Question 1: Tax Return preparation You have been engaged to prepare the 2021 federal income tax return for Alan and Erica Wright. Your tax forms should include, as applicable: Form 1040, Schedules 1, 4, A, B, C, D, E, SE and Forms 4684 and 8949. Your solution should contain a calculation of the tax due or refunded with the return and calculated in the form of the tax formula. Must be complete using 2021 forms. Use the following assumptions in preparing the return: o Use all opportunities under law to minimize the 2021 federal income tax. o If required information is missing, use reasonable assumptions to fill in the gaps. o Use whole dollars when preparing the tax return. o Do not prepare a state income tax return. o Ignore alternative minimum tax. Question 2: Identify and explain two reasonable tax planning items the family could use to minimize their tax liability and/or maximize their wealth. All items would be implemented in future years and do not impact the current tax return.

Given the following information:

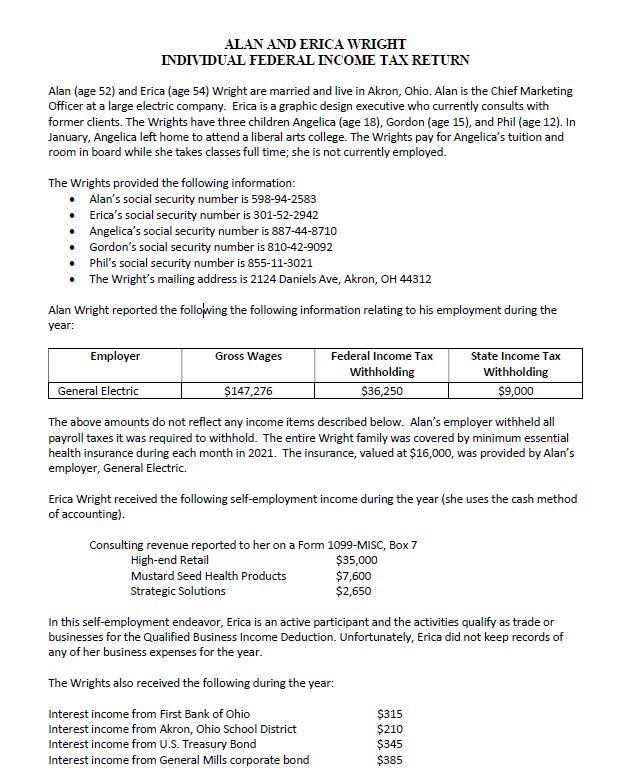

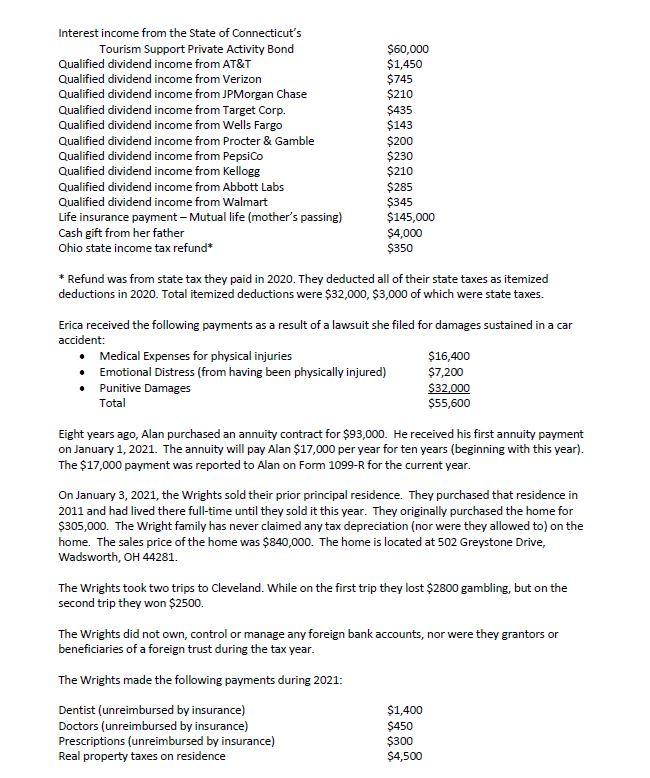

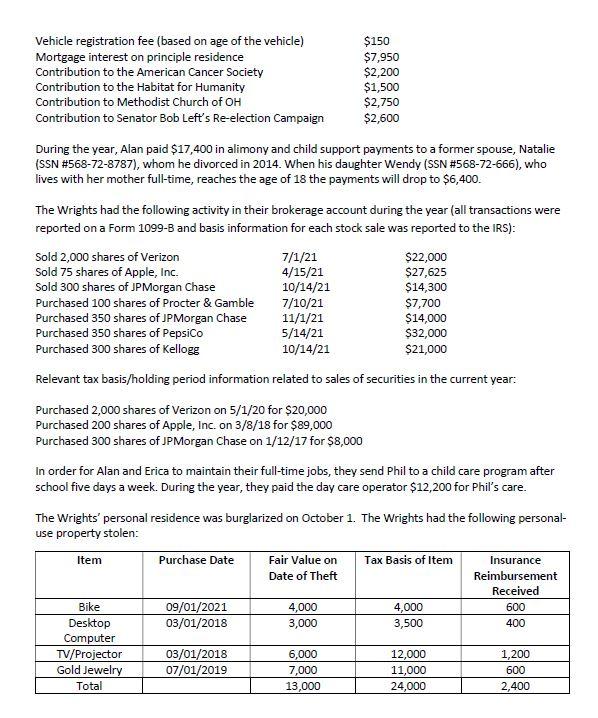

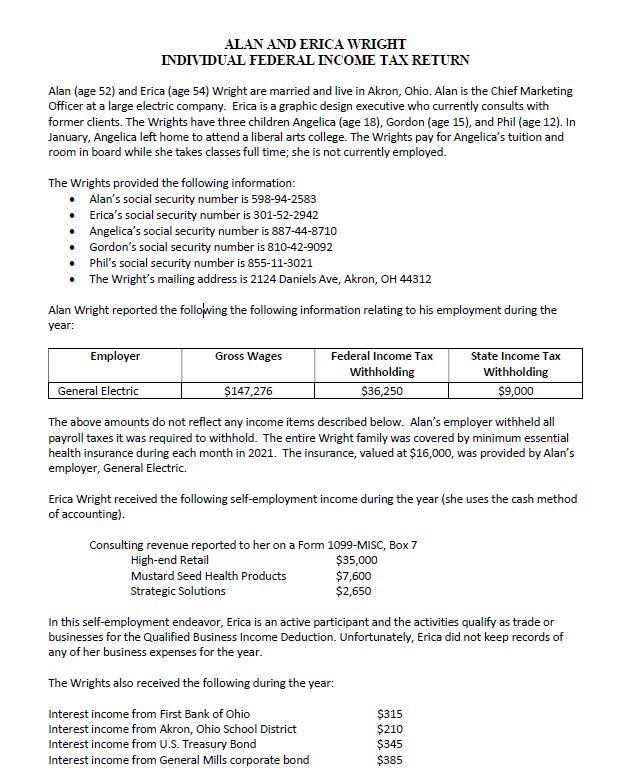

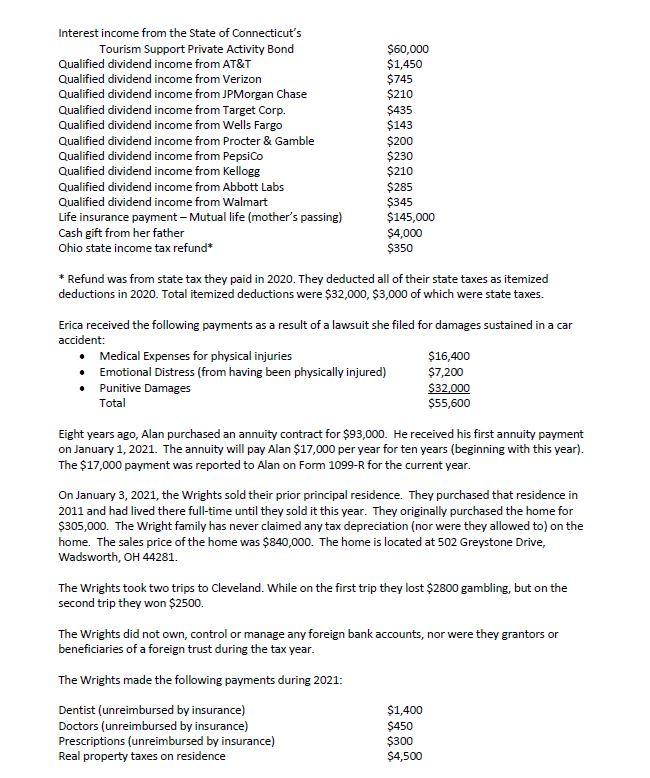

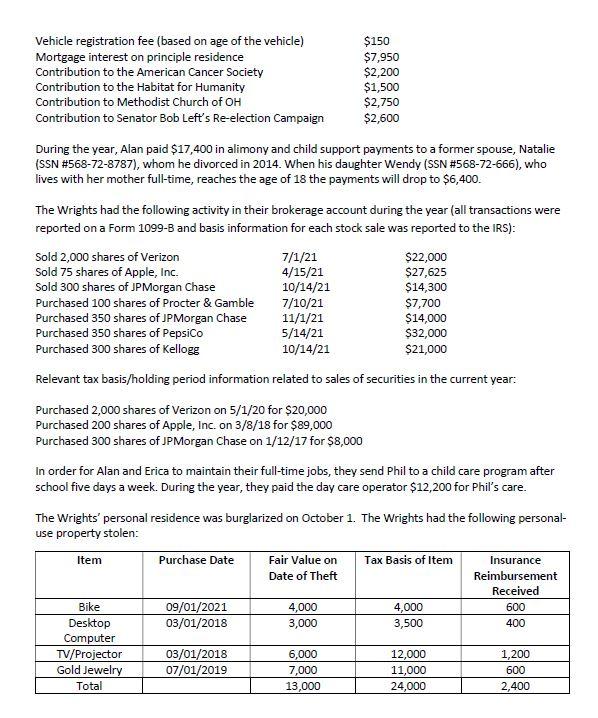

Alan (age 52) and Erica (age 54) Wright are married and live in Akron, Ohio. Alan is the Chief Marketing Officer at a large electric company. Erica is a graphic design executive who currently consults with former clients. The Wrights have three children Angelica (age 18), Gordon (age 15), and Phil (age 12). In January, Angelica left home to attend a liberal arts college. The Wrights pay for Angelica's tuition and room in board while she takes classes full time; she is not currently employed. The Wrights provided the following information: - Alan's social security number is 598-94-2583 - Erica's social security number is 301-52-2942 - Angelica's social security number is 887-44-8710 - Gordon's social security number is 810-42-9092 - Phil's social security number is 855-11-3021 - The Wright's mailing address is 2124 Daniels Ave, Akron, OH 44312 Alan Wright reported the follo'wing the following information relating to his employment during the year: The above amounts do not reflect any income items described below. Alan's employer withheld all payroll taxes it was required to withhold. The