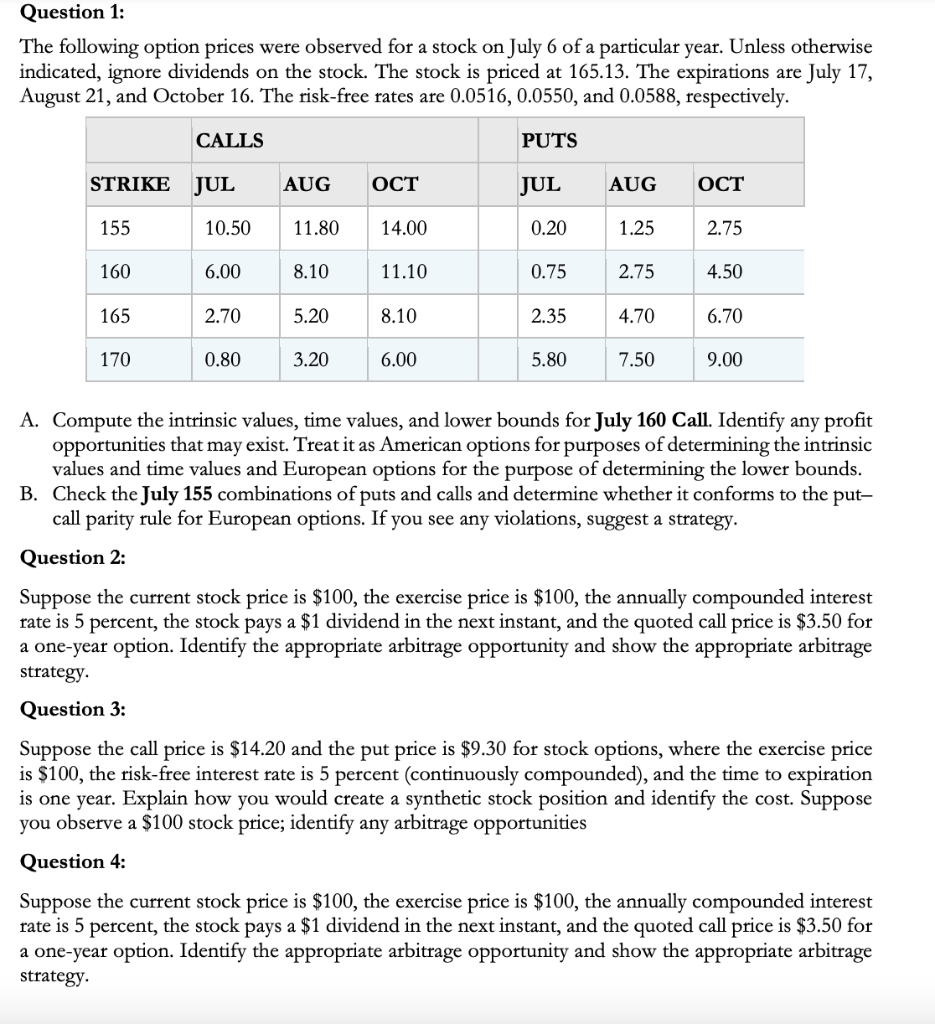

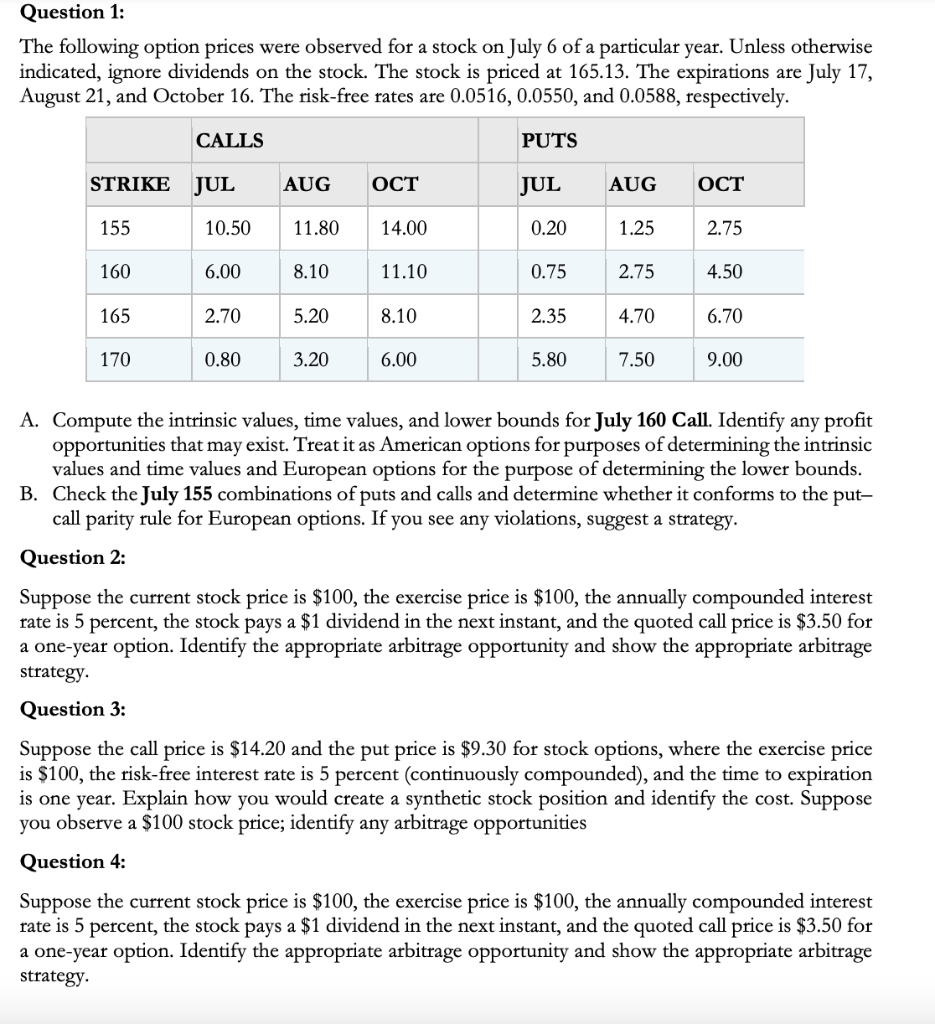

Question 1: The following option prices were observed for a stock on July 6 of a particular year. Unless otherwise indicated, ignore dividends on the stock. The stock is priced at 165.13. The expirations are July 17, August 21, and October 16. The risk-free rates are 0.0516, 0.0550, and 0.0588, respectively. CALLS PUTS STRIKE JUL AUG OCT JUL AUG OCT 155 10.50 11.80 14.00 0.20 1.25 2.75 160 6.00 8.10 11.10 0.75 2.75 4.50 165 2.70 5.20 8.10 2.35 4.70 6.70 170 0.80 3.20 6.00 5.80 7.50 9.00 A. Compute the intrinsic values, time values, and lower bounds for July 160 Call. Identify any profit opportunities that may exist. Treat it as American options for purposes of determining the intrinsic values and time values and European options for the purpose of determining the lower bounds. B. Check the July 155 combinations of puts and calls and determine whether it conforms to the put- call parity rule for European options. If you see any violations, suggest a strategy. Question 2: Suppose the current stock price is $100, the exercise price is $100, the annually compounded interest rate is 5 percent, the stock pays a $1 dividend in the next instant, and the quoted call price is $3.50 for a one-year option. Identify the appropriate arbitrage opportunity and show the appropriate arbitrage strategy Question 3: Suppose the call price is $14.20 and the put price is $9.30 for stock options, where the exercise price is $100, the risk-free interest rate is 5 percent (continuously compounded), and the time to expiration is one year. Explain how you would create a synthetic stock position and identify the cost. Suppose you observe a $100 stock price; identify any arbitrage opportunities Question 4: Suppose the current stock price is $100, the exercise price is $100, the annually compounded interest rate is 5 percent, the stock pays a $1 dividend in the next instant, and the quoted call price is $3.50 for a one-year option. Identify the appropriate arbitrage opportunity