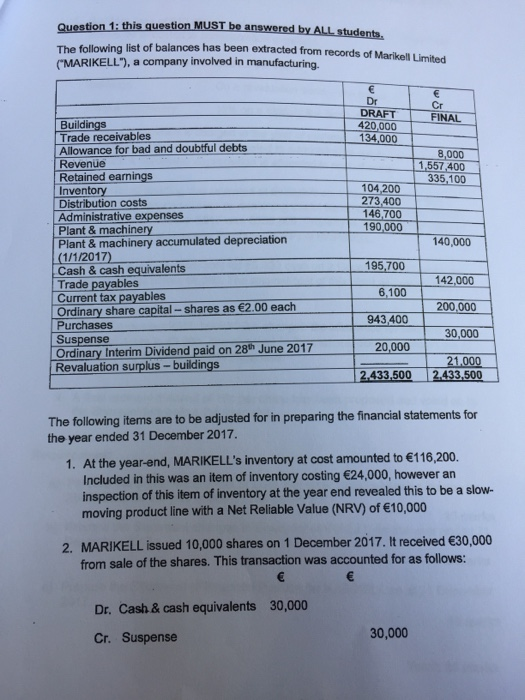

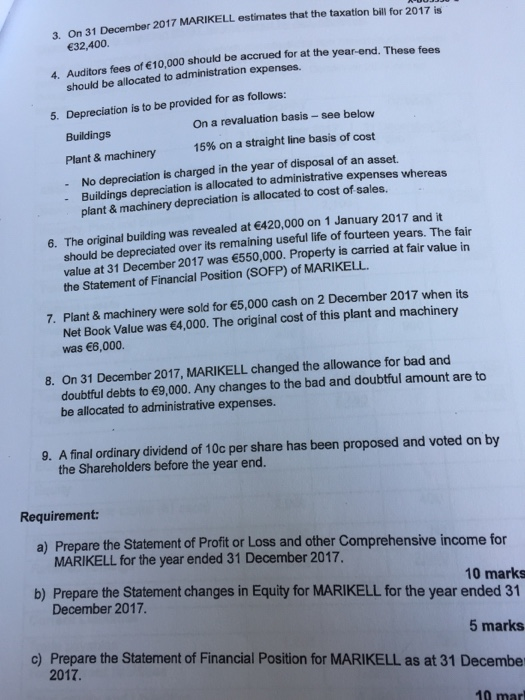

Question 1: this The following (MARIKELL"), a company involved in manufacturing ALL students list of balances has been extracted from records of Marikell Limited Dr DRAFT 420,000 Cr FINAL Buildings Trade receivables Allowance for bad and doubtful debts Revene Retained earnings Inventory Distribution costs Administrative expenses Plant& machinery Plant & machinery accumulated depreciation (1/1/2017) Cash & cash equivalents Trade payables Current tax payables Ordinary share capital-shares as 2.00 each 8,000 1.557 400 335,100 104,200 273,400 146,700 190,000 140,000 195,700 6,100 943 400 142,000 200,000 30,000 Purchases Suspense Ordinary Interim Dividend paid on 28 Revaluation surplus-buildings June 2017 oad en 79 9 2312090 oanion euase 20,000 2.433,500 2433,500 The following items are to be adjusted for in preparing the financial statements for the year ended 31 December 2017. 1. At the year-end, MARIKELL's inventory at cost amounted to 116,200. Included in this was an item of inventory costing 24,000, however an inspection of this item of inventory at the year end revealed this to be a slow- moving product line with a Net Reliable Value (NRV) of 10,000 2. MARIKELL issued 10,000 shares on 1 December 2017. It received 30,000 from sale of the shares. This transaction was accounted for as follows: Dr. Cash & cash equivalents 30,000 Cr. Suspense 30,000 2017 MARIKELL estimates that the taxation bill for 2017 is 3. On 31 December 32,400 be accrued for at the year-end. These fees 4. Auditors fees of 10,000 should should be allocated to administration expenses. 5. Depreciation is to be provided for as follows: On a revaluation basis - see below Buildings Plant & machinery - No depreciation is charged in the year of disposal of an asset 15% on a straight line basis of cost Buildings depreciation is allocated to administrative expenses whereas - plant & machinery depreciation is allocated to cost of sales. 6. The original building was revealed at 420,000 on 1 January 2017 and it should be depreciated over its remaining useful life of fourteen years. value at 31 December 2017 was 550,000. Property is carried at fair value in the Statement of Financial Position (SOFP) of MARIKELL. The fair 7. Plant & machinery were sold for 5,000 cash on 2 December 2017 when its Net Book Value was 4,000. The original cost of this plant and machinery was 6,000. 8. On 31 December 2017, MARIKELL changed the allowance for bad and doubtful debts to 9,000. Any changes to the bad and doubtful amount are to be allocated to administrative expenses. 9. A final ordinary dividend of 10c per share has been proposed and voted on by the Shareholders before the year eno. Requirement: a) Prepare the Statement of Profit or Loss and other Comprehensive income for MARIKELL for the year ended 31 December 2017. b) Prepare the Statement changes in Equity for MARIKELL for the year ended 31 10 marks December 2017. 