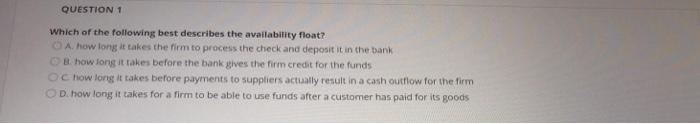

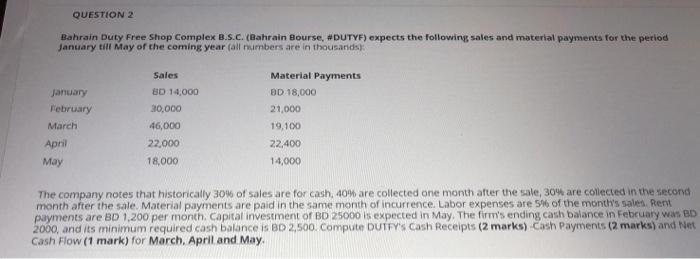

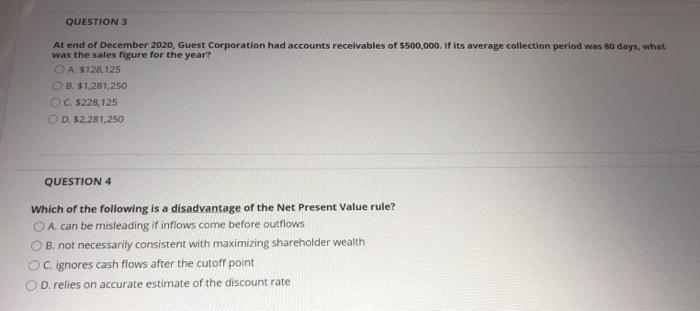

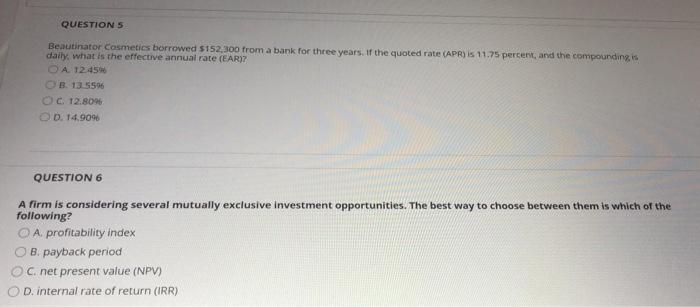

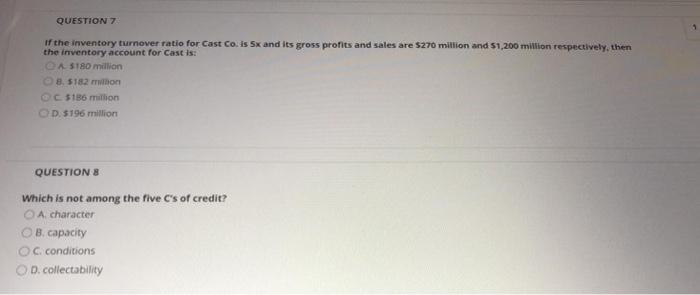

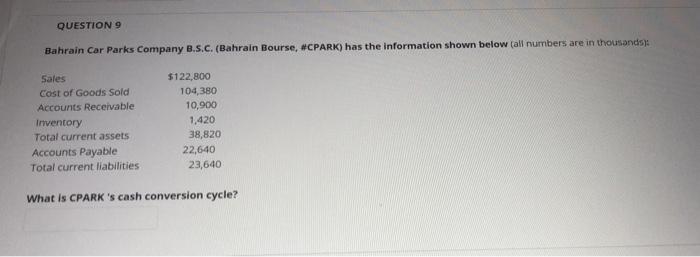

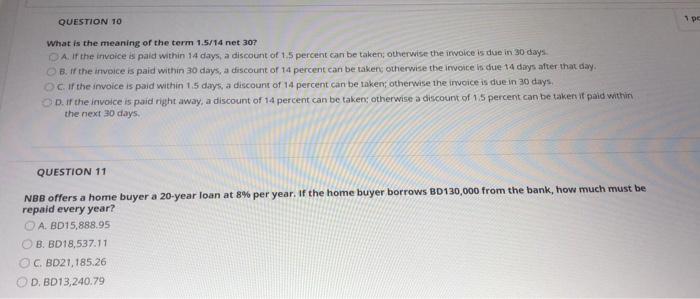

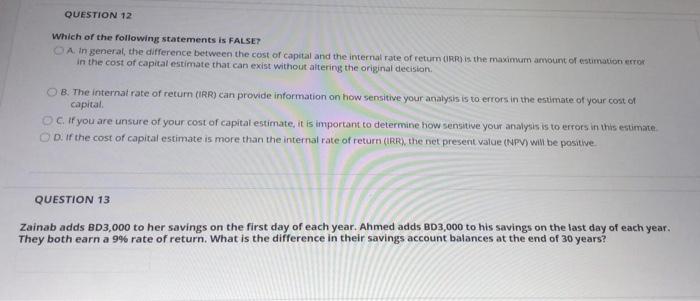

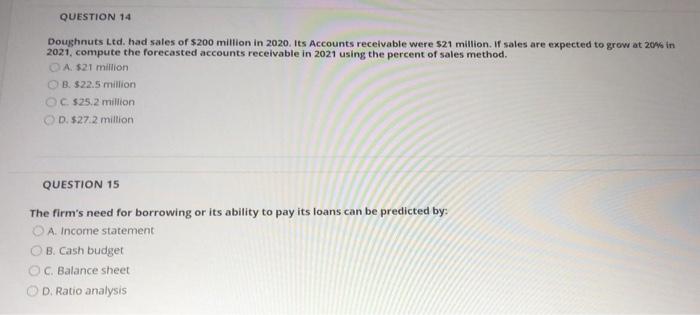

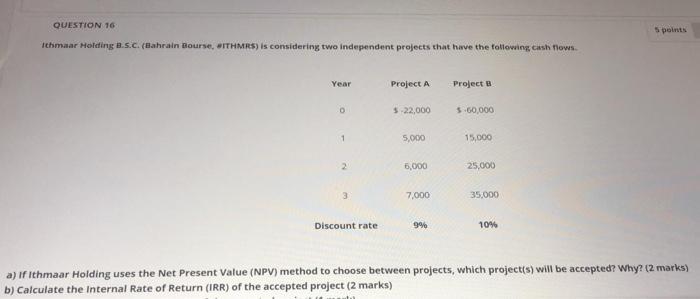

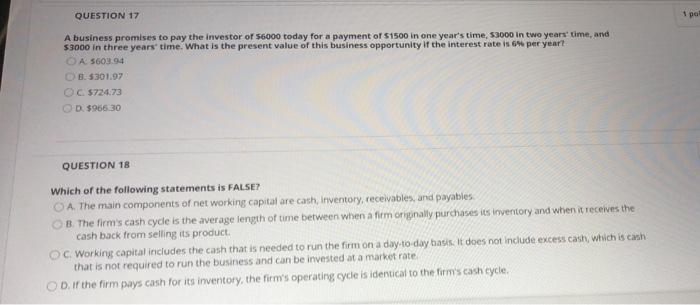

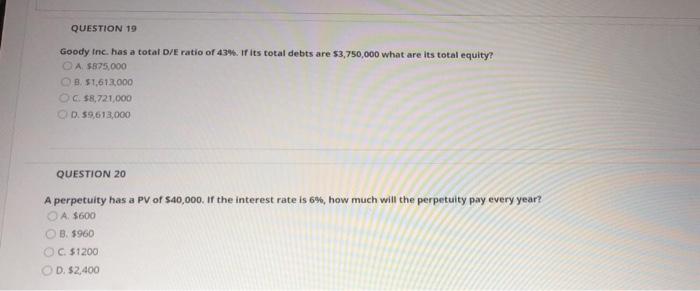

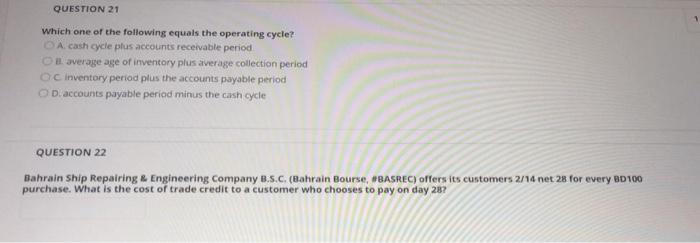

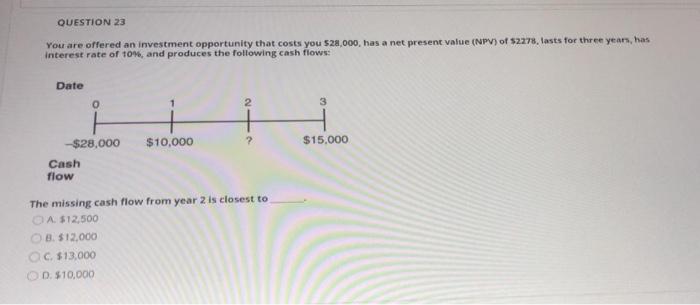

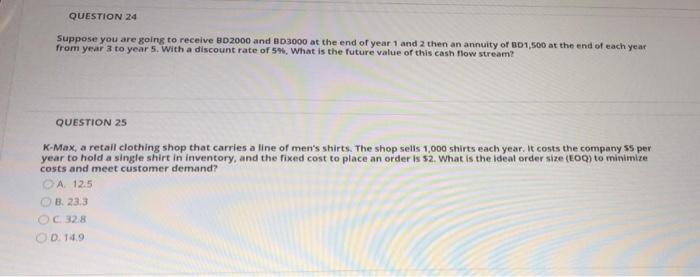

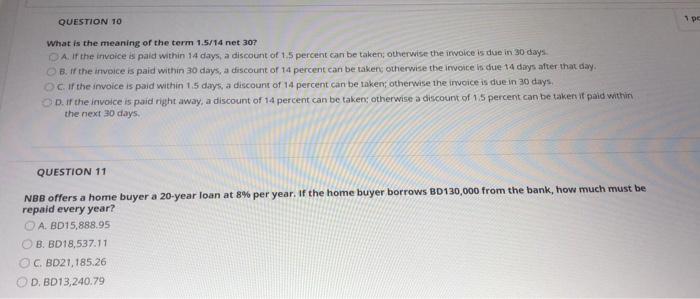

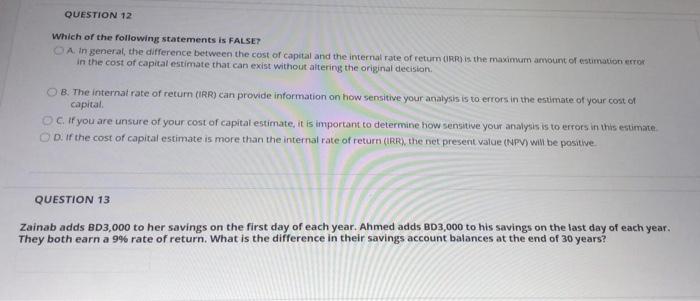

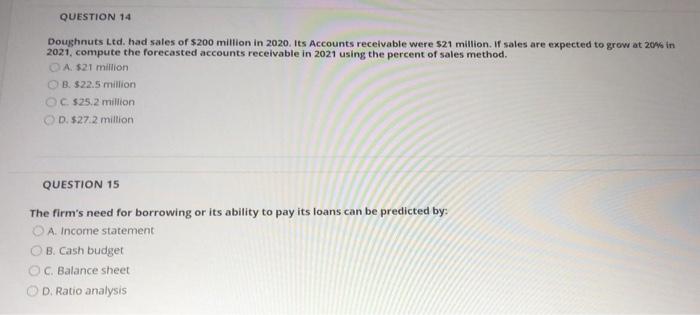

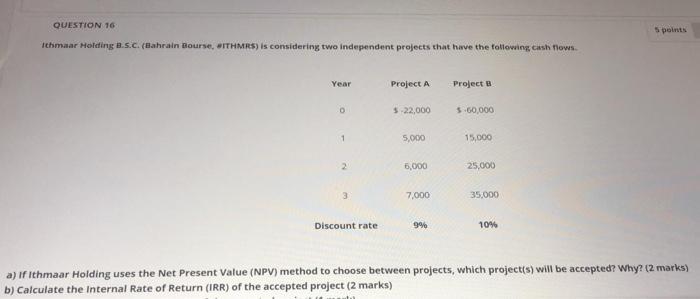

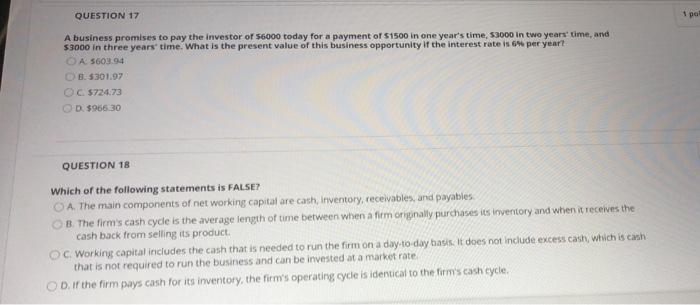

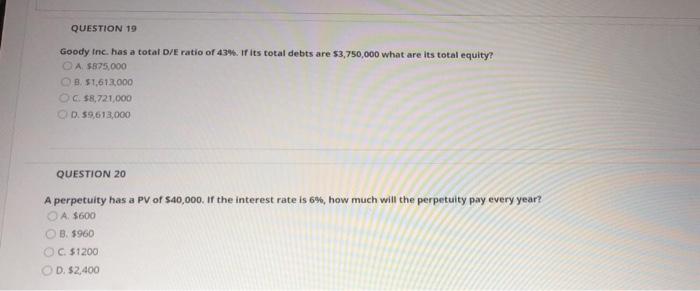

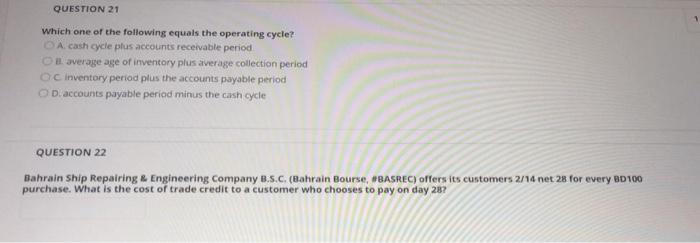

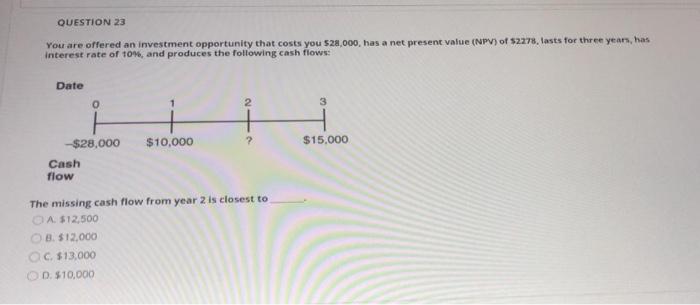

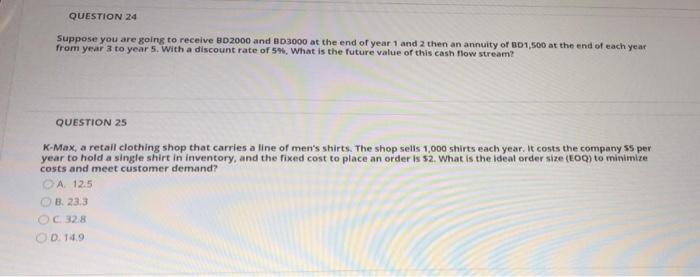

QUESTION 1 Which of the following best describes the availability float? A how long it takes the firm to process the check and deposit it in the bank B. how long it takes before the bank gives the firm credit for the funds O how long it takes before payments to suppliers actually result in a cash outflow for the firm D. how long it takes for a firm to be able to use funds after a customer has paid for its goods QUESTION 2 Bahrain Duty Free Shop Complex B.S.C. (Bahrain Bourse, #DUTYF) expects the following sales and material payments for the period January till May of the coming year (all numbers are in thousands Sales Material Payments January BD 14,000 