Question 1

The current spot GBP/USD rate is 1.9452 and the three-month forward rate is 1.9167. Based on your analysis of the exchange rate, you are pretty confident that the spot exchange rate will be 1.9229 in three months. Assume that you would like to trade 7,000,000 in the forward market.

What would be your speculative profit in dollar terms if the spot exchange rate actually turns out to be 1.9000. (USD, no cents)

Ans: __________________

Question 2

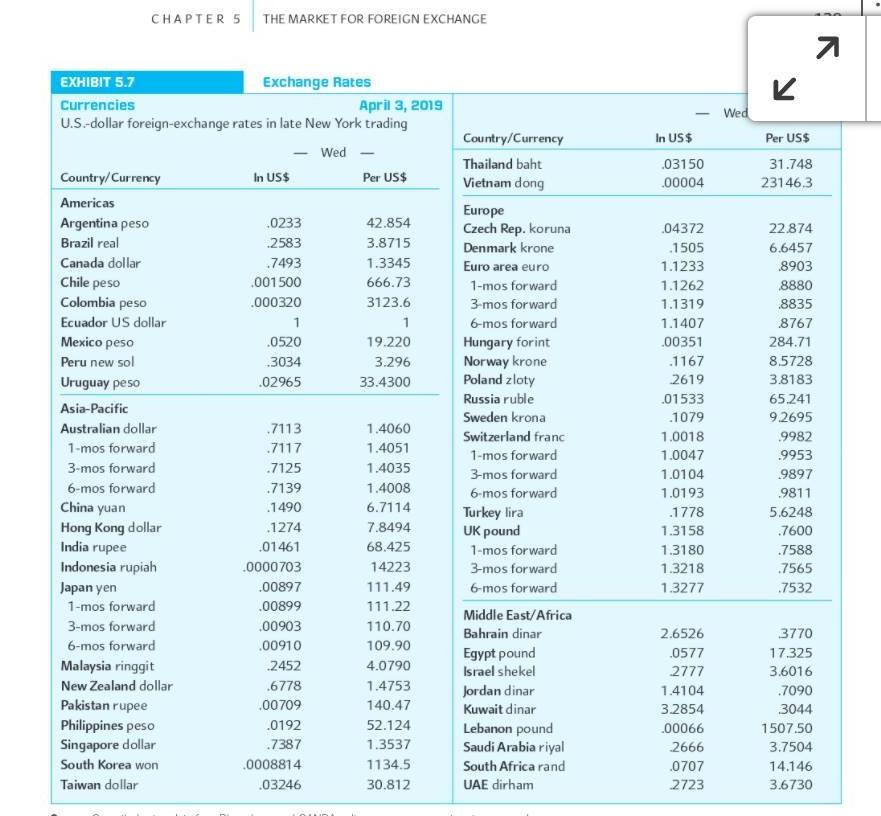

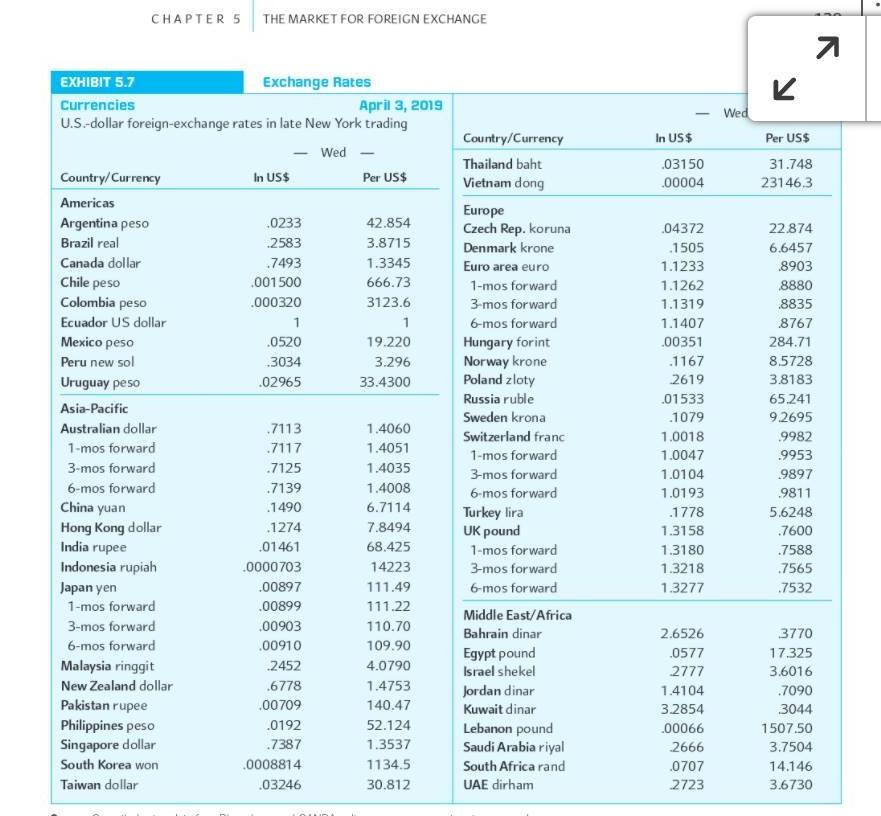

Using the quotes from Exhibit 5.7, calculate the three-month forward cross-exchange rate for CHF/JPY (XXX.XX)

