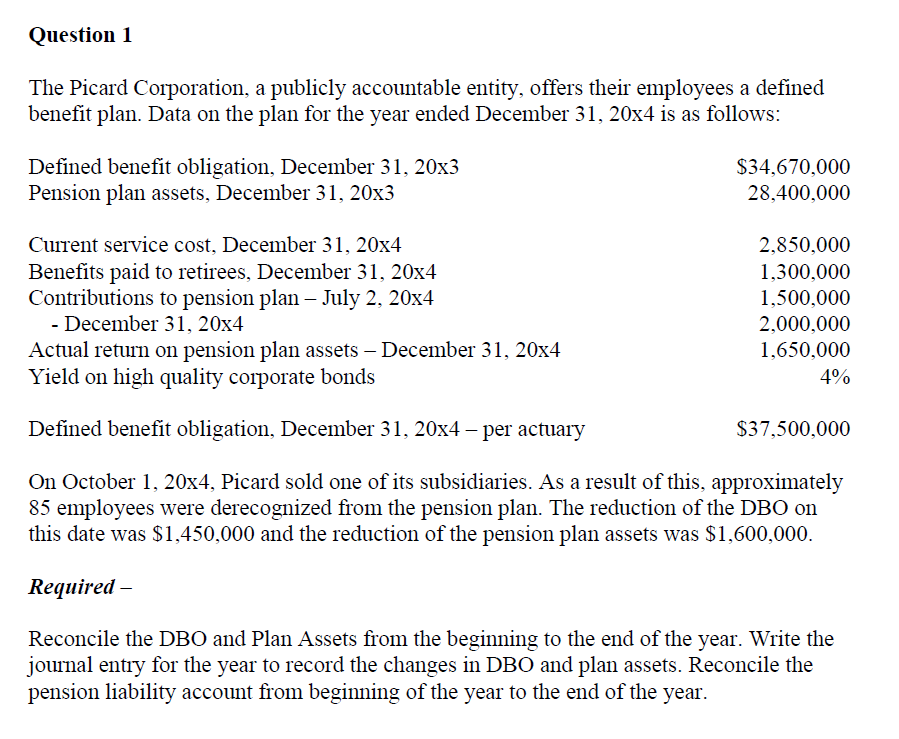

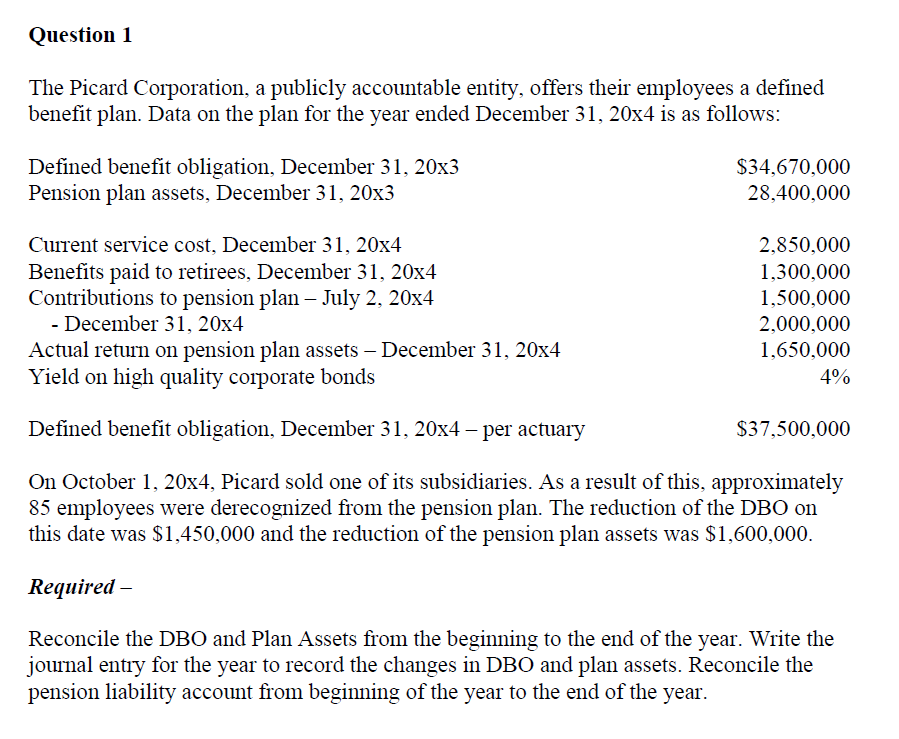

Question 1 The Picard Corporation, a publicly accountable entity, offers their employees a defined benefit plan. Data on the plan for the year ended December 31, 20x4 is as follows: Defined benefit obligation, December 31, 20x3 Pension plan assets, December 31, 20x3 $34,670,000 28,400,000 Current service cost, December 31, 20x4 2,850,000 Benefits paid to retirees, December 31, 20x4 Contributions to pension plan - July 2, 20x4 - December 31, 20x4 Actual return on pension plan assets December 31, 20x4 Yield on high quality corporate bonds 1,300,000 1,500,000 2,000,000 1,650,000 4% Defined benefit obligation, December 31, 20x4 - per actuary $37,500,000 On October 1, 20x4, Picard sold one of its subsidiaries. As a result of this, approximately 85 employees were derecognized from the pension plan. The reduction of the DBO on this date was $1,450,000 and the reduction of the pension plan assets was $1,600,000. Required - Reconcile the DBO and Plan Assets from the beginning to the end of the year. Write the journal entry for the year to record the changes in DBO and plan assets. Reconcile the pension liability account from beginning of the year to the end of the year Question 1 The Picard Corporation, a publicly accountable entity, offers their employees a defined benefit plan. Data on the plan for the year ended December 31, 20x4 is as follows: Defined benefit obligation, December 31, 20x3 Pension plan assets, December 31, 20x3 $34,670,000 28,400,000 Current service cost, December 31, 20x4 2,850,000 Benefits paid to retirees, December 31, 20x4 Contributions to pension plan - July 2, 20x4 - December 31, 20x4 Actual return on pension plan assets December 31, 20x4 Yield on high quality corporate bonds 1,300,000 1,500,000 2,000,000 1,650,000 4% Defined benefit obligation, December 31, 20x4 - per actuary $37,500,000 On October 1, 20x4, Picard sold one of its subsidiaries. As a result of this, approximately 85 employees were derecognized from the pension plan. The reduction of the DBO on this date was $1,450,000 and the reduction of the pension plan assets was $1,600,000. Required - Reconcile the DBO and Plan Assets from the beginning to the end of the year. Write the journal entry for the year to record the changes in DBO and plan assets. Reconcile the pension liability account from beginning of the year to the end of the year