Answered step by step

Verified Expert Solution

Question

1 Approved Answer

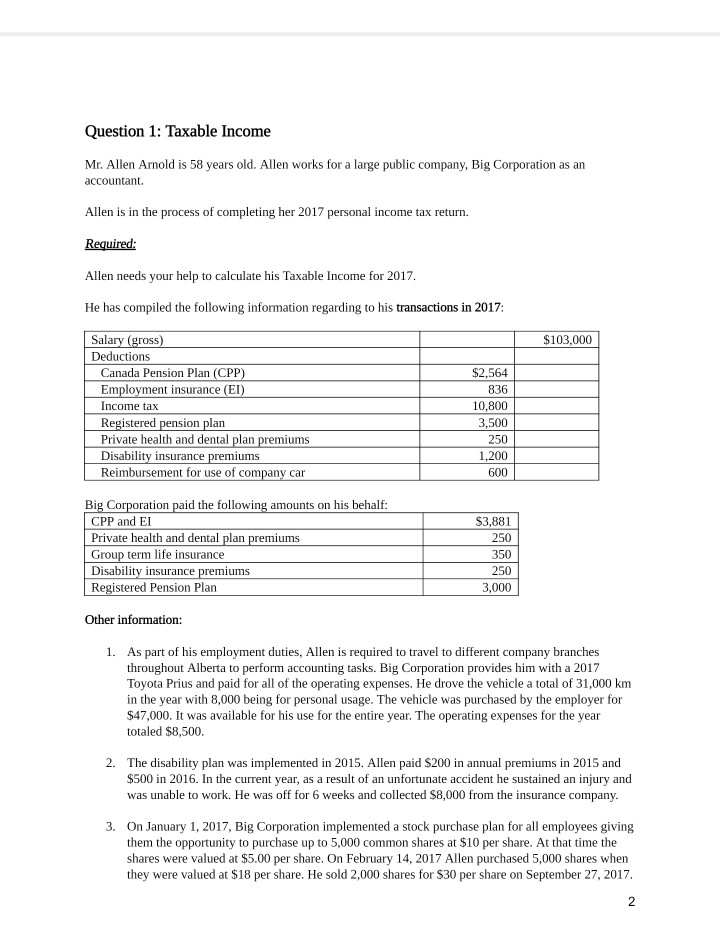

Question 1: Taxable Income Mr. Allen Arnold is 58 years old. Allen works for a large public company, Big Corporation as an accountant. Allen is