BD 18,000 February 20,000 21,000 March 46,000 19,100 April 22.000 22,400 May 18,000 14,000 The company notes that historically 30% of sales are for cash, 40% are collected one month after the sale, 30% are collected in the second month after the sale. Material payments are paid in the same month of incurrence Labor expenses are 56 of the month's sales Rent payments are BD 1,200 per month. Capital investment of BD 25000 is expected in May. The firm's ending cash balance in February was BD 2000, and its minimum required cash balances BD 2,500. Compute DUTFY's Cash Receipts (2 marks) Cash Payments (2 marks) and Net Cash Flow (1 mark) for March April and May, QUESTION 3 At end of December 2020, Guest Corporation had accounts receivables of $500,000. If its average collection period was so days, what was the sales figure for the year? OA 5128, 125 B. $1,281,250 C. $228,125 D. $2,281,250 QUESTION 4 Which of the following is a disadvantage of the Net Present Value rule? O A can be misleading it inflows come before outflows OB. not necessarily consistent with maximizing shareholder wealth OC ignores cash flows after the cutoff point OD. relies on accurate estimate of the discount rate QUESTIONS Beautinator Cosmetics borrowed $152,300 from a bank for three years. If the quoted rate (APR) 5 11.75 percent, and the compounding is daily, what is the effective annual rate (EAR) O A 12.45 OB 13 5596 OC 12.8096 OD 14.9096 QUESTION 6 A firm is considering several mutually exclusive investment opportunities. The best way to choose between them is which of the following? A profitability index B. payback period OC.net present value (NPV) D. internal rate of return (IRR) QUESTION 7 if the inventory turnover ratio for Cast Co. is 5x and its gross profits and sales are $270 million and 51,200 million respectively, then the inventory account for Cast is: O $180 million 8 $182 mion C51B6 million D. $196 million QUESTIONS Which is not among the five C's of credit? A character B. capacity OC. conditions OD. collectability QUESTION 9 Bahrain Car Parks Company B.S.C. (Bahrain Bourse, #CPARK) has the information shown below (all numbers are in thousands): $122,800 Sales Cost of Goods Sold Accounts Receivable Inventory Total current assets Accounts Payable Total current liabilities 104,380 10,900 1,420 38,820 22,640 23,640 What is CPARK's cash conversion cycle? 1 pe QUESTION 10 What is the meaning of the term 1.5/14 net 307 DA If the invoice is paid within 14 days, a discount of 1.5 percent can be taken; otherwise the invoice is due in 30 days OB. If the invoice is paid within 30 days, a discount of 14 percent can be taken otherwise the invoice in due 14 days after that day. c. If the invoice is paid within 1.5 days, a discount of 14 percent can be taken; otherwise the invoice is due in 30 days D. If the invoice is paid right away, a discount of 14 percent can be taken: otherwise a discount of 15 percent can be taken it paid within the next 30 days QUESTION 11 NBB offers a home buyer a 20-year loan at 8% per year. If the home buyer borrows BD130,000 from the bank, how much must be repaid every year? A. BD15,888.95 B. BD18,537.11 CBD21.185.26 D. BD13,240.79 QUESTION 12 Which of the following statements is FALSET A. In general, the difference between the cost of capital and the internal rate of return (IRR) is