Ans: ______________________________

Question 3

Using the quotes from Exhibit 5.7, calculate the one-month forward cross-exchange rate for EURCHF (X.XXXX)

Ans: _______________________________

Question 4

Assume you are a trader with Deutsche Bank. From the quote screen on your computer terminal, you notice that Dresdner Bank is quoting EUR/USD at 1.2516 and Credit Suisse is offering USD/CHF at 0.8860. You learn that UBS is making a direct market between the Swiss franc and the euro, with a current EUR/CHF of 1.1046. (Ignore bid-ask spreads for this problem.) Assume you have $5,000,000 with which to conduct the arbitrage. What is the profit or loss if you initially sell dollars for Swiss francs? (answer in USD, no cents)

Ans: __________________________________

Question 5

Assume you are a trader with Deutsche Bank. From the quote screen on your computer terminal, you notice that Dresdner Bank is quoting EUR/USD at 1.2457 and Credit Suisse is offering USD/CHF at 0.8852. You learn that UBS is making a direct market between the Swiss franc and the euro, with a current EUR/CHF of 1.1049. (Ignore bid-ask spreads for this problem.) Assume you have $5,000,000 with which to conduct the arbitrage. What is the profit or loss if you initially buy Euros with your USD? (answer in USD, no cents)

Ans: _______________________________

Question 6

Using the quotes from Exhibit 5.7, calculate the one-month forward cross-exchange rate for EUR/GBP (X.XXXX)

Ans: ______________________________

Question 7

A foreign exchange trader with a U.S. bank took a speculative short position of 7,000,000 when the GBP/USD was 1.3305. Subsequently, the exchange rate has changed to 1.3352. If the position is closed now, what is the profit/loss arising from that trade? (USD, no cents)

Ans: ____________________________

Question 8

A bank is quoting the following exchange rates

AUD/USD = 0.72 25-35

USD/CHF = 1.14 20-30

An Australian firm needs to sell Swiss francs. Calculate the cross-rate the bank will use. (X.XXXX)

Ans: _________________________

Question 9

Using Exhibit 5.7, calculate the six-month forward premium or discount for the Swiss franc versus the U.S. dollar. For simplicity, assume each month has 30 days. (X.XX%) or (-X.XX%)

Ans: ________________

Question 10

Using Exhibit 5.7, calculate the one-month forward premium or discount for the Euro versus the U.S. dollar. For simplicity, assume each month has 30 days. (X.XX%) or (-X.XX%)