and show the appropriate arbitrage strategy Question 1: The following option prices were observed for a stock on July 6 of a particular year. Unless otherwise indicated, ignore dividends on the stock. The stock is priced at 165.13. The expirations are July 17, August 21, and October 16. The risk-free rates are 0.0516, 0.0550, and 0.0588, respectively. CALLS PUTS STRIKE JUL AUG OCT JUL AUG OCT 155 10.50 11.80 14.00 0.20 1.25 2.75 160 6.00 8.10 11.10 0.75 2.75 4.50 165 2.70 5.20 8.10 2.35 4.70 6.70 170 0.80 3.20 6.00 5.80 7.50 9.00 A. Compute the intrinsic values, time values, and lower bounds for July 160 Call. Identify any profit opportunities that may exist. Treat it as American options for purposes of determining the intrinsic values and time values and European options for the purpose of determining the lower bounds. B. Check the July 155 combinations of puts and calls and determine whether it conforms to the put- call parity rule for European options. If you see any violations, suggest a strategy. Question 2: Suppose the current stock price is $100, the exercise price is $100, the annually compounded interest rate is 5 percent, the stock pays a $1 dividend in the next instant, and the quoted call price is $3.50 for a one-year option. Identify the appropriate arbitrage opportunity and show the appropriate arbitrage strategy Question 3: Suppose the call price is $14.20 and the put price is $9.30 for stock options, where the exercise price is $100, the risk-free interest rate is 5 percent (continuously compounded), and the time to expiration is one year. Explain how you would create a synthetic stock position and identify the cost. Suppose you observe a $100 stock price; identify any arbitrage opportunities Question 4: Suppose the current stock price is $100, the exercise price is $100, the annually compounded interest rate is 5 percent, the stock pays a $1 dividend in the next instant, and the quoted call price is $3.50 for a one-year option. Identify the appropriate arbitrage opportunity and show the appropriate arbitrage strategy