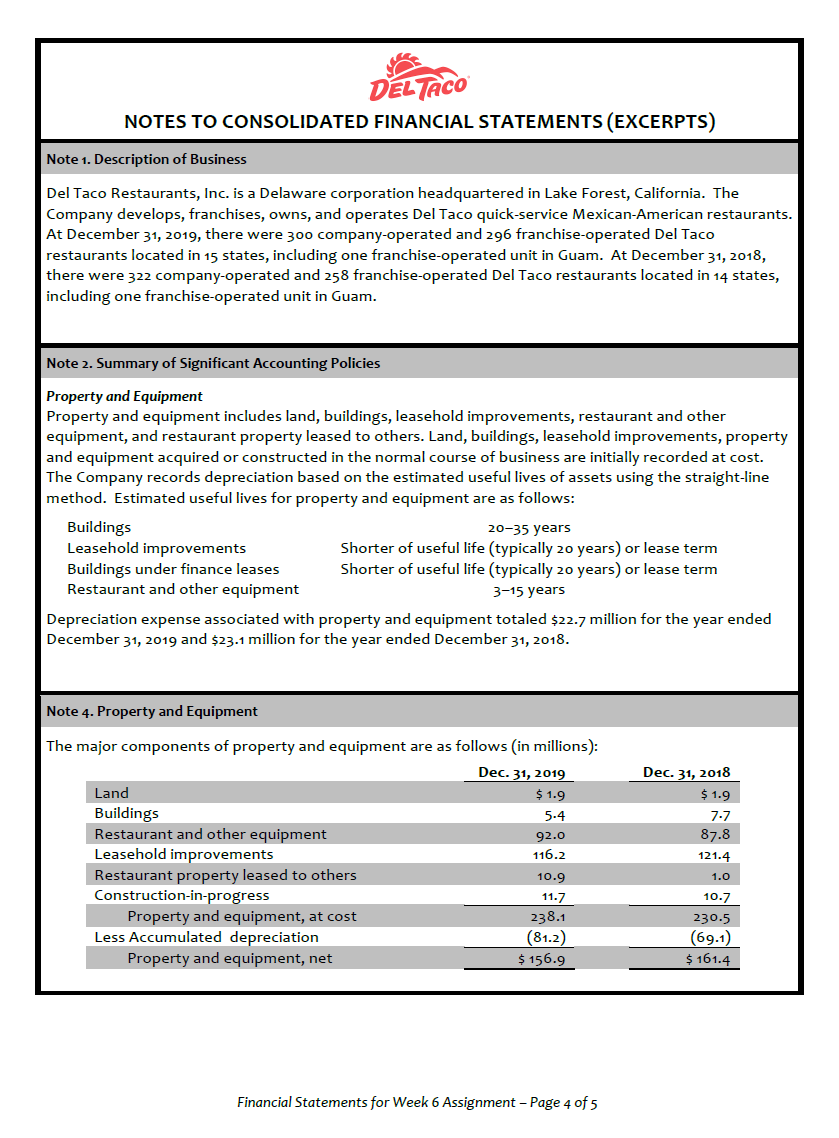

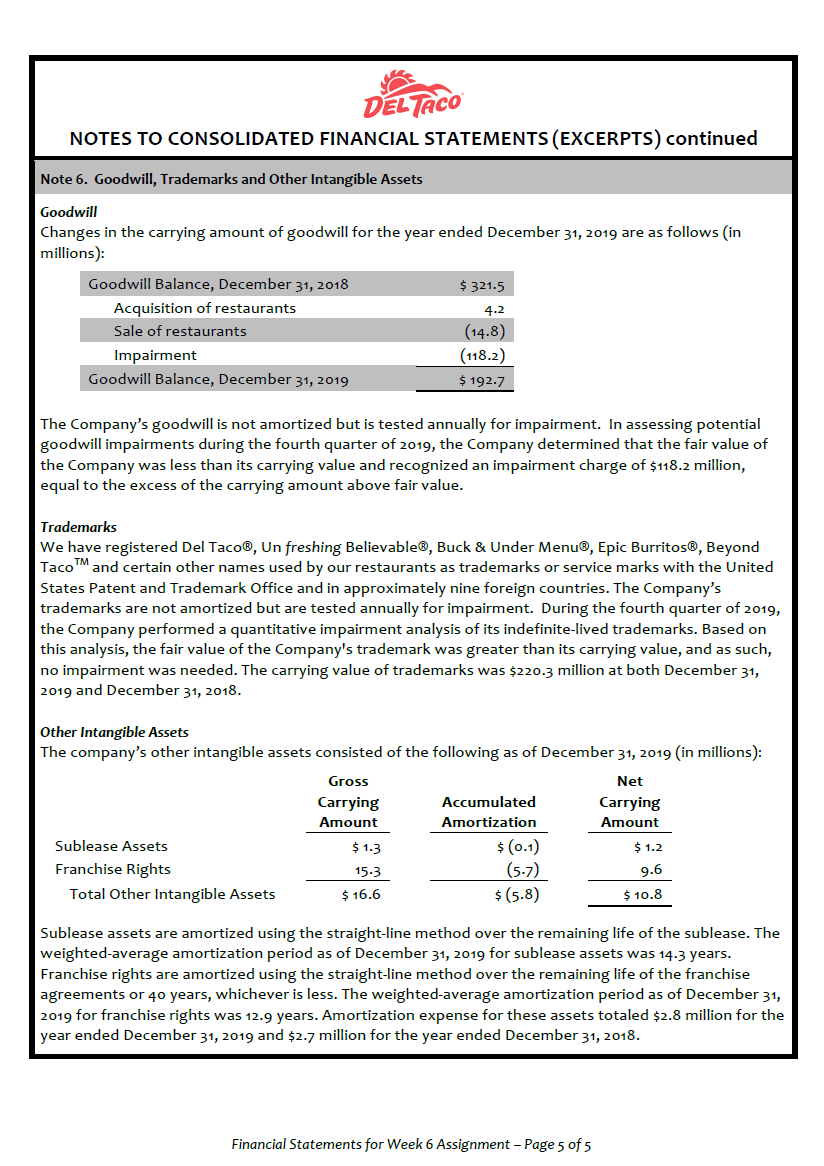

FINANCIAL STMTS FOR WEEK 6 ASSIGNMENT DEL TACO RESTAURANTS, INC. DELTACO CONSOLIDATED BALANCE SHEETS (IN MILLIONS OF $) As of Dec. 31, 2019 As of Dec. 31, 2018 $ 1.4 $ 7.2 3.2 3.6 3.1 2.9 ASSETS Cash & cash equivalents Accounts receivable, net Inventories Prepaid expenses and other Total current assets Property and equipment, net Operating lease right-of-use assets Goodwill 10.7 19.7 18.8 33.0 161.4 156.9 258.3 192.7 321.5 Trademarks 220.3 220.3 10.8 18.5 Other intangible assets other long-term assets Total assets 4.6 4.3 $759.0 $ 862.4 $19.9 $ 19.7 34.6 35.8 18.0 72.3 144.6 55.7 178.7 LIABILITIES & STOCKHOLDERS' EQUITY Accounts payable Accrued expenses Current portion of operating lease liabilities Total current liabilities Long-term debt, less current maturities Operating lease liabilities Other long-term liabilities Total liabilities Common stock and additional paid in capital Retained earnings Total stockholders' equity Total liabilities & stockholders' equity 257.4 86.1 102.3 560.4 333.2 (31.2) 336.7 337.2 85.1 302.0 $ 862.4 422.3 $ 759.0 DELTACO CONSOLIDATED STATEMENTS OF CASH FLOWS (IN MILLIONS OF $) Year ended Dec. 31, 2019 Year ended Dec. 31, 2018 $(118.3) $18.9 25.5 25.8 21.7 6.3 6.1 118.2 16.5 5.7 0.6 OPERATING ACTIVITIES Net Income Adjustments to reconcile net income to operating cash flows: Depreciation and amortization expense Operating lease asset amortization Stock compensation expense Impairment of goodwill other, net Changes in operating assets and liabilities: Accounts receivable Inventory Prepaid expenses and other assets Accounts payable Operating lease liabilities other accrued expenses and liabilities Net cash provided by operating activities INVESTING ACTIVITIES Purchases of property and equipment Proceeds from disposal of property and equipment Other, net Net cash used in investing activities (0.2) 1.8 (0.3) (0.2) (1.0) (0.3) (18.8) (0.3) 49.0 3.1 61.8 (43.7) (48.0) 14.1 1.3 0.3 (3.3) (50.0) (29.3) (7.4) 41.0 FINANCING ACTIVITIES Repurchase of common stock and warrants Proceeds from revolving credit facility Payments on revolving credit facility Other, net Net cash used in financing activities NET INCREASE IN CASH AND CASH EQUIVALENTS CASH AND CASH EQUIVALENTS, BEGINNING OF PERIOD CASH AND CASH EQUIVALENTS, END OF PERIOD (16.3) 31.0 (25.0) (0.9) (11.2) (55.0) (4.1) (25.5) (5.8) 7.2 $ 1.4 0.6 6.6 $7.2 Financial Statements for Week 6 Assignment - Page 2 of 5 DELTACO CONSOLIDATED STATEMENTS OF INCOME (IN MILLIONS OF $, EXCEPT PER SHARE AMOUNTS) Year ended Dec. 31, 2019 $513.0 130.7 156.1 Year ended Dec. 31, 2018 $ 505.5 128.9 Net sales 152.0 97-7 105.4 43.9 43.8 13.3 14.5 25.5 25.8 118.2 Food and paper expense Labor and related expense Occupancy expense General and administrative expense Advertising expense Depreciation and amortization expense Impairment of goodwill other miscellaneous operating expenses Operating income/loss) Interest expense Other income Income/(loss) before income taxes Income tax expense Net income/loss) 25.7 10.0 (1070) 34.0 7.3 9.1 0.7 0.4 (113.9) 4.4 $(118.3) 25.6 6.7 $18.9 Basic earnings per share $ (3.20) $ 0.50 Financial Statements for Week 6 Assignment - Page 3 of 5 DELTACO NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (EXCERPTS) Note 1. Description of Business Del Taco Restaurants, Inc. is a Delaware corporation headquartered in Lake Forest, California. The Company develops, franchises, owns, and operates Del Taco quick-service Mexican-American restaurants. At December 31, 2019, there were 300 company-operated and 296 franchise-operated Del Taco restaurants located in 15 states, including one franchise-operated unit in Guam. At December 31, 2018, there were 322 company-operated and 258 franchise-operated Del Taco restaurants located in 14 states, including one franchise-operated unit in Guam. Note 2. Summary of Significant Accounting Policies Property and Equipment Property and equipment includes land, buildings, leasehold improvements, restaurant and other equipment, and restaurant property leased to others. Land, buildings, leasehold improvements, property and equipment acquired or constructed in the normal course of business are initially recorded at cost. The Company records depreciation based on the estimated useful lives of assets using the straight-line method. Estimated useful lives for property and equipment are as follows: Buildings 20-35 years Leasehold improvements Shorter of useful life (typically 20 years) or lease term Buildings under finance leases Shorter of useful life (typically 20 years) or lease term Restaurant and other equipment 3-15 years Depreciation expense associated with property and equipment totaled $22.7 million for the year ended December 31, 2019 and $23.1 million for the year ended December 31, 2018. Note 4. Property and Equipment The major components of property and equipment are as follows (in millions): Dec. 31, 2019 Land $ 1.9 Buildings 5.4 Restaurant and other equipment 92.0 Leasehold improvements 116.2 Restaurant property leased to other 10.9 Construction-in-progress Property and equipment, at cost 238.1 Less Accumulated depreciation (81.2) Property and equipment, net $ 156.9 Dec. 31, 2018 $ 1.9 7.7 87.8 121.4 1.0 10.7 230.5 (69.1) $ 161.4 11.7 Financial Statements for Week 6 Assignment - Page 4 of 5 DELTACO NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (EXCERPTS) continued Note 6. Goodwill, Trademarks and Other Intangible Assets Goodwill Changes in the carrying amount of goodwill for the year ended December 31, 2019 are as follows (in millions): Goodwill Balance, December 31, 2018 Acquisition of restaurants Sale of restaurants Impairment Goodwill Balance, December 31, 2019 $ 321.5 4.2 (14.8) (118.2) $ 192.7 The Company's goodwill is not amortized but is tested annually for impairment. In assessing potential goodwill impairments during the fourth quarter of 2019, the Company determined that the fair value of the Company was less than its carrying value and recognized an impairment charge of $118.2 million, equal to the excess of the carrying amount above fair value. Trademarks We have registered Del Taco, Un freshing Believable, Buck & Under Menu, Epic Burritos, Beyond