Question

QUESTION 1 Topic: an LP application in Portfolio selection(14 marks) A brokerage firm has been tasked with investing $650,000 for a new client with the

QUESTION 1Topic: an LP application in Portfolio selection(14 marks)

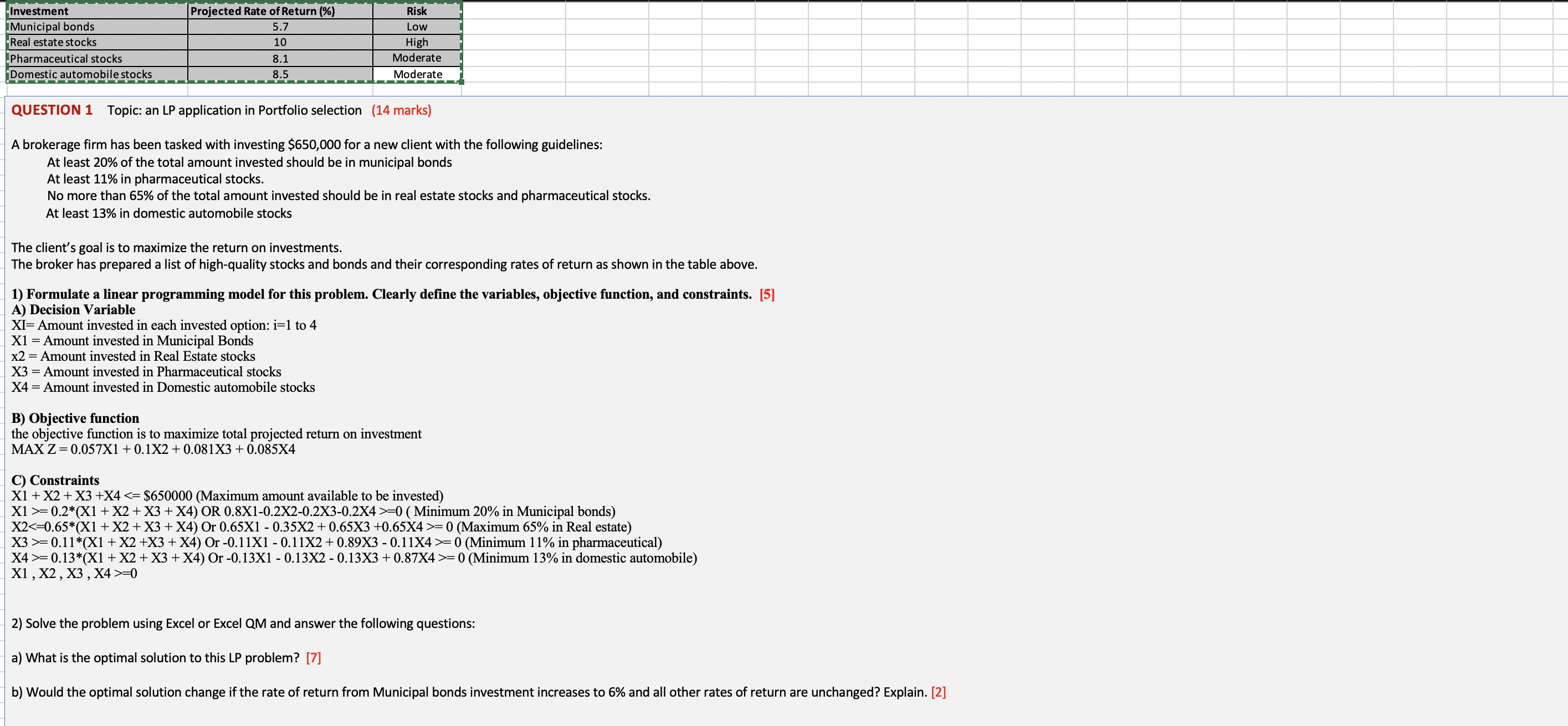

A brokerage firm has been tasked with investing $650,000 for a new client with the following guidelines:

At least 20% of the total amount invested should be in municipal bonds

At least 11% in pharmaceutical stocks.

No more than 65% of the total amount invested should be in real estate stocks and pharmaceutical stocks.

At least 13% in domestic automobile stocks

The client's goal is to maximize the return on investments.

The broker has prepared a list of high-quality stocks and bonds and their corresponding rates of returnas shown in the table above.

1) Formulate a linear programming model for this problem.Clearly definethe variables, objective function, and constraints.[5]

A) Decision Variable

XI= Amount invested in each invested option: i=1 to 4

X1 = Amount invested in Municipal Bonds

x2 = Amount invested in Real Estate stocks

X3 = Amount invested in Pharmaceutical stocks

X4 = Amount invested in Domestic automobile stocks

B) Objective function

the objective function is to maximize total projected return on investment

MAX Z = 0.057X1 + 0.1X2 + 0.081X3 + 0.085X4

C) Constraints

X1 + X2 + X3 +X4

X1 >= 0.2*(X1 + X2 + X3 + X4) OR 0.8X1-0.2X2-0.2X3-0.2X4 >=0 ( Minimum 20% in Municipal bonds)

X2= 0 (Maximum 65% in Real estate)

X3 >= 0.11*(X1 + X2 +X3 + X4) Or -0.11X1 - 0.11X2 + 0.89X3 - 0.11X4 >= 0 (Minimum 11% in pharmaceutical)

X4 >= 0.13*(X1 + X2 + X3 + X4) Or -0.13X1 - 0.13X2 - 0.13X3 + 0.87X4 >= 0 (Minimum 13% in domestic automobile)

X1 , X2 , X3 , X4 >=0

2) Solve the problem using Excel or Excel QM and answer the following questions:

a) What is the optimal solution to this LP problem?[7]

b) Would the optimal solution change if the rate of return from Municipal bonds investment increases to 6% and all other rates of return areunchanged?Explain.[2]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started