entire Wright family was covered by minimum essential health insurance during each month in 2021 . The insurance, valued at $16,000, was provided by Alan's employer, General Electric. Erica Wright received the following self-employment income during the year (she uses the cash method of accounting). In this self-employment endeavor, Erica is an active participant and the activities qualify as trade or businesses for the Qualified Business Income Deduction. Unfortunately, Erica did not keep records of any of her business expenses for the year. The Wrights also received the following during the year: * Refund was from state tax they paid in 2020 . They deducted all of their state taxes as itemized deductions in 2020 . Total itemized deductions were $32,000,$3,000 of which were state taxes. Erica received the following payments as a result of a lawsuit she filed for damages sustained in a car arridant. Eight years ago, Alan purchased an annuity contract for $93,000. He received his first annuity payment on January 1, 2021. The annuity will pay Alan $17,000 per year for ten years (beginning with this year). The $17,000 payment was reported to Alan on Form 1099-R for the current year. On January 3, 2021, the Wrights sold their prior principal residence. They purchased that residence in 2011 and had lived there full-time until they sold it this year. They originally purchased the home for $305,000. The Wright family has never claimed any tax depreciation (nor were they allowed to) on the home. The sales price of the home was $840,000. The home is located at 502 Greystone Drive, Wadsworth, OH 44281. The Wrights took two trips to Cleveland. While on the first trip they lost $2800 gambling, but on the second trip they won $2500. The Wrights did not own, control or manage any foreign bank accounts, nor were they grantors or beneficiaries of a foreign trust during the tax year. The Wrights made the following payments during 2021 : During the year, Alan paid $17,400 in alimony and child support payments to a former spouse, Natalie (SSN #568-72-8787), whom he divorced in 2014. When his daughter Wendy (SSN #568-72-666), who lives with her mother full-time, reaches the age of 18 the payments will drop to $6,400. The Wrights had the following activity in their brokerage account during the year (all transactions were reported on a Form 1099-B and basis information for