the maximum amount of estimation error in the cost of capital estimate that can exist without altering the original decision B. The internat rate of return (IRR) can provide information on how sensitive your analysis is to errors in the estimate of your cost of capital c. if you are unsure of your cost of capital estimate, it is important to determine how sensitive your analysis is to errors in this estimate D. Ir the cost of capital estimate is more than the internal rate of return (IRR), the vet present value (NPV) will be positive QUESTION 13 Zainab adds BD3,000 to her savings on the first day of each year. Ahmed adds BD3,000 to his savings on the last day of each year. They both earn a 9% rate of return. What is the difference in their savings account balances at the end of 30 years? QUESTION 14 Doughnuts Ltd. had sales of $200 million in 2020. Its Accounts receivable were 521 million. If sales are expected to grow at 20 in 2021, compute the forecasted accounts receivable in 2021 using the percent of sales method. A $21 million OB. $22.5 million C$25.2 million D. $27.2 million QUESTION 15 The firm's need for borrowing or its ability to pay its loans can be predicted by: A. Income statement B. Cash budget C. Balance sheet D. Ratio analysis QUESTION 16 Spoints Ithmaar Holding B.Sc. (Bahrain Bourse, WITHMRS) is considering two independent projects that have the following cash flows Year Project A Project 0 $ 22,000 5.60,000 1 5.000 15,000 2 5,000 25,000 3 7,000 35.000 Discount rate 9% 10% a) if ithmaar Holding uses the Net Present Value (NPV) method to choose between projects, which project(s) will be accepted? Why? (2 marks) b) Calculate the