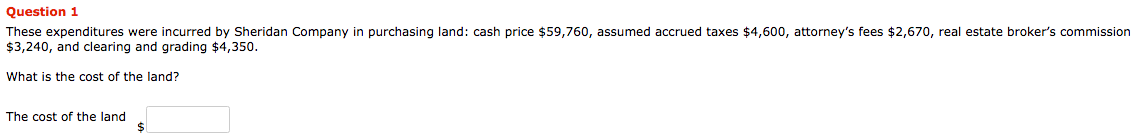

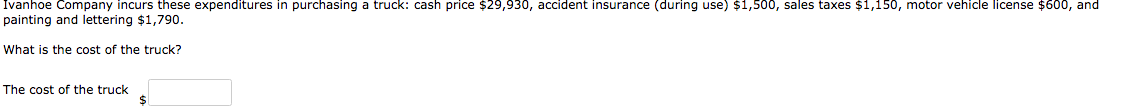

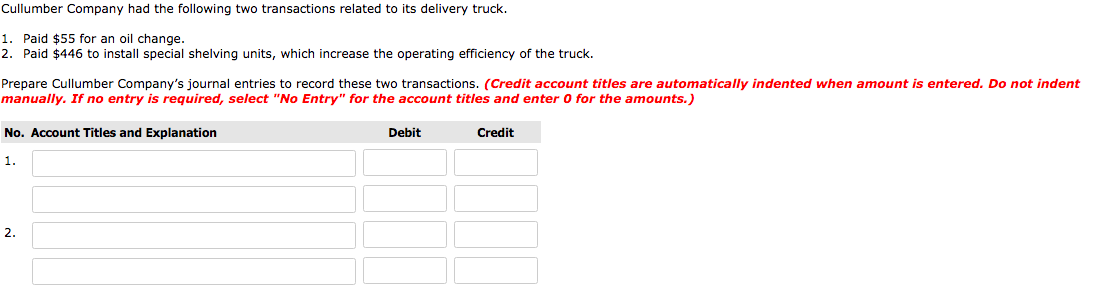

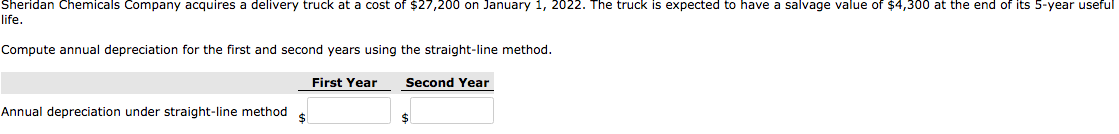

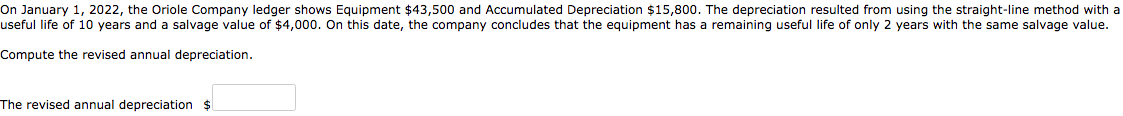

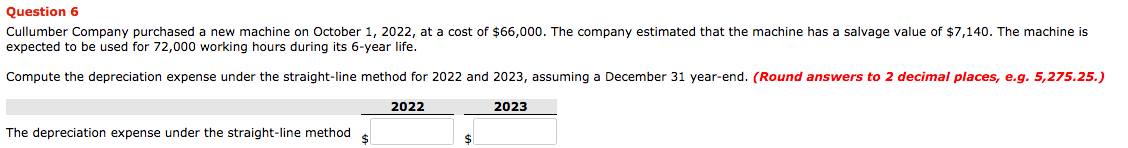

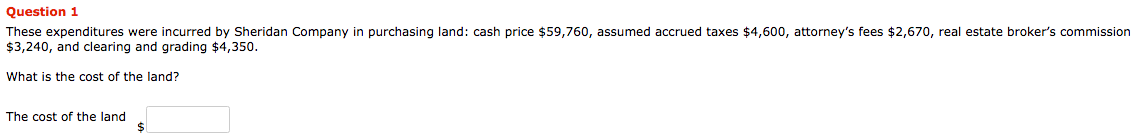

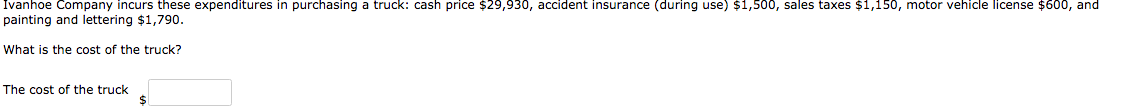

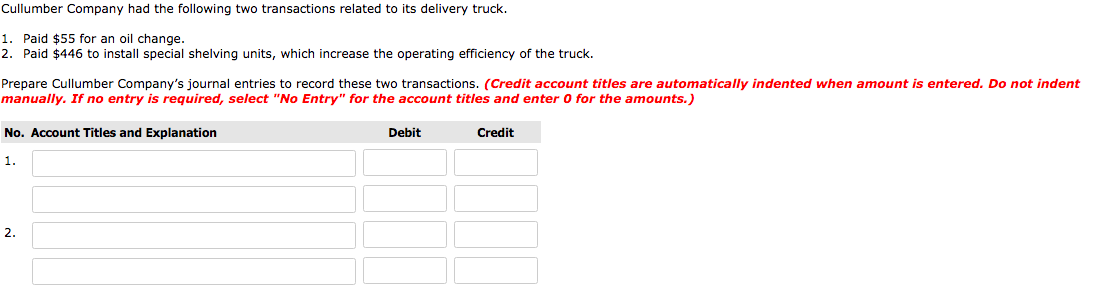

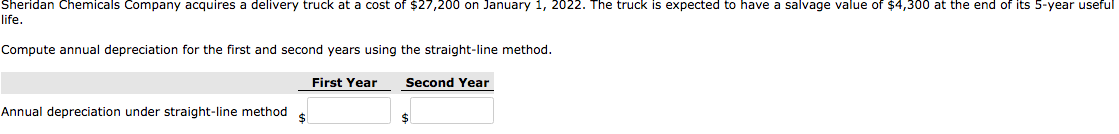

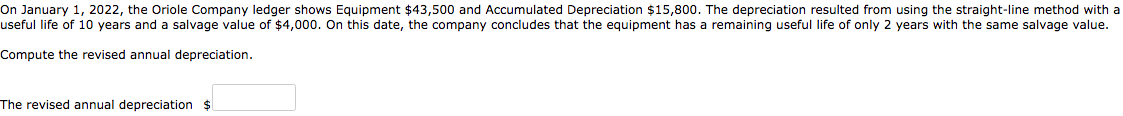

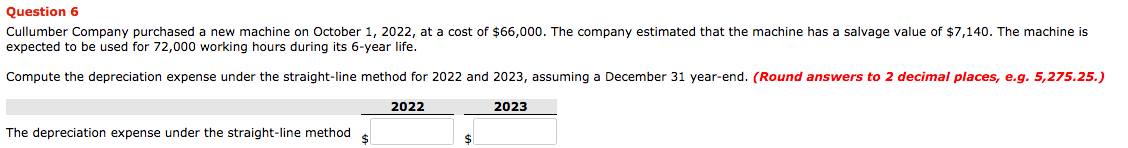

Question 1 These expenditures were incurred by Sheridan Company in purchasing land: cash price $59,760, assumed accrued taxes $4,600, attorney's fees $2,670, real estate broker's commission $3,240, and clearing and grading $4,350. What is the cost of the land? The cost of the land Ivanhoe Company incurs these expenditures in purchasing a truck: cash price $29,930, accident insurance (during use) $1,500, sales taxes $1,150, motor vehicle license $600, and painting and lettering $1,790. What is the cost of the truck? The cost of the truck Cullumber Company had the following two transactions related to its delivery truck. 1. Paid $55 for an oil change. 2. Paid $446 to install special shelving units, which increase the operating efficiency of the truck. Prepare Cullumber Company's journal entries to record these two transactions. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) No. Account Titles and Explanation Debit Credit 1. Sheridan Chemicals Company acquires a delivery truck at a cost of $27,200 on January 1, 2022. The truck is expected to have a salvage value of $4,300 at the end of its 5-year useful life. Compute annual depreciation for the first and second years using the straight-line method. First Year Second Year Annual depreciation under straight-line methods On January 1, 2022, the Oriole Company ledger shows Equipment $43,500 and Accumulated Depreciation $15,800. The depreciation resulted from using the straight-line method with a useful life of 10 years and a salvage value of $4,000. On this date, the company concludes that the equipment has a remaining useful life of only 2 years with the same salvage value. Compute the revised annual depreciation. The revised annual depreciation $ Question 6 Cullumber Company purchased a new machine on October 1, 2022, at a cost of $66,000. The company estimated that the machine has a salvage value of $7,140. The machine is expected to be used for 72,000 working hours during its 6-year life. Compute the depreciation expense under the straight-line method for 2022 and 2023, assuming a December 31 year-end. (Round answers to 2 decimal places, e.g. 5,275.25.) 2022 2023 The depreciation expense under the straight-line method