each stock sale was reported to the IRS): Relevant tax basis/holding period information related to sales of securities in the current year: Purchased 2,000 shares of Verizon on 5/1/20 for $20,000 Purchased 200 shares of Apple, Inc. on 3/8/18 for $89,000 Purchased 300 shares of JPMorgan Chase on 1/12/17 for $8,000 In order for Alan and Erica to maintain their full-time jobs, they send Phil to a child care program after school five days a week. During the year, they paid the day care operator $12,200 for Phil's care. The Wrights' personal residence was burglarized on October 1 . The Wrights had the following personaluse property stolen: Alan (age 52) and Erica (age 54) Wright are married and live in Akron, Ohio. Alan is the Chief Marketing Officer at a large electric company. Erica is a graphic design executive who currently consults with former clients. The Wrights have three children Angelica (age 18), Gordon (age 15), and Phil (age 12). In January, Angelica left home to attend a liberal arts college. The Wrights pay for Angelica's tuition and room in board while she takes classes full time; she is not currently employed. The Wrights provided the following information: - Alan's social security number is 598-94-2583 - Erica's social security number is 301-52-2942 - Angelica's social security number is 887-44-8710 - Gordon's social security number is 810-42-9092 - Phil's social security number is 855-11-3021 - The Wright's mailing address is 2124 Daniels Ave, Akron, OH 44312 Alan Wright reported the follo'wing the following information relating to his employment during the year: The above amounts do not reflect any income items described below. Alan's employer withheld all payroll taxes it was required to withhold. The entire Wright family was covered by minimum essential health insurance during each month in 2021 . The insurance, valued at $16,000, was provided by Alan's employer, General Electric. Erica Wright received the following self-employment income during the year (she uses the cash method of accounting). In this self-employment endeavor, Erica is an active participant and the activities qualify as trade or businesses for the Qualified Business Income Deduction. Unfortunately, Erica did not keep records of any of her business expenses for the year. The Wrights also received the following during the year: * Refund was from state tax they paid