Answered step by step

Verified Expert Solution

Question

1 Approved Answer

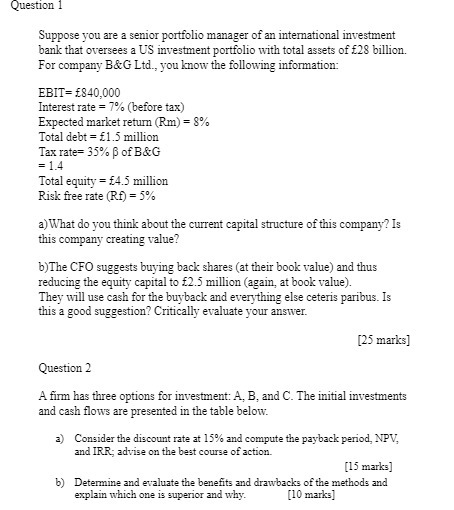

Question 1 Suppose you are a senior portfolio manager of an international investment bank that oversees a US investment portfolio with total assets of

Question 1 Suppose you are a senior portfolio manager of an international investment bank that oversees a US investment portfolio with total assets of 28 billion. For company B&G Ltd., you know the following information: EBIT= 840,000 Interest rate = 7% (before tax) Expected market return (Rm) = 8% Total debt = 1.5 million Tax rate=35% of B&G = 1.4 Total equity 4.5 million Risk free rate (Rf) = 5% a) What do you think about the current capital structure of this company? Is this company creating value? b)The CFO suggests buying back shares (at their book value) and thus reducing the equity capital to 2.5 million (again, at book value). They will use cash for the buyback and everything else ceteris paribus. Is this a good suggestion? Critically evaluate your answer. [25 marks] Question 2 A firm has three options for investment: A, B, and C. The initial investments and cash flows are presented in the table below. a) Consider the discount rate at 15% and compute the payback period, NPV, and IRR; advise on the best course of action. [15 marks] b) Determine and evaluate the benefits and drawbacks of the methods and explain which one is superior and why. [10 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Question 1 a Evaluate the Current Capital Structure We are provided with the following information EBIT 840000 Interest Rate 7 Expected Market Return r m rm rm 8 Debt 15 million Tax Rate 35 Beta beta ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started