Answered step by step

Verified Expert Solution

Question

1 Approved Answer

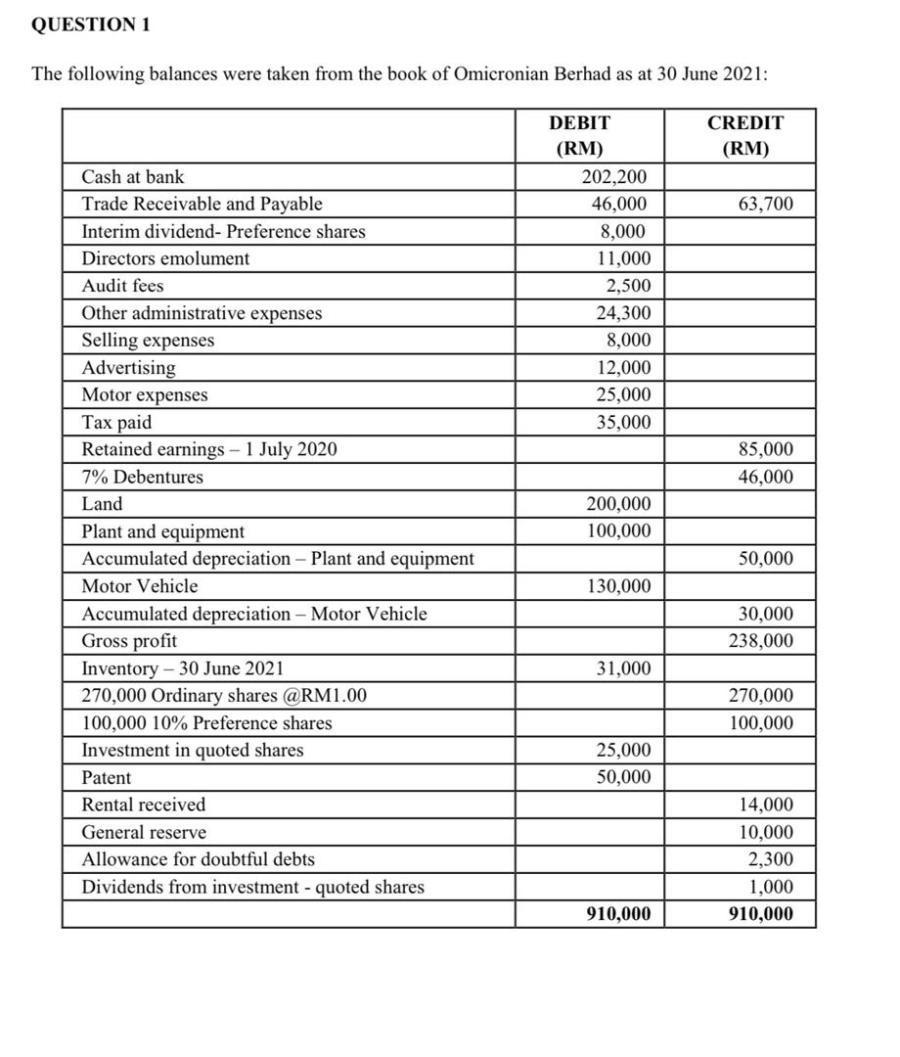

QUESTION 1 The following balances were taken from the book of Omicronian Berhad as at 30 June 2021: CREDIT (RM) Cash at bank Trade