Internal Rate of Return (IRR) of the accepted project (2 marks) ay if thaar Holding uses the Net Present Value (NPV) method to choose between projects, which project will be accepted? Why marks) bi Calculate the internal Rate of Return (R) of the accepted project (2 marks) Calculate the profitability Index (Pl) of the accepted project (1 mark) NoteYou are allowed to use Financial Color For the toolbar press ALT10 IPO or ALTINFIOIMCI BIVS Paragraph Arial I. X !!! QUESTION 17 1 pa A business promises to pay the investor of 56000 today for a payment of $1500 in one year's time, 53000 in two years' time, and 53000 in three years' time. What is the present value of this business opportunity if the interest rate is 6% per year! O A 5603.94 OB5301.97 OG $724.73 OD $966.30 QUESTION 18 Which of the following statements is FALSE? A. The main components of net working capital are cash, inventory, receivables, and payables B. The firm's cash cycle is the average length of time between when a firm originally purchases its inventory and when it receives the cash back from selling its product OC Working capital includes the cash that is needed to run the firm on a day to day basis. It does not include excess cash, which is cash that is not required to run the business and can be invested at a market rate D. If the firm pays cash for its inventory, the firm's operating cycle is identical to the firm's cash cycle QUESTION 19 Goody Inc. has a total D/E ratio of 43%. If its total debts are $3,750,000 what are its total equity! O A $875,000 B. 51,613,000 $8,721,000 0.59,613,000 QUESTION 20 A perpetuity has a PV of $40,000. If the interest rate is 6%, how much