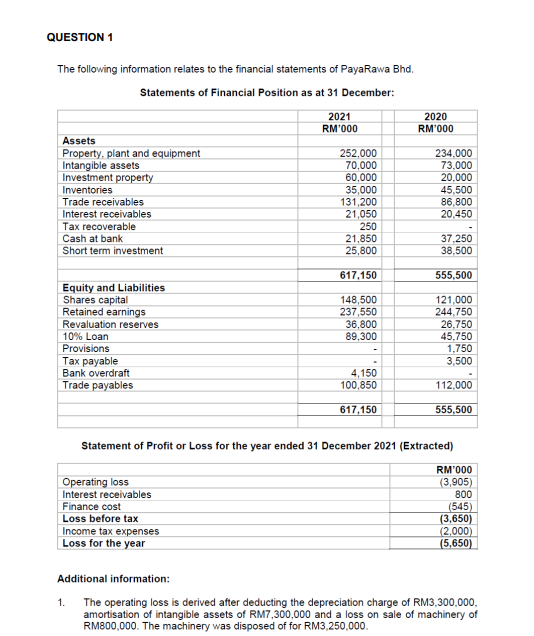

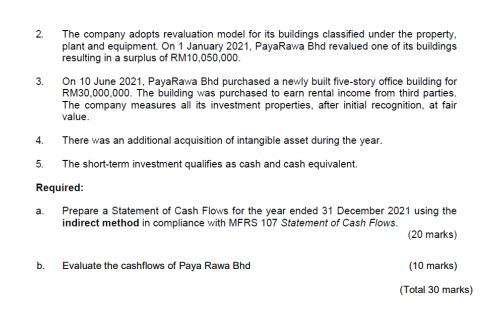

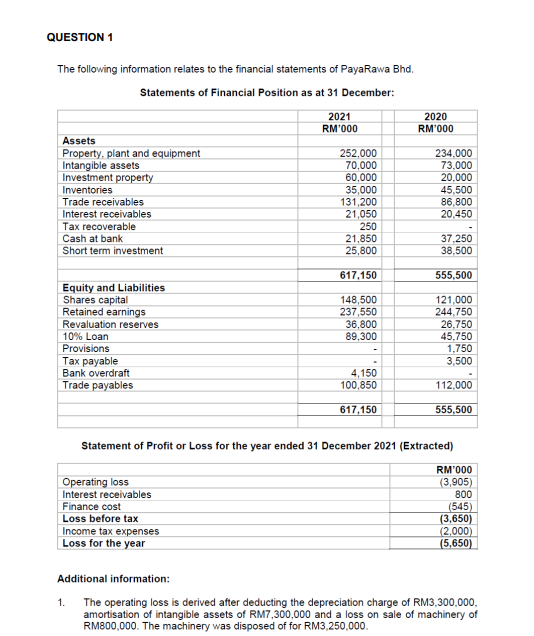

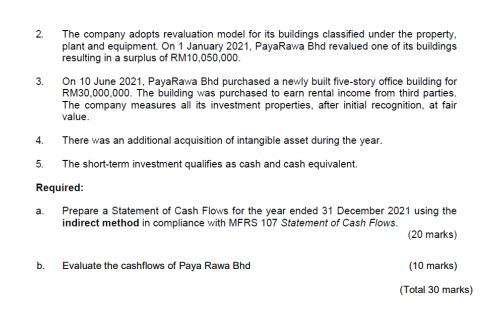

QUESTION 1 The following information relates to the financial statements of PayaRawa Bhd. Statements of Financial Position as at 31 December: Assets Property, plant and equipment Intangible assets Investment property Inventories Trade receivables Interest receivables Tax recoverable Cash at bank Short term investment Equity and Liabilities Shares capital Retained earnings Revaluation reserves 10% Loan Provisions Tax payable Bank overdraft Trade payables Operating loss Interest receivables Finance cost Loss before tax Income tax expenses Loss for the year 2021 RM'000 1. 252,000 70,000 60,000 35,000 131,200 21,050 250 21,850 25,800 617,150 148,500 237,550 36,800 89,300 4,150 100,850 617,150 2020 RM'000 234,000 73,000 20,000 45,500 86,800 20,450 37,250 38,500 555,500 121,000 244,750 26,750 45,750 1,750 3,500 112,000 Statement of Profit or Loss for the year ended 31 December 2021 (Extracted) 555,500 RM'000 (3,905) 800 (545) (3,650) (2,000) (5,650) Additional information: The operating loss is derived after deducting the depreciation charge of RM3,300,000, amortisation of intangible assets of RM7,300,000 and a loss on sale of machinery of RM800,000. The machinery was disposed of for RM3,250,000. 2. 3. 4. 5. There was an additional acquisition of intangible asset during the year. The short-term investment qualifies as cash and cash equivalent. Required: a. The company adopts revaluation model for its buildings classified under the property, plant and equipment. On 1 January 2021, PayaRawa Bhd revalued one of its buildings resulting in a surplus of RM10,050,000. b. On 10 June 2021, Paya Rawa Bhd purchased a newly built five-story office building for RM30,000,000. The building was purchased to earn rental income from third parties. The company measures all its investment properties, after initial recognition, at fair value. Prepare a Statement of Cash Flows for the year ended 31 December 2021 indirect method in compliance with MFRS 107 Statement of Cash Flows. using the (20 marks) Evaluate the cashflows of Paya Rawa Bhd (10 marks) (Total 30 marks) QUESTION 1 The following information relates to the financial statements of PayaRawa Bhd. Statements of Financial Position as at 31 December: Assets Property, plant and equipment Intangible assets Investment property Inventories Trade receivables Interest receivables Tax recoverable Cash at bank Short term investment Equity and Liabilities Shares capital Retained earnings Revaluation reserves 10% Loan Provisions Tax payable Bank overdraft Trade payables Operating loss Interest receivables Finance cost Loss before tax Income tax expenses Loss for the year 2021 RM'000 1. 252,000 70,000 60,000 35,000 131,200 21,050 250 21,850 25,800 617,150 148,500 237,550 36,800 89,300 4,150 100,850 617,150 2020 RM'000 234,000 73,000 20,000 45,500 86,800 20,450 37,250 38,500 555,500 121,000 244,750 26,750 45,750 1,750 3,500 112,000 Statement of Profit or Loss for the year ended 31 December 2021 (Extracted) 555,500 RM'000 (3,905) 800 (545) (3,650) (2,000) (5,650) Additional information: The operating loss is derived after deducting the depreciation charge of RM3,300,000, amortisation of intangible assets of RM7,300,000 and a loss on sale of machinery of RM800,000. The machinery was disposed of for RM3,250,000. 2. 3. 4. 5. There was an additional acquisition of intangible asset during the year. The short-term investment qualifies as cash and cash equivalent. Required: a. The company adopts revaluation model for its buildings classified under the property, plant and equipment. On 1 January 2021, PayaRawa Bhd revalued one of its buildings resulting in a surplus of RM10,050,000. b. On 10 June 2021, Paya Rawa Bhd purchased a newly built five-story office building for RM30,000,000. The building was purchased to earn rental income from third parties. The company measures all its investment properties, after initial recognition, at fair value. Prepare a Statement of Cash Flows for the year ended 31 December 2021 indirect method in compliance with MFRS 107 Statement of Cash Flows. using the (20 marks) Evaluate the cashflows of Paya Rawa Bhd (10 marks) (Total 30 marks)