Taco oTM and certain other names used by our restaurants as trademarks or service marks with the United States Patent and Trademark Office and in approximately nine foreign countries. The Company's trademarks are not amortized but are tested annually for impairment. During the fourth quarter of 2019, the Company performed a quantitative impairment analysis of its indefinite-lived trademarks. Based on this analysis, the fair value of the Company's trademark was greater than its carrying value, and as such, no impairment was needed. The carrying value of trademarks was $220.3 million at both December 31, 2019 and December 31, 2018. Other Intangible Assets The company's other intangible assets consisted of the following as of December 31, 2019 (in millions): Gross Net Carrying Accumulated Carrying Amount Amortization Amount Sublease Assets $ 1.3 $ (0.1) $ 1.2 Franchise Rights 15.3 (5.7) 9.6 Total Other Intangible Assets $ 16.6 $(5.8) $ 10.8 Sublease assets are amortized using the straight-line method over the remaining life of the sublease. The weighted average amortization period as of December 31, 2019 for sublease assets was 14.3 years. Franchise rights are amortized using the straight-line method over the remaining life of the franchise agreements or 40 years, whichever is less. The weighted average amortization period as of December 31, 2019 for franchise rights was 12.9 years. Amortization expense for these assets totaled $2.8 million for the year ended December 31, 2019 and $2.7 million for the year ended December 31, 2018. Financial Statements for Week 6 Assignment - Page 5 of 5 FINANCIAL STMTS FOR WEEK 6 ASSIGNMENT DEL TACO RESTAURANTS, INC. DELTACO CONSOLIDATED BALANCE SHEETS (IN MILLIONS OF $) As of Dec. 31, 2019 As of Dec. 31, 2018 $ 1.4 $ 7.2 3.2 3.6 3.1 2.9 ASSETS Cash & cash equivalents Accounts receivable, net Inventories Prepaid expenses and other Total current assets Property and equipment, net Operating lease right-of-use assets Goodwill 10.7 19.7 18.8 33.0 161.4 156.9 258.3 192.7 321.5 Trademarks 220.3 220.3 10.8 18.5 Other intangible assets other long-term assets Total assets 4.6 4.3 $759.0 $ 862.4 $19.9 $ 19.7 34.6 35.8 18.0 72.3 144.6 55.7 178.7 LIABILITIES & STOCKHOLDERS' EQUITY Accounts payable Accrued expenses Current portion of operating lease liabilities Total current liabilities Long-term debt, less current maturities Operating lease liabilities Other long-term liabilities Total liabilities Common stock and additional paid in capital Retained earnings Total stockholders' equity Total liabilities & stockholders' equity 257.4 86.1 102.3 560.4 333.2 (31.2) 336.7 337.2 85.1 302.0 $ 862.4 422.3 $ 759.0 DELTACO CONSOLIDATED STATEMENTS OF CASH FLOWS (IN MILLIONS OF $) Year ended Dec. 31, 2019 Year ended Dec. 31, 2018 $(118.3) $18.9 25.5 25.8 21.7 6.3 6.1 118.2 16.5 5.7 0.6 OPERATING ACTIVITIES Net Income Adjustments to reconcile net income to operating cash flows: Depreciation and amortization expense Operating lease asset amortization Stock compensation expense Impairment of goodwill other, net Changes in operating assets and liabilities: Accounts receivable