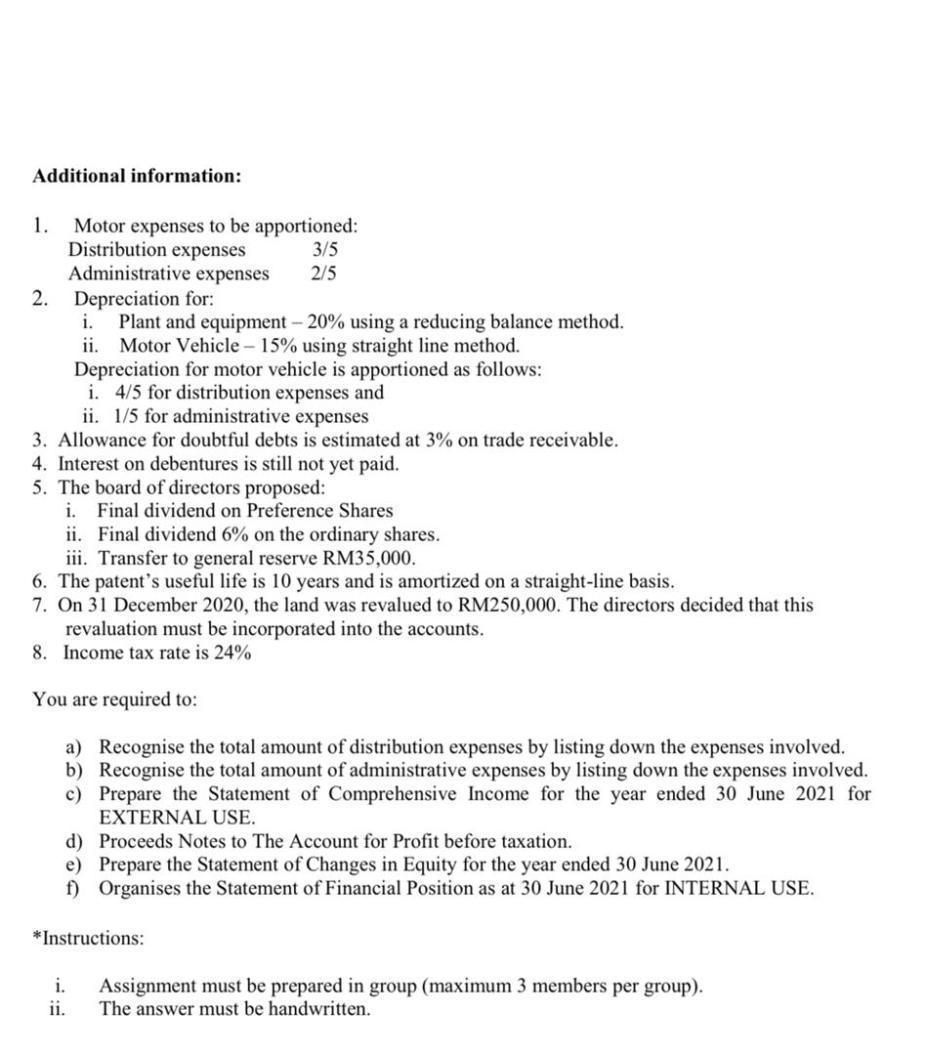

QUESTION 1 The following balances were taken from the book of Omicronian Berhad as at 30 June 2021: CREDIT (RM) Cash at bank Trade Receivable and Payable Interim dividend- Preference shares Directors emolument Audit fees Other administrative expenses Selling expenses Advertising Motor expenses Tax paid Retained earnings - 1 July 2020 7% Debentures Land Plant and equipment Accumulated depreciation - Plant and equipment Motor Vehicle Accumulated depreciation - Motor Vehicle Gross profit Inventory - 30 June 2021 270,000 Ordinary shares @RM1.00 100,000 10% Preference shares Investment in quoted shares Patent Rental received General reserve Allowance for doubtful debts Dividends from investment - quoted shares DEBIT (RM) 202,200 46,000 8,000 11,000 2,500 24,300 8,000 12,000 25,000 35,000 200,000 100,000 130,000 31,000 25,000 50,000 910,000 63,700 85,000 46,000 50,000 30,000 238,000 270,000 100,000 14,000 10,000 2,300 1,000 910,000 Additional information: 1. Motor expenses to be apportioned: Distribution expenses Administrative expenses Depreciation for: 2. 3/5 2/5 i. Plant and equipment - 20% using a reducing balance method. ii. Motor Vehicle -15% using straight line method. Depreciation for motor vehicle is apportioned as follows: i. 4/5 for distribution expenses and ii. 1/5 for administrative expenses 3. Allowance for doubtful debts is estimated at 3% on trade receivable. 4. Interest on debentures is still not yet paid. 5. The board of directors proposed: i. Final dividend on Preference Shares ii. Final dividend 6% on the ordinary shares. iii. Transfer to general reserve RM35,000. 6. The patent's useful life is 10 years and is amortized on a straight-line basis. 7. On 31 December 2020, the land was revalued to RM250,000. The directors decided that this revaluation must be incorporated into the accounts. 8. Income tax rate is 24% You are required to: a) Recognise the total amount of distribution expenses by listing down the expenses involved. b) Recognise the total amount of administrative expenses by listing down the expenses involved. c) Prepare the Statement of Comprehensive Income for the year ended 30 June 2021 for EXTERNAL USE. d) Proceeds Notes to The Account for Profit before taxation. e) Prepare the Statement of Changes in Equity for the year ended 30 June 2021. f) Organises the Statement of Financial Position as at 30 June 2021 for INTERNAL USE. *Instructions: i. ii. Assignment must be prepared in group (maximum 3 members per group). The answer must be handwritten.

Step by Step Solution

★★★★★

3.40 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

aThe distribution expenses for Omicronian Berhad are as follows 1 Motor expenses 4515000 12000 2 Depreciation for motor vehicle 4515000 12000 3 Distribution expenses 3524300 14580 4 Advertising 50000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started