Ans: ____________________

CHAPTER 5 THE MARKET FOR FOREIGN EXCHANGE K Wed In US$ .03150 .00004 Per US$ 31.748 23146,3 EXHIBIT 5.7 Exchange Rates Currencies April 3, 2019 U.S. dollar foreign-exchange rates in late New York trading Wed Country/Currency In US$ Per US$ Americas Argentina peso .0233 42.854 Brazil real .2583 3.8715 Canada dollar .7493 1.3345 Chile peso ,001500 666.73 Colombia peso .000320 3123.6 Ecuador US dollar 1 1 Mexico peso .0520 19.220 Peru new sol -3034 3.296 Uruguay peso .02965 33.4300 Asia-Pacific Australian dollar .7113 1.4060 1-mos forward .7117 1.4051 3-mos forward .7125 1.4035 6-mos forward .7139 1.4008 China yuan .1490 6.7114 Hong Kong dollar .1274 7.8494 India rupee .01461 68.425 Indonesia rupiah .0000703 14223 Japan yen .00897 111.49 1-mos forward .00899 111.22 3-mos forward ,00903 110.70 6-mos forward .00910 109.90 Malaysia ringgit .2452 4.0790 New Zealand dollar .6778 1.4753 Pakistan rupee .00709 140.47 Philippines peso .0192 52.124 Singapore dollar .7387 1.3537 South Korea won .0008814 1134.5 Taiwan dollar .03246 30.812 Country/Currency Thailand baht Vietnam dong Europe Czech Rep. koruna Denmark krone Euro area euro 1-mos forward 3-mos forward 6-mos forward Hungary forint Norway Krone Poland zloty Russia ruble Sweden krona Switzerland franc 1-mos forward 3-mos forward 6-mos forward Turkey lira UK pound 1-mos forward 3-mos forward 6-mos forward Middle East/Africa Bahrain dinar Egypt pound Israel shekel Jordan dinar Kuwait dinar Lebanon pound Saudi Arabia riyal South Africa rand UAE dirham .04372 1505 1.1233 1.1262 1.1319 1.1407 _00351 .1167 2619 _01533 1079 1.0018 1.0047 1.0104 1.0193 1778 1.3158 1.3180 1.3218 1.3277 22.874 6.6457 8903 8880 .8835 8767 284.71 85728 3.8183 65.241 9.2695 .9982 9953 9897 9811 5.6248 .7600 .7588 .7565 .7532 2.6526 .0577 2777 1.4104 3.2854 .00066 .2666 .0707 2723 3770 17.325 3.6016 .7090 3044 1507.50 3.7504 14.146 3.6730 Nuwait uirlar D.2014 DU44 ilippines peso gapore dollar .0192 .7387 .0008814 .03246 52.124 1.3537 1134.5 30.812 Lebanon pound Saudi Arabia riyal South Africa rand UAE dirham + - uth Korea won wan dollar Source: Compiled using data from Bloomberg and OANDA online currency converter at www.oanda.com. In this textbook, we will use the following notation for spot rate quotations. In gen- eral, S(j/k) will refer to the price of one unit of currency k in terms of currency j. Thus, the American term quote from Exhibit 5.7 for the British pound on Wednesday, April 3 is S($/) = 1.3158. The corresponding European quote is S(T$) = .7600. When the context is clear as to what terms the quotation is in, the less cumbersome S will be used to denote the spot rate. It should be intuitive that the American and European term quotes are reciprocals of one another. That is, (5.1) 1 S($/) S(/$) 1 1.3158 = .7600 CHAPTER 5 THE MARKET FOR FOREIGN EXCHANGE K Wed In US$ .03150 .00004 Per US$ 31.748 23146,3 EXHIBIT 5.7 Exchange Rates Currencies April 3, 2019 U.S. dollar foreign-exchange rates in late New York trading Wed Country/Currency In US$ Per US$ Americas Argentina peso .0233 42.854 Brazil real .2583 3.8715 Canada dollar .7493 1.3345 Chile peso ,001500 666.73 Colombia peso .000320 3123.6 Ecuador US dollar 1 1 Mexico peso .0520 19.220 Peru new sol -3034 3.296 Uruguay peso .02965 33.4300 Asia-Pacific Australian dollar .7113 1.4060 1-mos forward .7117 1.4051 3-mos forward .7125 1.4035 6-mos forward .7139 1.4008 China yuan .1490 6.7114 Hong Kong dollar .1274 7.8494 India rupee .01461 68.425 Indonesia rupiah .0000703 14223 Japan yen .00897 111.49 1-mos forward .00899 111.22 3-mos forward ,00903 110.70 6-mos forward .00910 109.90 Malaysia ringgit .2452 4.0790 New Zealand dollar .6778 1.4753 Pakistan rupee .00709 140.47 Philippines peso .0192 52.124 Singapore dollar .7387 1.3537 South Korea won .0008814 1134.5 Taiwan dollar .03246 30.812 Country/Currency Thailand baht Vietnam dong Europe Czech Rep. koruna Denmark krone Euro area euro 1-mos forward 3-mos forward 6-mos forward Hungary forint Norway Krone Poland zloty Russia ruble Sweden krona Switzerland franc 1-mos forward 3-mos forward 6-mos forward Turkey lira UK pound 1-mos forward 3-mos forward 6-mos forward Middle East/Africa Bahrain dinar Egypt pound Israel shekel Jordan dinar Kuwait dinar Lebanon pound Saudi Arabia riyal South Africa rand UAE dirham .04372 1505 1.1233 1.1262 1.1319 1.1407 _00351 .1167 2619 _01533 1079 1.0018 1.0047 1.0104 1.0193 1778 1.3158 1.3180 1.3218 1.3277 22.874 6.6457 8903 8880 .8835 8767 284.71 85728 3.8183 65.241 9.2695 .9982 9953 9897 9811 5.6248 .7600 .7588 .7565 .7532 2.6526 .0577 2777 1.4104 3.2854 .00066 .2666 .0707 2723 3770 17.325 3.6016 .7090 3044 1507.50 3.7504 14.146 3.6730 Nuwait uirlar D.2014 DU44 ilippines peso gapore dollar .0192 .7387 .0008814 .03246 52.124 1.3537 1134.5 30.812 Lebanon pound Saudi Arabia riyal South Africa rand UAE dirham + - uth Korea won wan dollar Source: Compiled using data from Bloomberg and OANDA online currency converter at www.oanda.com. In this textbook, we will use the following notation for spot rate quotations. In gen- eral, S(j/k) will refer to the price of one unit of currency k in terms of currency j. Thus, the American term quote from Exhibit 5.7 for the British pound on Wednesday, April 3 is S($/) = 1.3158. The corresponding European quote is S(T$) = .7600. When the context is clear as to what terms the quotation is in, the less cumbersome S will be used to denote the spot rate. It should be intuitive that the American and European term quotes are reciprocals of one another. That is, (5.1) 1 S($/) S(/$) 1 1.3158 = .7600