Inventory Prepaid expenses and other assets Accounts payable Operating lease liabilities other accrued expenses and liabilities Net cash provided by operating activities INVESTING ACTIVITIES Purchases of property and equipment Proceeds from disposal of property and equipment Other, net Net cash used in investing activities (0.2) 1.8 (0.3) (0.2) (1.0) (0.3) (18.8) (0.3) 49.0 3.1 61.8 (43.7) (48.0) 14.1 1.3 0.3 (3.3) (50.0) (29.3) (7.4) 41.0 FINANCING ACTIVITIES Repurchase of common stock and warrants Proceeds from revolving credit facility Payments on revolving credit facility Other, net Net cash used in financing activities NET INCREASE IN CASH AND CASH EQUIVALENTS CASH AND CASH EQUIVALENTS, BEGINNING OF PERIOD CASH AND CASH EQUIVALENTS, END OF PERIOD (16.3) 31.0 (25.0) (0.9) (11.2) (55.0) (4.1) (25.5) (5.8) 7.2 $ 1.4 0.6 6.6 $7.2 Financial Statements for Week 6 Assignment - Page 2 of 5 DELTACO CONSOLIDATED STATEMENTS OF INCOME (IN MILLIONS OF $, EXCEPT PER SHARE AMOUNTS) Year ended Dec. 31, 2019 $513.0 130.7 156.1 Year ended Dec. 31, 2018 $ 505.5 128.9 Net sales 152.0 97-7 105.4 43.9 43.8 13.3 14.5 25.5 25.8 118.2 Food and paper expense Labor and related expense Occupancy expense General and administrative expense Advertising expense Depreciation and amortization expense Impairment of goodwill other miscellaneous operating expenses Operating income/loss) Interest expense Other income Income/(loss) before income taxes Income tax expense Net income/loss) 25.7 10.0 (1070) 34.0 7.3 9.1 0.7 0.4 (113.9) 4.4 $(118.3) 25.6 6.7 $18.9 Basic earnings per share $ (3.20) $ 0.50 Financial Statements for Week 6 Assignment - Page 3 of 5 DELTACO NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (EXCERPTS) Note 1. Description of Business Del Taco Restaurants, Inc. is a Delaware corporation headquartered in Lake Forest, California. The Company develops, franchises, owns, and operates Del Taco quick-service Mexican-American restaurants. At December 31, 2019, there were 300 company-operated and 296 franchise-operated Del Taco restaurants located in 15 states, including one franchise-operated unit in Guam. At December 31, 2018, there were 322 company-operated and 258 franchise-operated Del Taco restaurants located in 14 states, including one franchise-operated unit in Guam. Note 2. Summary of Significant Accounting Policies Property and Equipment Property and equipment includes land, buildings, leasehold improvements, restaurant and other equipment, and restaurant property leased to others. Land, buildings, leasehold improvements, property and equipment acquired or constructed in the normal course of business are initially recorded at cost. The Company records depreciation based on the estimated useful lives of assets using the straight-line method. Estimated useful lives for property and equipment are as follows: Buildings 20-35 years Leasehold improvements Shorter of useful life (typically 20 years) or lease term Buildings under finance leases Shorter of useful life (typically 20 years) or lease term Restaurant and other equipment 3-15 years Depreciation expense associated with property and equipment