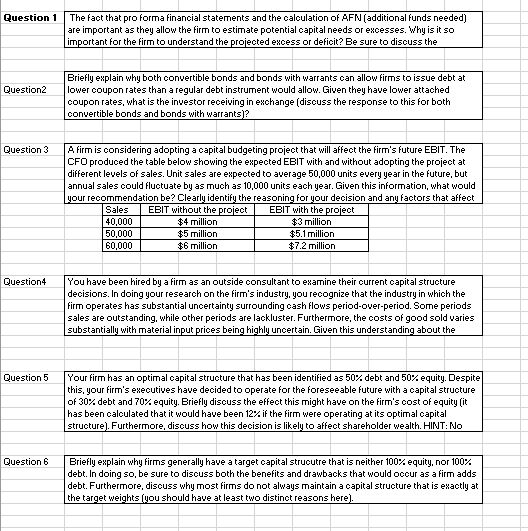

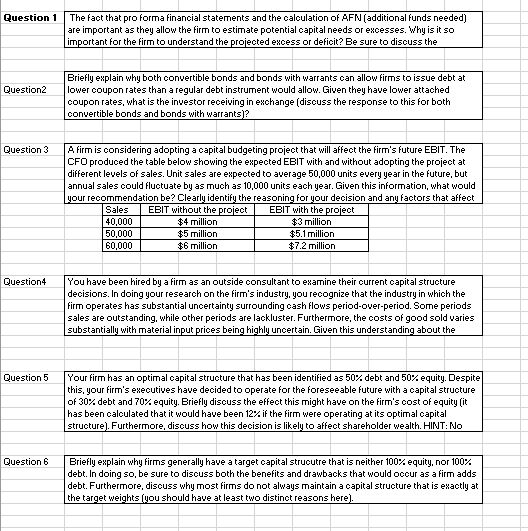

Question 1 The fact that pro forma financial statements and the calculation of AFN (additional funds needed) are important as they allow the firm to estimate potential capital needs or excesses. Why is it so important for the firm to understand the projected excess or deficit? Be sure to discuss the Question2 Briefly explain why both convertible bonds and bonds with warrants can allow firms to issue debt at lower coupon rates than a regular debt instrument would allow. Given they have lower attached coupon rates, what is the investor receiving in exchange (discuss the response to this for both convertible bonds and bonds with warrants)? Question 3 A firm is considering adopting a capital budgeting project that will affect the firm's future EBIT. The CFO produced the table below showing the expected EBIT with and without adopting the project at different levels of sales. Unit sales are expected to average 50,000 units every year in the future, but annual sales could fluctuate by as much as 10,000 units each year. Given this information, what would your recommendation be? Clearly identify the reasoning for your decision and any factors that affect Sales EBIT without the project EBIT with the project 40,000 $4 million $3 million 50,000 $5 million $5.1 million 60,000 $6 million $7.2 million Question4 You have been hired by a firm as an outside consultant to examine their current capital structure decisions. In doing your research on the firm's industry. you recognize that the industry in which the firm operates has substantial uncertainty surrounding cash flows period-over-period. Some periods sales are outstanding, while other periods are lackluster. Furthermore, the costs of good sold varies substantially with material input prices being highly uncertain. Given this understanding about the Question 5 Your firm has an optimal capital structure that has been identified as 50% debt and 50% equity. Despite this, your firm's executives have decided to operate for the foreseeable future with a capital structure of 30% debt and 70% equity. Briefly discuss the effect this might have on the firm's cost of equity (it has been calculated that it would have been 12% if the firm were operating at its optimal capital structure). Furthermore, discuss how this decision is likely to affect shareholder wealth. HINT: No Question 6 Briefly explain why firms generally have a target capital strucutre that is neither 100% equity, nor 100% debt. In doing so, be sure to discuss both the benefits and drawbacks that would occur as a firm adds debt. Furthermore, discuss why most firms do not always maintain a capital structure that is exactly at the target weights (you should have at least two distinct reasons here). Question 1 The fact that pro forma financial statements and the calculation of AFN (additional funds needed) are important as they allow the firm to estimate potential capital needs or excesses. Why is it so important for the firm to understand the projected excess or deficit? Be sure to discuss the Question2 Briefly explain why both convertible bonds and bonds with warrants can allow firms to issue debt at lower coupon rates than a regular debt instrument would allow. Given they have lower attached coupon rates, what is the investor receiving in exchange (discuss the response to this for both convertible bonds and bonds with warrants)? Question 3 A firm is considering adopting a capital budgeting project that will affect the firm's future EBIT. The CFO produced the table below showing the expected EBIT with and without adopting the project at different levels of sales. Unit sales are expected to average 50,000 units every year in the future, but annual sales could fluctuate by as much as 10,000 units each year. Given this information, what would your recommendation be? Clearly identify the reasoning for your decision and any factors that affect Sales EBIT without the project EBIT with the project 40,000 $4 million $3 million 50,000 $5 million $5.1 million 60,000 $6 million $7.2 million Question4 You have been hired by a firm as an outside consultant to examine their current capital structure decisions. In doing your research on the firm's industry. you recognize that the industry in which the firm operates has substantial uncertainty surrounding cash flows period-over-period. Some periods sales are outstanding, while other periods are lackluster. Furthermore, the costs of good sold varies substantially with material input prices being highly uncertain. Given this understanding about the Question 5 Your firm has an optimal capital structure that has been identified as 50% debt and 50% equity. Despite this, your firm's executives have decided to operate for the foreseeable future with a capital structure of 30% debt and 70% equity. Briefly discuss the effect this might have on the firm's cost of equity (it has been calculated that it would have been 12% if the firm were operating at its optimal capital structure). Furthermore, discuss how this decision is likely to affect shareholder wealth. HINT: No Question 6 Briefly explain why firms generally have a target capital strucutre that is neither 100% equity, nor 100% debt. In doing so, be sure to discuss both the benefits and drawbacks that would occur as a firm adds debt. Furthermore, discuss why most firms do not always maintain a capital structure that is exactly at the target weights (you should have at least two distinct reasons here)