Answered step by step

Verified Expert Solution

Question

1 Approved Answer

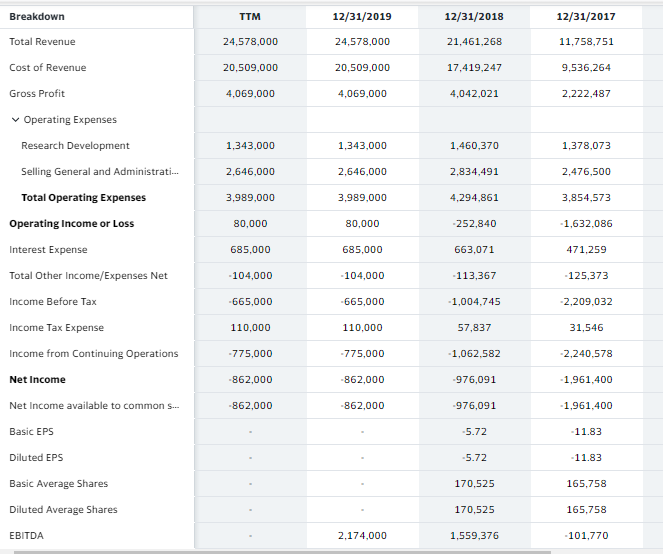

Can someone help me with a vertical analysis of Tesla's income statement? Here is their income statement: Thank you! Breakdown TTM 12/31/2019 12/31/2018 12/31/2017 Total

Can someone help me with a vertical analysis of Tesla's income statement?

Here is their income statement:

Thank you!

Breakdown TTM 12/31/2019 12/31/2018 12/31/2017 Total Revenue 24,578,000 24,578,000 21,461,268 11.758,751 Cost of Revenue 20,509,000 20,509,000 17,419,247 9,536,264 Gross Profit 4,069,000 4,069,000 4,042,021 2,222,487 Operating Expenses Research Development 1,343,000 1.343,000 1,460,370 1,378,073 Selling General and Administrati... 2,646,000 2,646,000 2,834,491 2,476,500 Total Operating Expenses 3.989,000 3,989,000 4,294,861 3,854,573 Operating Income or Loss 80,000 80,000 -252,840 -1,632,086 Interest Expense 685,000 685.000 663,071 471,259 Total Other Income/Expenses Net -104,000 -104,000 -113,367 -125,373 Income Before Tax -665,000 -665,000 1,004,745 -2,209,032 Income Tax Expense 110,000 110,000 57,837 31.546 Income from Continuing Operations -775,000 -775,000 -1,062.582 -2,240.578 Net Income -862,000 -862,000 -976,091 1,961,400 Net Income available to common s... -862,000 -862,000 -976,091 1,961,400 Basic EPS -5.72 11.83 Diluted EPS -5.72 11.83 Basic Average Shares 170,525 165,758 Diluted Average Shares 170,525 165,758 EBITDA 2,174,000 1,559,376 -101,770Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started