Question

The Employee Provident Fund, the Malaysia national compulsory saving scheme for individuals employed in the Malaysian private sector. The EPF is publicly managed and financed

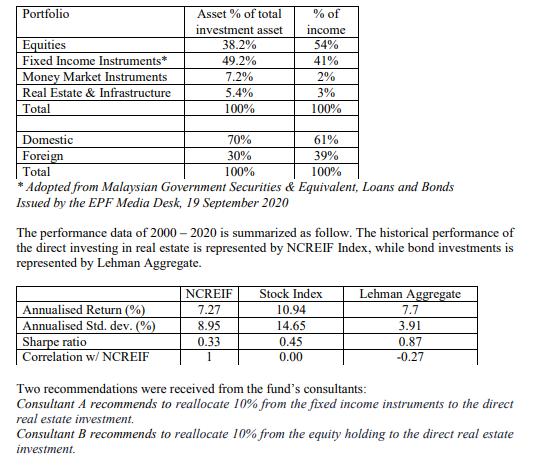

The Employee Provident Fund, the Malaysia national compulsory saving scheme for individuals employed in the Malaysian private sector. The EPF is publicly managed and financed through contributions amounting to 23% of the employees' payroll. Currently MYR 7.0 billion, representing 2.5% of the total assets, are invested in global equities or are allocated for investment in overseas equities. The decision concerning a global bond mandate is still pending. EPF assets are managed in-house as well as by approved external portfolio managers. Two additional foreign fund manager licenses are expected to be awarded in near future. These fund managers will be mandated to invest the remaining balance allocated to equities. EPF is planning to outsource MYR 2 billion to external portfolio managers with MYR 1 billion allocated to equity and bond managers respectively. The fund recorded a gross investment income of RM15.12 billion for the second quarter ended 30 June 2020. Equities, which contributed 54% to total gross income, registered RM8.11 billion. Fixed Income instruments contributed RM6.17 billion while real estate and infrastructure, as well as Money Market instruments, contributed RM0.47 billion and RM0.37 billion respectively. Chief EPF Officer Alizakri Alias said, “The EPF’s Strategic Asset Allocation framework, that guides us in how we structure our investments and portfolio, served us well during the tumultuous first half of the year. For example, our exposure in Fixed Income instruments enabled us to ride out the initial slump at the beginning of the quarter. We then saw an upward movement in equities towards the end of the quarter when both the FBM KLCI and the global markets started to improve as economies gradually but cautiously reopened. Moving forward, we remain cautious as a second COVID-19 wave remains a possibility which will have a major negative multiplier impact on the already weak economic conditions faced by many countries which have yet to come out of the first wave.” EPF’s Strategic Asset Allocation (SAA) allocates 51% to Fixed Income instruments, 36% to Equities, 10% to Real Estate and Infrastructure and 3% to Money Market instruments as a framework to optimise its long term returns within tolerable risk limits. The EPF’s overseas diversification strategy guided by the SAA has helped add value to its overall performance. As at end-June 2020, the EPF’s investment assets stood at RM929.64 billion, of which 30% was invested in overseas investments. As of the second quarter of the year 2020, 39% of the total gross investment income recorded was contributed by the EPF’s overseas investments.

(a) Which asset allocation strategy is employed by Employee Provident Fund? Discuss the steps in implementing this strategy. (10 marks)

(b) Calculate the return on investment (ROI): (i) equities, (ii) fixed income, (iii) money market, (iv) real estate and infrastructure. (v) domestic investments and (vi) foreign investments. (10 marks)

(c) Critically assess the effectiveness of Strategic Asset Allocation strategy employed by Employee Provident Fund, with reference to the attributes of all the asset classes, namely equities, fixed income, money market and real estate. (20 marks)

(d) Critically assess the recommendation suggested by: (i) consultant A and (ii) consultant B.

You are required to refer to (i) risk, (ii) return, (iii) liquidity and (iv) diversification of the two asset classes to which the two consultants are referring.

Portfolio Equities Fixed Income Instruments* Money Market Instruments Real Estate & Infrastructure Total Domestic Foreign Total Asset % of total investment asset 61% 39% 100% *Adopted from Malaysian Government Securities & Equivalent, Loans and Bonds Issued by the EPF Media Desk, 19 September 2020 Annualised Return (%) Annualised Std. dev. (%) 38.2% 49.2% 7.2% 5.4% 100% Sharpe ratio Correlation w/ NCREIF The performance data of 2000-2020 is summarized as follow. The historical performance of the direct investing in real estate is represented by NCREIF Index, while bond investments is represented by Lehman Aggregate. 70% 30% 100% 8.95 0.33 % of income 54% 41% 2% 3% 100% NCREIF Stock Index 7.27 10.94 14.65 0.45 0.00 Lehman Aggregate 7.7 3.91 0.87 -0.27 Two recommendations were received from the fund s consultants: Consultant A recommends to reallocate 10% from the fixed income instruments to the direct real estate investment. Consultant B recommends to reallocate 10% from the equity holding to the direct real estate investment.

Step by Step Solution

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a The Employee Provident Fund employs a strategic asset allocation strategy wherein 51 of the assets are allocated to fixed income instruments 36 to equities 10 to real estate and infrastructure and 3 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started