in 2020 . They deducted all of their state taxes as itemized deductions in 2020 . Total itemized deductions were $32,000,$3,000 of which were state taxes. Erica received the following payments as a result of a lawsuit she filed for damages sustained in a car arridant. Eight years ago, Alan purchased an annuity contract for $93,000. He received his first annuity payment on January 1, 2021. The annuity will pay Alan $17,000 per year for ten years (beginning with this year). The $17,000 payment was reported to Alan on Form 1099-R for the current year. On January 3, 2021, the Wrights sold their prior principal residence. They purchased that residence in 2011 and had lived there full-time until they sold it this year. They originally purchased the home for $305,000. The Wright family has never claimed any tax depreciation (nor were they allowed to) on the home. The sales price of the home was $840,000. The home is located at 502 Greystone Drive, Wadsworth, OH 44281. The Wrights took two trips to Cleveland. While on the first trip they lost $2800 gambling, but on the second trip they won $2500. The Wrights did not own, control or manage any foreign bank accounts, nor were they grantors or beneficiaries of a foreign trust during the tax year. The Wrights made the following payments during 2021 : During the year, Alan paid $17,400 in alimony and child support payments to a former spouse, Natalie (SSN #568-72-8787), whom he divorced in 2014. When his daughter Wendy (SSN #568-72-666), who lives with her mother full-time, reaches the age of 18 the payments will drop to $6,400. The Wrights had the following activity in their brokerage account during the year (all transactions were reported on a Form 1099-B and basis information for each stock sale was reported to the IRS): Relevant tax basis/holding period information related to sales of securities in the current year: Purchased 2,000 shares of Verizon on 5/1/20 for $20,000 Purchased 200 shares of Apple, Inc. on 3/8/18 for $89,000 Purchased 300 shares of JPMorgan Chase on 1/12/17 for $8,000 In order for Alan and Erica to maintain their full-time jobs, they send Phil to a child care program after school five days a week. During the year, they paid the day care operator $12,200 for Phil's care. The Wrights' personal residence was burglarized on October 1 . The Wrights had the following personaluse property stolen