Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 1 - WORTH 15 POINTS IF ALL QUESTIONS ARE ANSWERED CORRECTLY Moe and Larry established a partnership on January 1, 2019. Moe invested cash

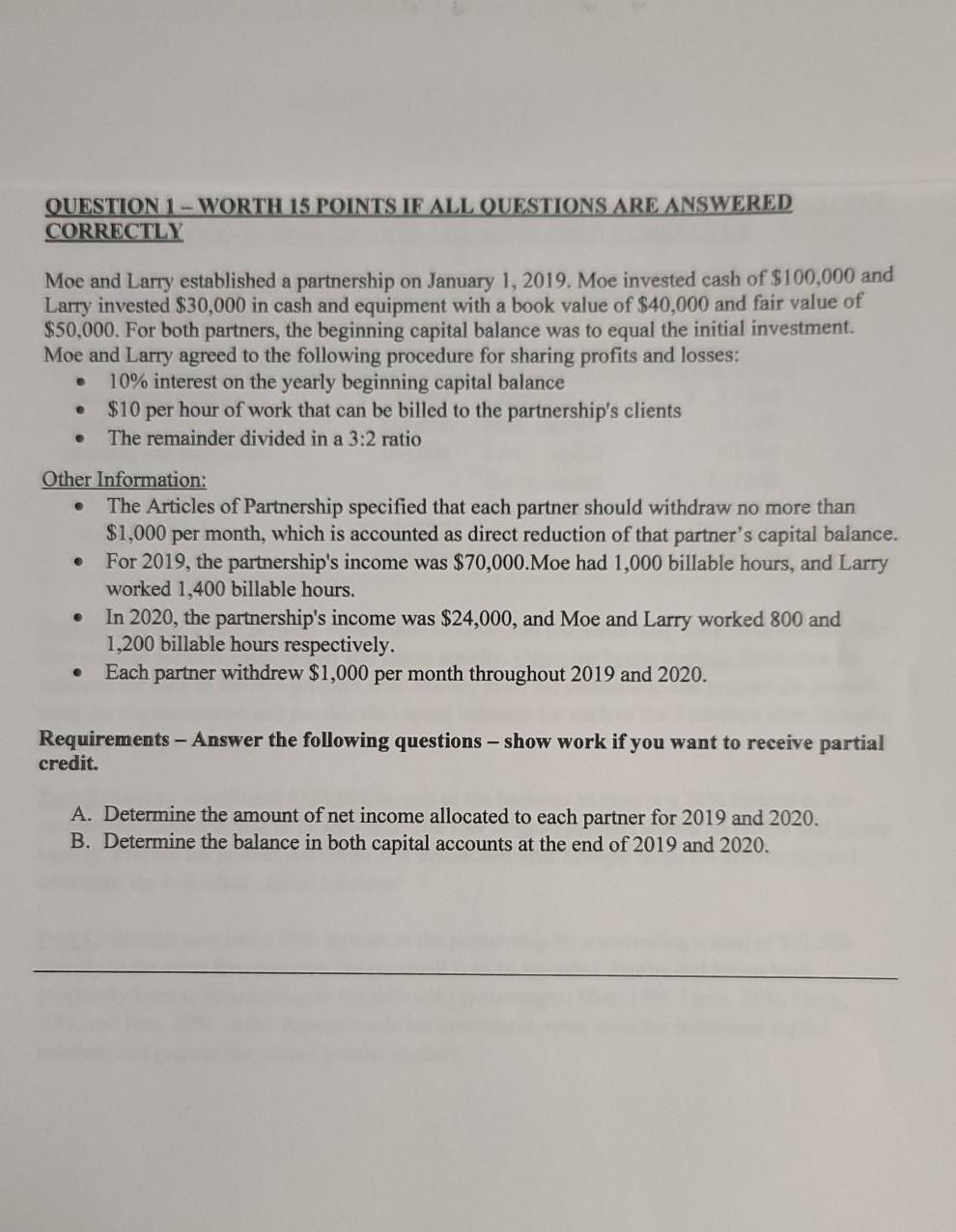

QUESTION 1 - WORTH 15 POINTS IF ALL QUESTIONS ARE ANSWERED CORRECTLY Moe and Larry established a partnership on January 1, 2019. Moe invested cash of $100,000 and Larry invested $30,000 in cash and equipment with a book value of $40,000 and fair value of $50,000. For both partners, the beginning capital balance was to equal the initial investment. Moe and Larry agreed to the following procedure for sharing profits and losses: 10% interest on the yearly beginning capital balance $10 per hour of work that can be billed to the partnership's clients The remainder divided in a 3:2 ratio e e Other Information: The Articles of Partnership specified that each partner should withdraw no more than $1,000 per month, which is accounted as direct reduction of that partner's capital balance. For 2019, the partnership's income was $70,000. Moe had 1,000 billable hours, and Larry worked 1,400 billable hours. In 2020, the partnership's income was $24,000, and Moe and Larry worked 800 and 1,200 billable hours respectively. Each partner withdrew $1,000 per month throughout 2019 and 2020. Requirements - Answer the following questions - show work if you want to receive partial credit. A. Determine the amount of net income allocated to each partner for 2019 and 2020. B. Determine the balance in both capi accounts at the end of 2019 and

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started