will the perpetuity pay every year? A $600 OB. $960 C. $1200 D. $2,400 QUESTION 21 which one of the following equals the operating cycle? A cash cycle plus accounts receivable period On average age of inventory plus average collection period o inventory period plus the accounts payable period D. accounts payable period minus the cash cycle QUESTION 22 Bahrain Ship Repairing & Engineering Company B.S.C.(Bahrain Bourse, #BASREC) offers its customers 2/14 net 28 for every BD100 purchase. What is the cost of trade credit to a customer who chooses to pay on day 28? QUESTION 23 You are offered an investment opportunity that costs you 528,000, has a net present value (NPV) of $2278, lasts for three years, has interest rate of 10%, and produces the following cash flows: Date O 2 3 -$28,000 $10,000 ? $15.000 Cash flow The missing cash flow from year 2 is closest to A $12,500 8. $12,000 C. $13,000 D. $10,000 QUESTION 24 Suppose you are going to receive 2000 and 803000 at the end of year 1 and 2 then an annuity of BD1,500 at the end of each year from year 3 to year 5. with a discount rate of 59, What is the future value of this cash flow stream? QUESTION 25 K-Max, a retall clothing shop that carries a line of men's shirts. The shop sells 1,000 shirts each year. It costs the company s5 per year to hold a single shirt in inventory, and the fixed cost to place an order is 52. What is the ideal order size (EO) to minimize and A 12.5 B23.3 OC 32.8 OD. 149 QUESTION 26 Which of the following would increase a firm's cash conversion cycle? O A. Increase inventory days. OB. Decrease accounts receivable days. OC. Increase accounts payable days. D. Increase cash days