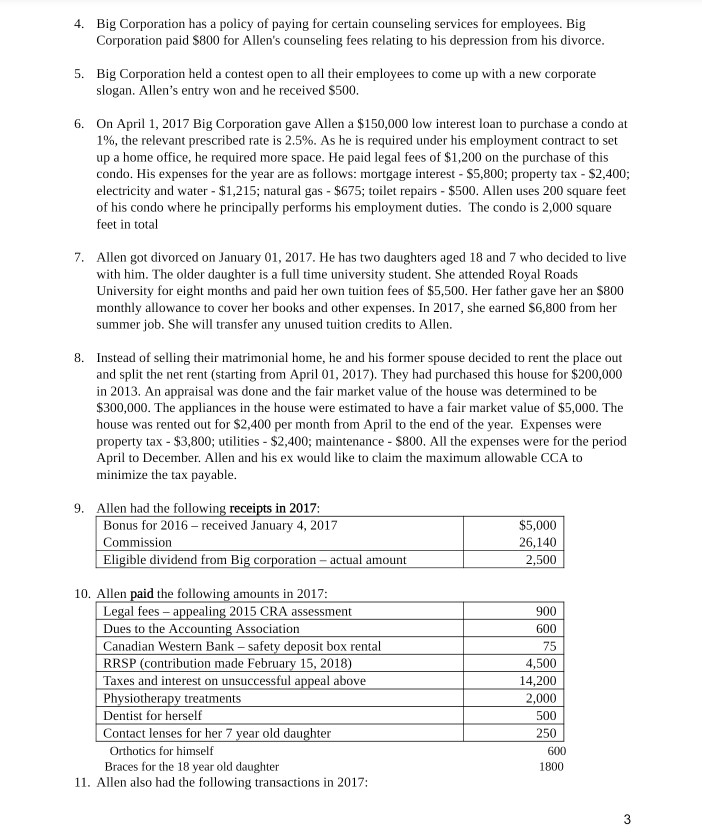

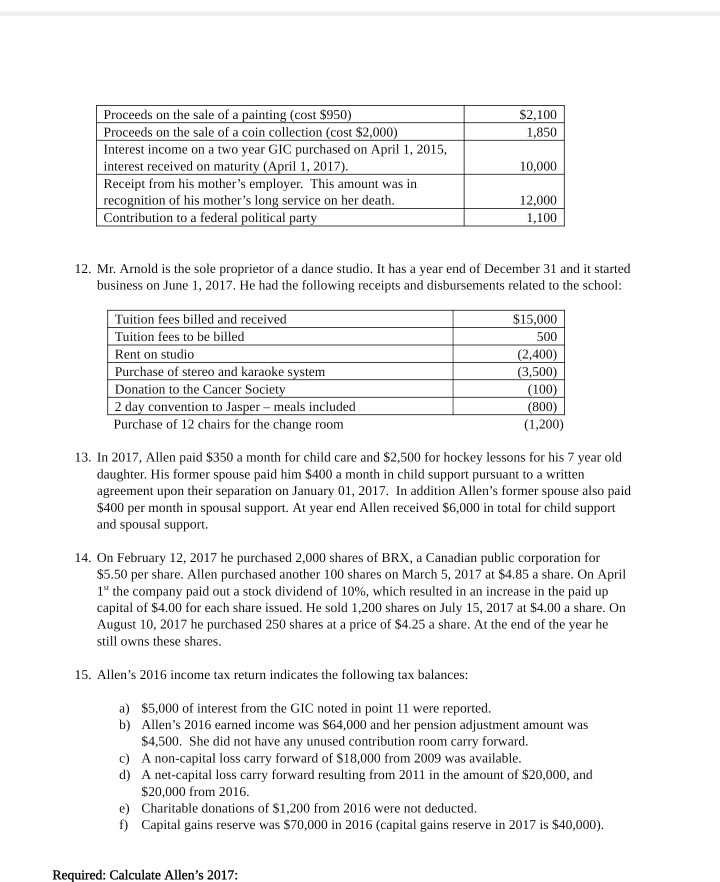

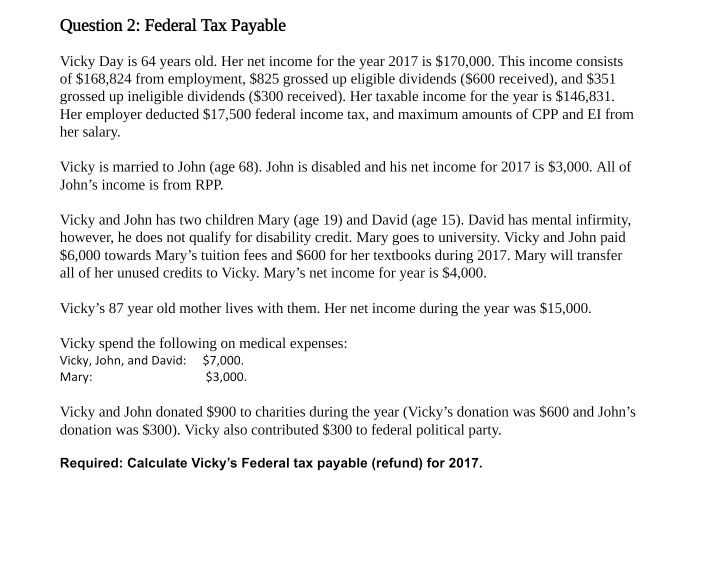

Question 1: Taxable Income Mr. Allen Arnold is 58 years old. Allen works for a large public company, Big Corporation as an accountant. Allen is in the process of completing her 2017 personal income tax return. Required: Allen needs your help to calculate his Taxable Income for 2017 He has compiled the following information regarding to his transactions in 2017: Sala Deductions ross $103,000 Canada Pension Plan (CPP) Employment insurance (EI Income tax Registered Private health and dental plan premiums Disability insu Reimbursement for use of company car $2,564 836 10,800 3,500 250 1,200 600 pension plan rance premiumns ation paid the following amounts on his behalf: CPP and EI Private health and dental plan premiums Group term life insurance Disability insurance premiums Registered Pension Plan $3,881 250 350 250 3,000 Other information: 1. As part of his employment duties, Allen is required to travel to different company branches throughout Alberta to perform accounting tasks. Big Corporation provides him with a 2017 Toyota Prius and paid for all of the operating expenses. He drove the vehicle a total of 31,000 km in the year with 8,000 being for personal usage. The vehicle was purchased by the employer for $47,000. It was available for his use for the entire year. The operating expenses for the year totaled $8,500 2. The disability plan was implemented in 2015. Allen paid $200 in annual premiums in 2015 and $500 in 2016. In the current year, as a result of an unfortunate accident he sustained an injury and was unable to work. He was off for 6 weeks and collected S8,000 from the insurance company. 3. On January 1, 2017, Big Corporation implemented a stock purchase plan for all employees giving them the opportunity to purchase up to 5,000 common shares at $10 per share. At that time the shares were valued at $5.00 per share. On February 14, 2017 Allen purchased 5,000 shares when they were valued at $18 per share. He sold 2,000 shares for S30 per share on September 27, 2017 Question 1: Taxable Income Mr. Allen Arnold is 58 years old. Allen works for a large public company, Big Corporation as an accountant. Allen is in the process of completing her 2017 personal income tax return. Required: Allen needs your help to calculate his Taxable Income for 2017 He has compiled the following information regarding to his transactions in 2017: Sala Deductions ross $103,000 Canada Pension Plan (CPP) Employment insurance (EI Income tax Registered Private health and dental plan premiums Disability insu Reimbursement for use of company car $2,564 836 10,800 3,500 250 1,200 600 pension plan rance premiumns ation paid the following amounts on his behalf: CPP and EI Private health and dental plan premiums Group term life insurance Disability insurance premiums Registered Pension Plan $3,881 250 350 250 3,000 Other information: 1. As part of his employment duties, Allen is required to travel to different company branches throughout Alberta to perform accounting tasks. Big Corporation provides him with a 2017 Toyota Prius and paid for all of the operating expenses. He drove the vehicle a total of 31,000 km in the year with 8,000 being for personal usage. The vehicle was purchased by the employer for $47,000. It was available for his use for the entire year. The operating expenses for the year totaled $8,500 2. The disability plan was implemented in 2015. Allen paid $200 in annual premiums in 2015 and $500 in 2016. In the current year, as a result of an unfortunate accident he sustained an injury and was unable to work. He was off for 6 weeks and collected S8,000 from the insurance company. 3. On January 1, 2017, Big Corporation implemented a stock purchase plan for all employees giving them the opportunity to purchase up to 5,000 common shares at $10 per share. At that time the shares were valued at $5.00 per share. On February 14, 2017 Allen purchased 5,000 shares when they were valued at $18 per share. He sold 2,000 shares for S30 per share on September 27, 2017

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started