Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 The following information relates to GC Company for the current year: table [ [ , Common,Special,Total ] , [ Units produced, 6

Question

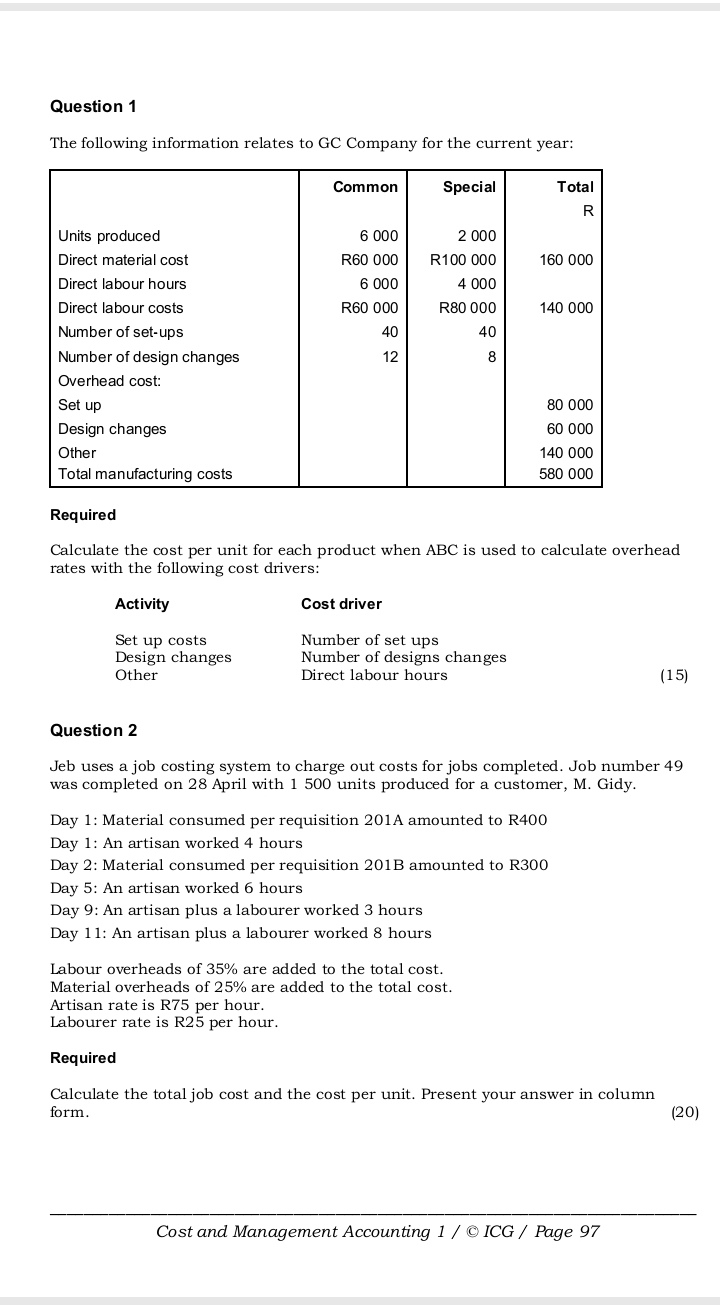

The following information relates to GC Company for the current year:

tableCommon,Special,TotalUnits produced,Direct material cost,RRDirect labour hours,Direct labour costs,RRNumber of setups,Number of design changes,Overhead cost:Set upDesign changes,,,OtherTotal manufacturing costs,,,

Required

Calculate the cost per unit for each product when ABC is used to calculate overhead rates with the following cost drivers:

tableActivityCost drivercostsNumber of set upsDesign changes,Number of designs changesOtherDirect labour hours

Question

Jeb uses a job costing system to charge out costs for jobs completed. Job number was completed on April with units produced for a customer, M Gidy.

Day : Material consumed per requisition A amounted to R

Day : An artisan worked hours

Day : Material consumed per requisition B amounted to R

Day : An artisan worked hours

Day : An artisan plus a labourer worked hours

Day : An artisan plus a labourer worked hours

Labour overheads of are added to the total cost.

Material overheads of are added to the total cost.

Artisan rate is R per hour.

Labourer rate is R per hour.

Required

Calculate the total job cost and the cost per unit. Present your answer in column form.

Cost and Management Accounting C ICG Page

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started