Answered step by step

Verified Expert Solution

Question

1 Approved Answer

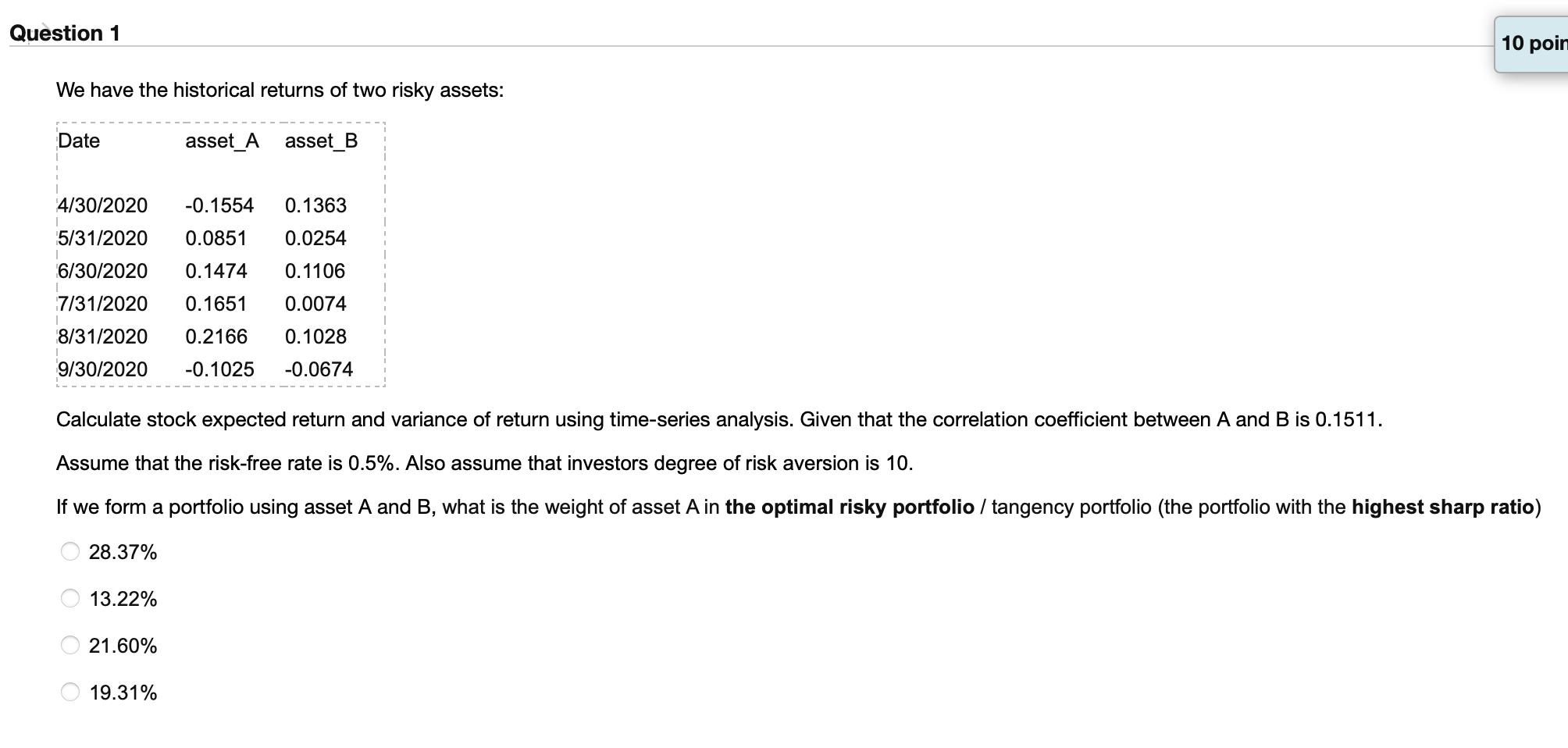

Question 1 We have the historical returns of two risky assets: asset_A asset_B Date 4/30/2020 -0.1554 0.1363 5/31/2020 0.0851 0.0254 6/30/2020 0.1474 0.1106 7/31/2020

