Answered step by step

Verified Expert Solution

Question

1 Approved Answer

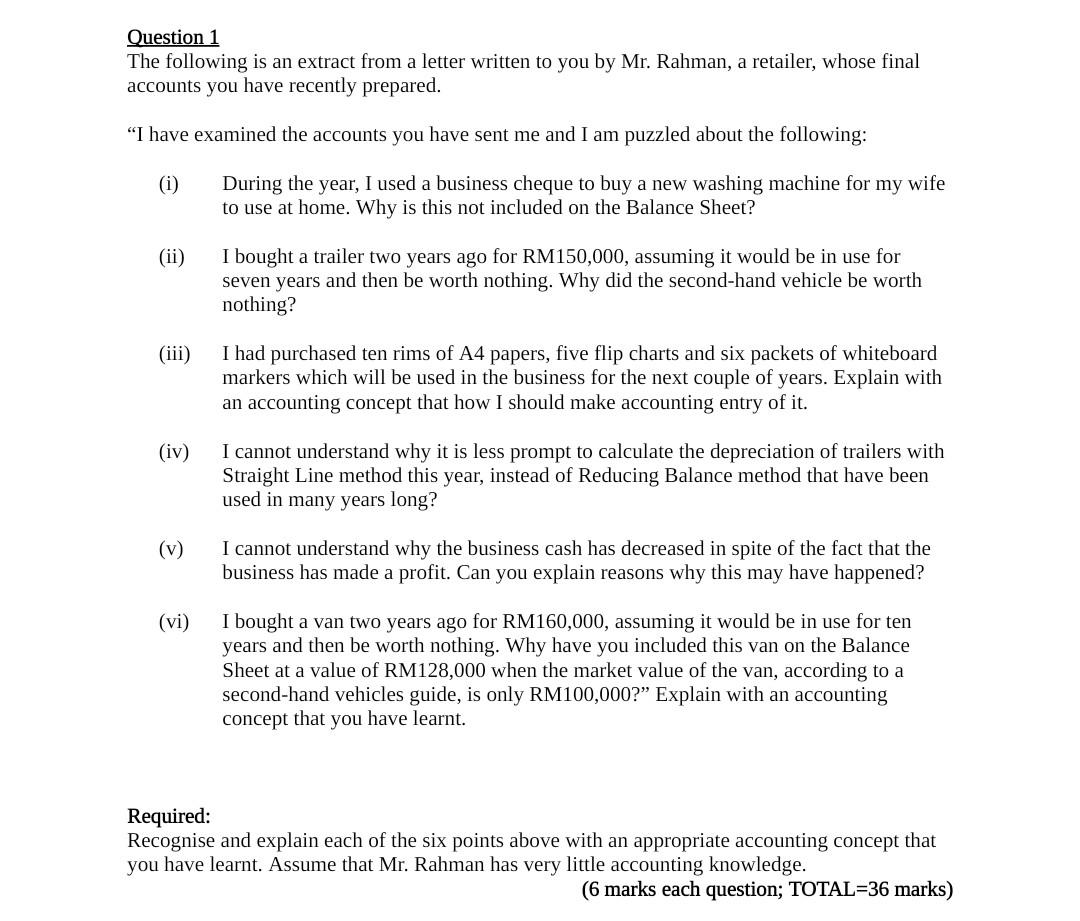

Question 1 The following is an extract from a letter written to you by Mr. Rahman, a retailer, whose final accounts you have recently prepared.

Question 1 The following is an extract from a letter written to you by Mr. Rahman, a retailer, whose final accounts you have recently prepared. "I have examined the accounts you have sent me and I am puzzled about the following: (i) During the year, I used a business cheque to buy a new washing machine for my wife to use at home. Why is this not included on the Balance Sheet? (ii) I bought a trailer two years ago for RM150,000, assuming it would be in use for seven years and then be worth nothing. Why did the second-hand vehicle be worth nothing? (iii) I had purchased ten rims of A4 papers, five flip charts and six packets of whiteboard markers which will be used in the business for the next couple of years. Explain with an accounting concept that how I should make accounting entry of it. (iv) I cannot understand why it is less prompt to calculate the depreciation of trailers with Straight Line method this year, instead of Reducing Balance method that have been used in many years long? I cannot understand why the business cash has decreased in spite of the fact that the business has made a profit. Can you explain reasons why this may have happened? (v) (vi) I bought a van two years ago for RM160,000, assuming it would be in use for ten years and then be worth nothing. Why have you included this van on the Balance Sheet at a value of RM128,000 when the market value of the van, according to a second-hand vehicles guide, is only RM100,000? Explain with an accounting concept that you have learnt. Required: Recognise and explain each of the six points above with an appropriate accounting concept that you have learnt. Assume that Mr. Rahman has very little accounting knowledge. (6 marks each question; TOTAL=36 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started