Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 The following timeline depicts the homes Nicolas Laberge owned over the course of his life. Required: Show how the principal residence exemption

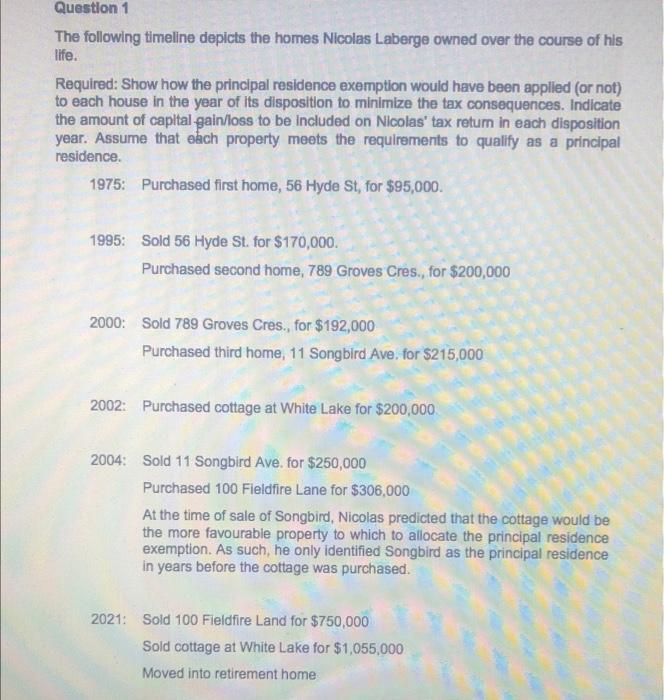

Question 1 The following timeline depicts the homes Nicolas Laberge owned over the course of his life. Required: Show how the principal residence exemption would have been applied (or not) to each house in the year of its disposition to minimize the tax consequences. Indicate the amount of capital gain/loss to be included on Nicolas' tax return in each disposition year. Assume that each property meets the requirements to qualify as a principal residence. 1975: Purchased first home, 56 Hyde St, for $95,000. 1995: Sold 56 Hyde St. for $170,000. Purchased second home, 789 Groves Cres., for $200,000 2000: Sold 789 Groves Cres., for $192,000 Purchased third home, 11 Songbird Ave. for $215,000 2002: Purchased cottage at White Lake for $200,000 2004: Sold 11 Songbird Ave. for $250,000 Purchased 100 Fieldfire Lane for $306,000 At the time of sale of Songbird, Nicolas predicted that the cottage would be the more favourable property to which to allocate the principal residence exemption. As such, he only identified Songbird as the principal residence in years before the cottage was purchased. 2021: Sold 100 Fieldfire Land for $750,000 Sold cottage at White Lake for $1,055,000 Moved into retirement home

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

The principal residence exemption would have been applied to the first home 56 Hyde St in the year o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started