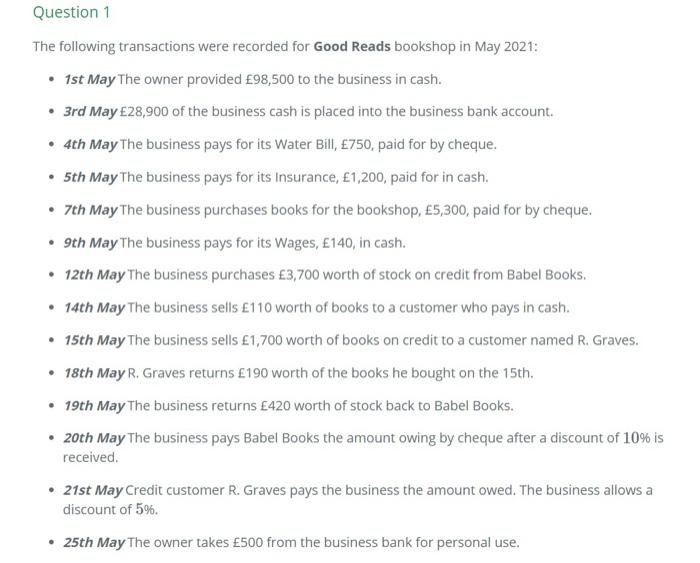

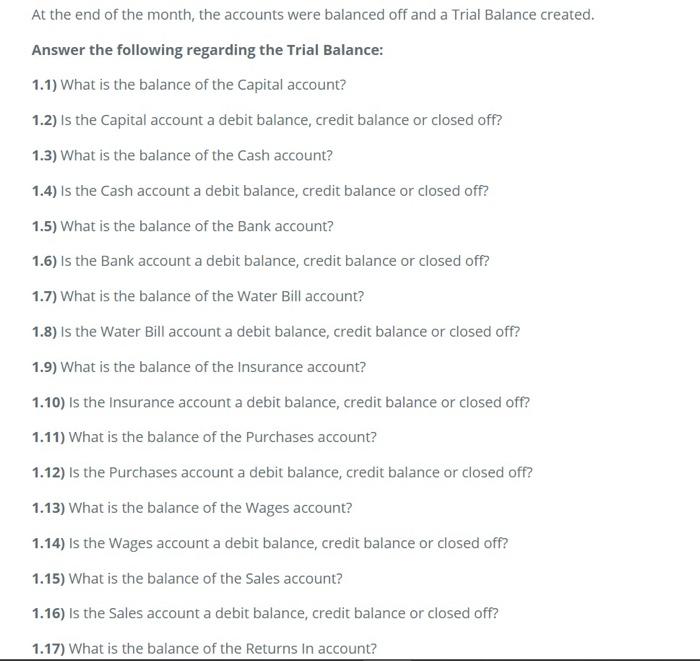

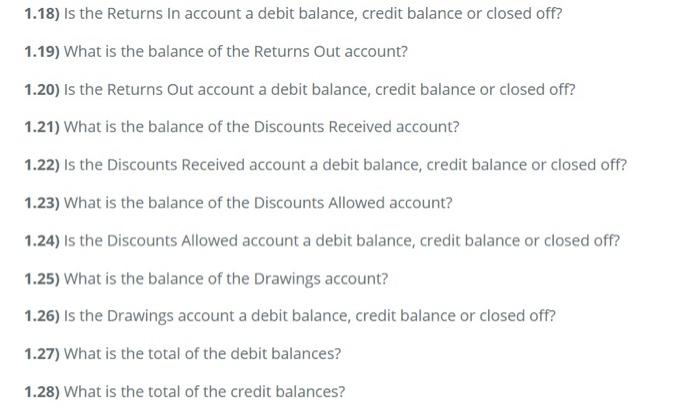

Question 1 The following transactions were recorded for Good Reads bookshop in May 2021: 1st May The owner provided 98,500 to the business in cash. 3rd May 28,900 of the business cash is placed into the business bank account. 4th May The business pays for its Water Bill, 750, paid for by cheque. 5th May The business pays for its Insurance, 1,200, paid for in cash. 7th May The business purchases books for the bookshop, 5,300, paid for by cheque. 9th May The business pays for its Wages, 140, in cash. 12th May The business purchases 3,700 worth of stock on credit from Babel Books. 14th May The business sells 110 worth of books to a customer who pays in cash. 15th May The business sells 1,700 worth of books on credit to a customer named R. Graves. 18th May R. Graves returns 190 worth of the books he bought on the 15th. 19th May The business returns 420 worth of stock back to Babel Books. 20th May The business pays Babel Books the amount owing by cheque after a discount of 10% is received 21st May Credit customer R. Graves pays the business the amount owed. The business allows a discount of 5%. 25th May The owner takes 500 from the business bank for personal use. At the end of the month, the accounts were balanced off and a Trial Balance created. Answer the following regarding the Trial Balance: 1.1) What is the balance of the Capital account? 1.2) Is the Capital account a debit balance, credit balance or closed off? 1.3) What is the balance of the Cash account? 1.4) is the Cash account a debit balance, credit balance or closed off? 1.5) What is the balance of the Bank account? 1.6) Is the Bank account a debit balance, credit balance or closed off? 1.7) What is the balance of the Water Bill account? 1.8) Is the Water Bill account a debit balance, credit balance or closed off? 1.9) What is the balance of the Insurance account? 1.10) Is the Insurance account a debit balance, credit balance or closed off? 1.11) What is the balance of the Purchases account? 1.12) Is the Purchases account a debit balance, credit balance or closed off? 1.13) What is the balance of the Wages account? 1.14) Is the Wages account a debit balance, credit balance or closed off? 1.15) What is the balance of the Sales account? 1.16) Is the Sales account a debit balance, credit balance or closed off? 1.17) What is the balance of the Returns In account? 1.18) is the Returns In account a debit balance, credit balance or closed off? 1.19) What is the balance of the Returns out account? 1.20) is the Returns out account a debit balance, credit balance or closed off? 1.21) What is the balance of the Discounts Received account? 1.22) Is the Discounts Received account a debit balance, credit balance or closed off? 1.23) What is the balance of the Discounts Allowed account? 1.24) Is the Discounts Allowed account a debit balance, credit balance or closed off? 1.25) What is the balance of the Drawings account? 1.26) Is the Drawings account a debit balance, credit balance or closed off? 1.27) What is the total of the debit balances? 1.28) What is the total of the credit balances