5 marks c) Prepare the Statement of Financial Position for MARIKELL as at 31 Decembe 2017. Question 1: this The following (MARIKELL"), a company involved in manufacturing ALL students list of balances has been extracted from records of Marikell Limited Dr DRAFT 420,000 Cr FINAL Buildings Trade receivables Allowance for bad and doubtful debts Revene Retained earnings Inventory Distribution costs Administrative expenses Plant& machinery Plant & machinery accumulated depreciation (1/1/2017) Cash & cash equivalents Trade payables Current tax payables Ordinary share capital-shares as 2.00 each 8,000 1.557 400 335,100 104,200 273,400 146,700 190,000 140,000 195,700 6,100 943 400 142,000 200,000 30,000 Purchases Suspense Ordinary Interim Dividend paid on 28 Revaluation surplus-buildings June 2017 oad en 79 9 2312090 oanion euase 20,000 2.433,500 2433,500 The following items are to be adjusted for in preparing the financial statements for the year ended 31 December 2017. 1. At the year-end, MARIKELL's inventory at cost amounted to 116,200. Included in this was an item of inventory costing 24,000, however an inspection of this item of inventory at the year end revealed this to be a slow- moving product line with a Net Reliable Value (NRV) of 10,000 2. MARIKELL issued 10,000 shares on 1 December 2017. It received 30,000 from sale of the shares. This transaction was accounted for as follows: Dr. Cash & cash equivalents 30,000 Cr. Suspense 30,000 2017 MARIKELL estimates that the taxation bill for 2017 is 3. On 31 December 32,400 be accrued for at the year-end. These fees 4. Auditors fees of 10,000 should should be allocated to administration expenses. 5. Depreciation is to be provided for as follows: On a revaluation basis - see below Buildings Plant & machinery - No depreciation is charged in the year of disposal of an asset 15% on a straight line basis of cost Buildings depreciation is allocated to administrative expenses whereas - plant & machinery depreciation is allocated to cost of sales. 6. The original building was revealed at 420,000 on 1 January 2017 and it should be depreciated over its remaining useful life of fourteen years. value at 31 December 2017 was 550,000. Property is carried at fair value in the Statement of Financial Position (SOFP) of MARIKELL. The fair 7. Plant & machinery were sold for 5,000 cash on 2 December 2017 when its Net Book Value was 4,000. The original cost of this plant and machinery was 6,000. 8. On 31 December 2017, MARIKELL changed the allowance for bad and doubtful debts to 9,000. Any changes to the bad and doubtful amount are to be allocated to administrative expenses. 9. A final ordinary dividend of 10c per share has been proposed and voted on by the Shareholders before the year eno. Requirement: a) Prepare the Statement of Profit or Loss and other Comprehensive income for MARIKELL for the year ended 31 December 2017. b) Prepare the Statement changes in Equity for MARIKELL for the year ended 31 10 marks December 2017. 5 marks c) Prepare the Statement of Financial Position for MARIKELL as at 31 Decembe 2017