Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 - Short answer (20 Marks) 1 quotations) Discuss and explain the following types of risk. (use your own words and not a. Debt

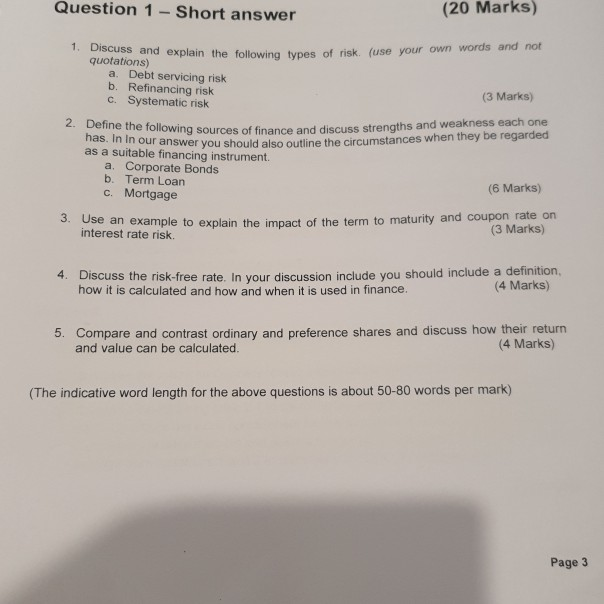

Question 1 - Short answer (20 Marks) 1 quotations) Discuss and explain the following types of risk. (use your own words and not a. Debt servicing risk b. Refinancing risk (3 Marks) c. Systematic risk 2. Define the following sources of finance and discuss strengths and weakness each one has In In our answer you should also outline the circumstances when they be regarded as a suitable financing instrument. a. Corporate Bonds b. Term Loan (6 Marks) c. Mortgage 3. Use an example to explain the impact of the term to maturity and coupon rate on (3 Marks) interest rate risk. 4. Discuss the risk-free rate. In your discussion include you should include a definition how it is calculated and how and when it is used in finance. (4 Marks) 5. Compare and contrast ordinary and preference shares and discuss how their return and value can be calculated. (4 Marks) (The indicative word length for the above questions is about 50-80 words per mark) Page 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started