totaled $22.7 million for the year ended December 31, 2019 and $23.1 million for the year ended December 31, 2018. Note 4. Property and Equipment The major components of property and equipment are as follows (in millions): Dec. 31, 2019 Land $ 1.9 Buildings 5.4 Restaurant and other equipment 92.0 Leasehold improvements 116.2 Restaurant property leased to other 10.9 Construction-in-progress Property and equipment, at cost 238.1 Less Accumulated depreciation (81.2) Property and equipment, net $ 156.9 Dec. 31, 2018 $ 1.9 7.7 87.8 121.4 1.0 10.7 230.5 (69.1) $ 161.4 11.7 Financial Statements for Week 6 Assignment - Page 4 of 5 DELTACO NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (EXCERPTS) continued Note 6. Goodwill, Trademarks and Other Intangible Assets Goodwill Changes in the carrying amount of goodwill for the year ended December 31, 2019 are as follows (in millions): Goodwill Balance, December 31, 2018 Acquisition of restaurants Sale of restaurants Impairment Goodwill Balance, December 31, 2019 $ 321.5 4.2 (14.8) (118.2) $ 192.7 The Company's goodwill is not amortized but is tested annually for impairment. In assessing potential goodwill impairments during the fourth quarter of 2019, the Company determined that the fair value of the Company was less than its carrying value and recognized an impairment charge of $118.2 million, equal to the excess of the carrying amount above fair value. Trademarks We have registered Del Taco, Un freshing Believable, Buck & Under Menu, Epic Burritos, Beyond Taco oTM and certain other names used by our restaurants as trademarks or service marks with the United States Patent and Trademark Office and in approximately nine foreign countries. The Company's trademarks are not amortized but are tested annually for impairment. During the fourth quarter of 2019, the Company performed a quantitative impairment analysis of its indefinite-lived trademarks. Based on this analysis, the fair value of the Company's trademark was greater than its carrying value, and as such, no impairment was needed. The carrying value of trademarks was $220.3 million at both December 31, 2019 and December 31, 2018. Other Intangible Assets The company's other intangible assets consisted of the following as of December 31, 2019 (in millions): Gross Net Carrying Accumulated Carrying Amount Amortization Amount Sublease Assets $ 1.3 $ (0.1) $ 1.2 Franchise Rights 15.3 (5.7) 9.6 Total Other Intangible Assets $ 16.6 $(5.8) $ 10.8 Sublease assets are amortized using the straight-line method over the remaining life of the sublease. The weighted average amortization period as of December 31, 2019 for sublease assets was 14.3 years. Franchise rights are amortized using the straight-line method over the remaining life of the franchise agreements or 40 years, whichever is less. The weighted average amortization period as of December 31, 2019 for franchise rights was 12.9 years. Amortization expense for these assets totaled $2.8 million for the year ended December 31, 2019 and $2.7 million for the year ended December 31, 2018. Financial Statements for Week 6 Assignment - Page 5 of 5