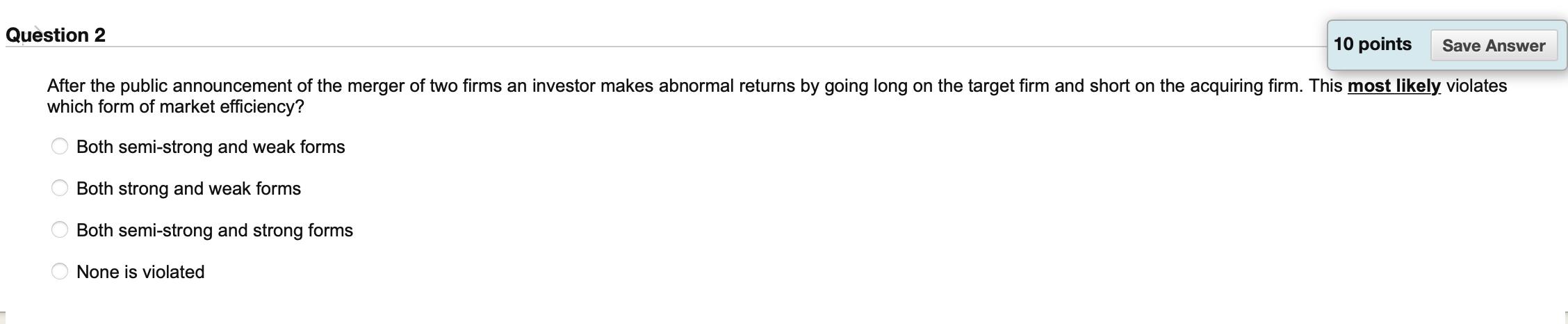

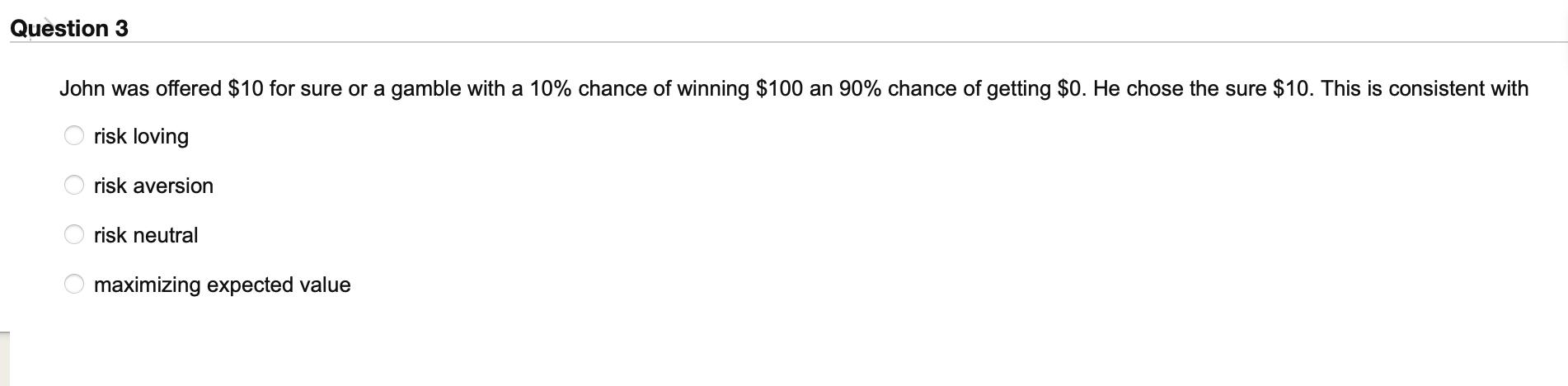

Question 1 We have the historical returns of two risky assets: asset_A asset_B Date 4/30/2020 -0.1554 0.1363 5/31/2020 0.0851 0.0254 6/30/2020 0.1474 0.1106 7/31/2020 0.1651 0.0074 8/31/2020 0.2166 0.1028 9/30/2020 -0.1025 -0.0674 Calculate stock expected return and variance of return using time-series analysis. Given that the correlation coefficient between A and B is 0.1511. Assume that the risk-free rate is 0.5%. Also assume that investors degree of risk aversion is 10. If we form a portfolio using asset A and B, what is the weight of asset A in the optimal risky portfolio / tangency portfolio (the portfolio with the highest sharp ratio) 28.37% 13.22% 21.60% 10 poin 19.31% Question 2 10 points Save Answer After the public announcement of the merger of two firms an investor makes abnormal returns by going long on the target firm and short on the acquiring firm. This most likely violates which form of market efficiency? Both semi-strong and weak forms Both strong and weak forms Both semi-strong and strong forms None is violated OOO O Question 3 John was offered $10 for sure or a gamble with a 10% chance of winning $100 an 90% chance of getting $0. He chose the sure $10. This is consistent with risk loving risk aversion risk neutral maximizing expected value

Step by Step Solution

★★★★★

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Question 1 Part 1 Stock Expected Return and Variance Expected Return Calculate the individual historical returns for each asset asset A and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started